Mortgage Rates Remain at Historic Lows

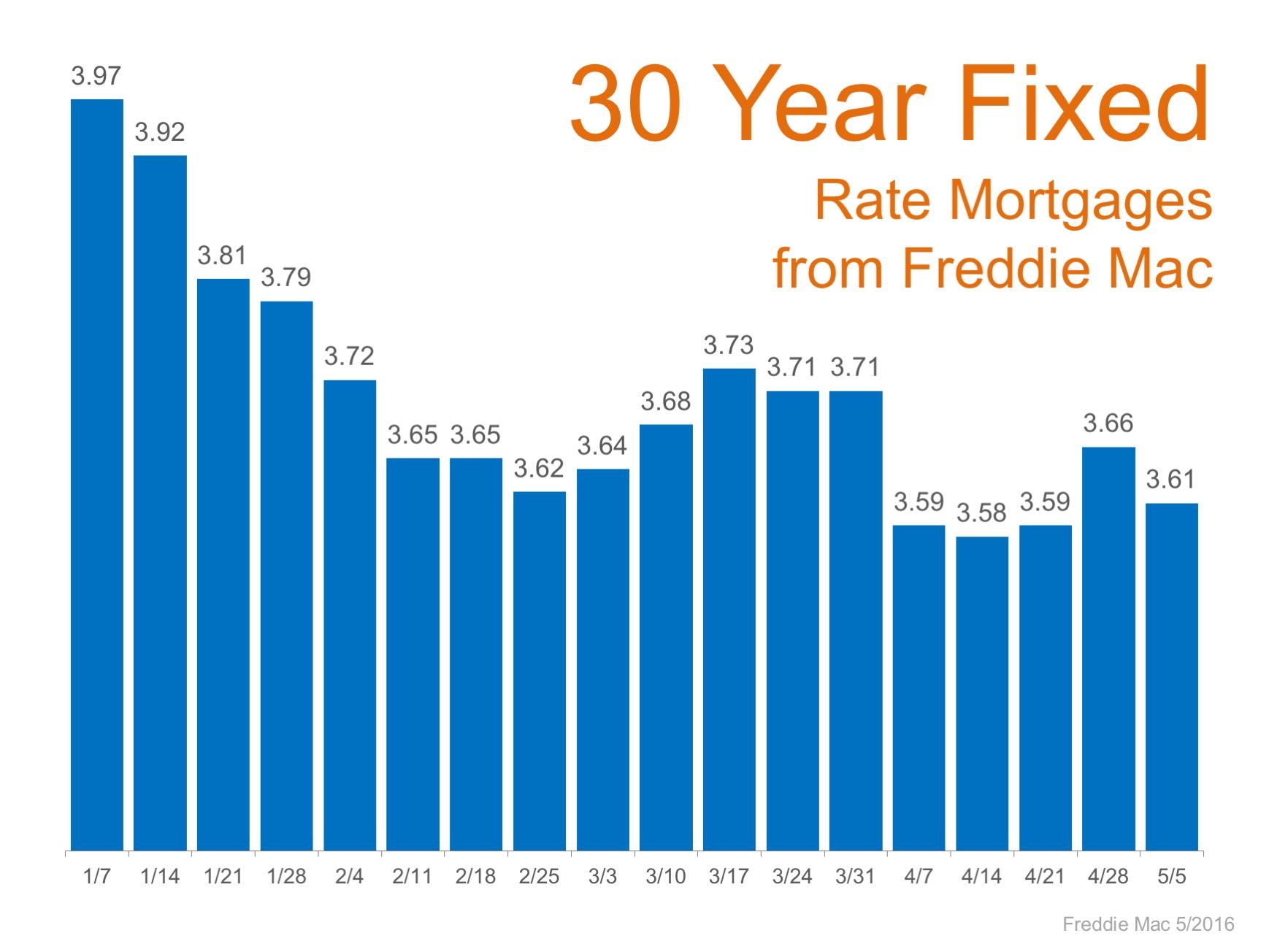

The latest report from Freddie Mac shows that the 30-year fixed-rate mortgage averaged 3.61% last week, slightly down from the week before (3.66%), and nearly 20 points lower than a year ago (3.80%).

This is great news for homebuyers who are dealing with rising prices due to a low inventory of homes for sale in many areas of the country. Freddie Mac expressed their optimism for the rates to remain low throughout the spring in a recent blog post:

“We expect mortgage interest rates to stay well under 4% as we head into the heart of the spring homebuying season. We’re predicting it to be the best one in 10 years, which should provide even greater opportunities for first-time homebuyers.”

Below is a chart of the weekly average rates in 2016, according to Freddie Mac.

Rates have again fallen to historic lows yet many experts still expect them to increase in 2016. One thing we know for sure is that, according to Freddie Mac, current rates are the best they have been since last April.

Sean Becketti, Chief Economist for Freddie Mac recently explained:

“Since the start of February, mortgage rates have varied within a narrow range providing an extended period for house hunters to take advantage of historically low rates.”

Bottom Line

If you are thinking of buying your first home or moving up to your ultimate dream home, now is a great time to get a sensational rate on your mortgage.

|

Members: Sign in now to set up your Personalized Posts & start sharing today!

Not a Member Yet? Click Here to learn more about KCM’s newest feature, Personalized Posts. |