- Want to know some of the top mistakes sellers are making today and how to make sure they don’t happen to you too?

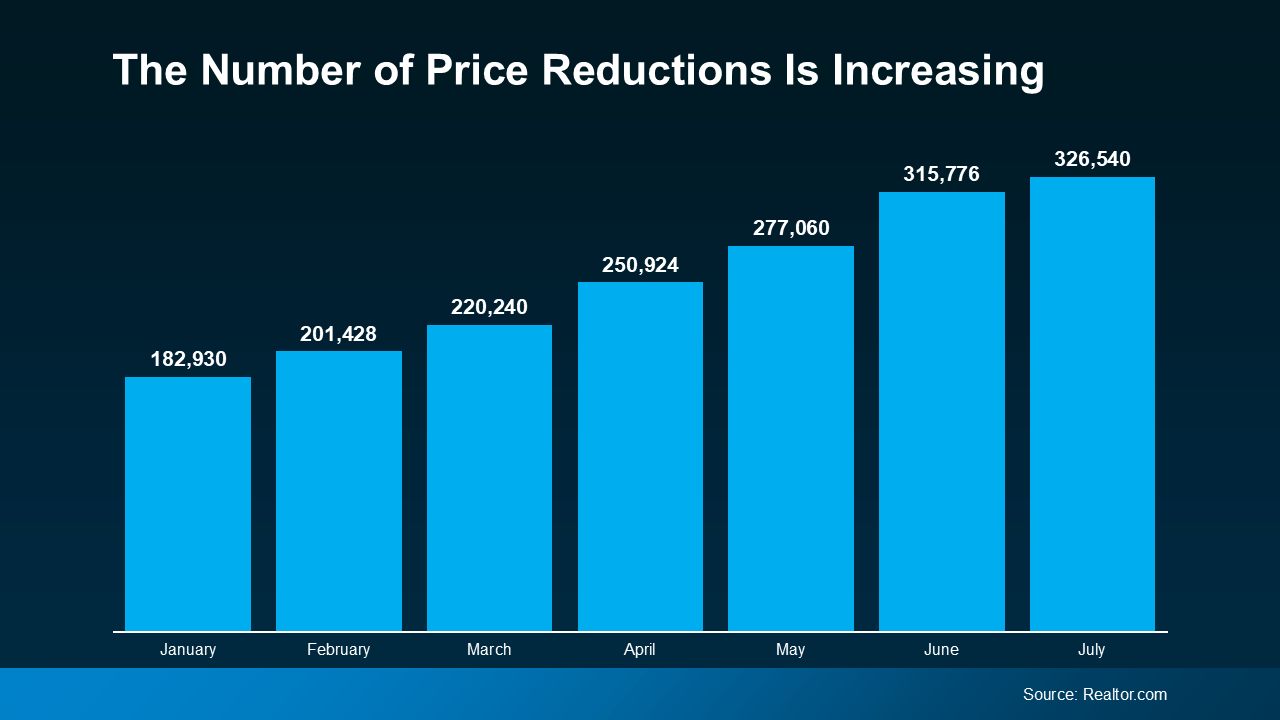

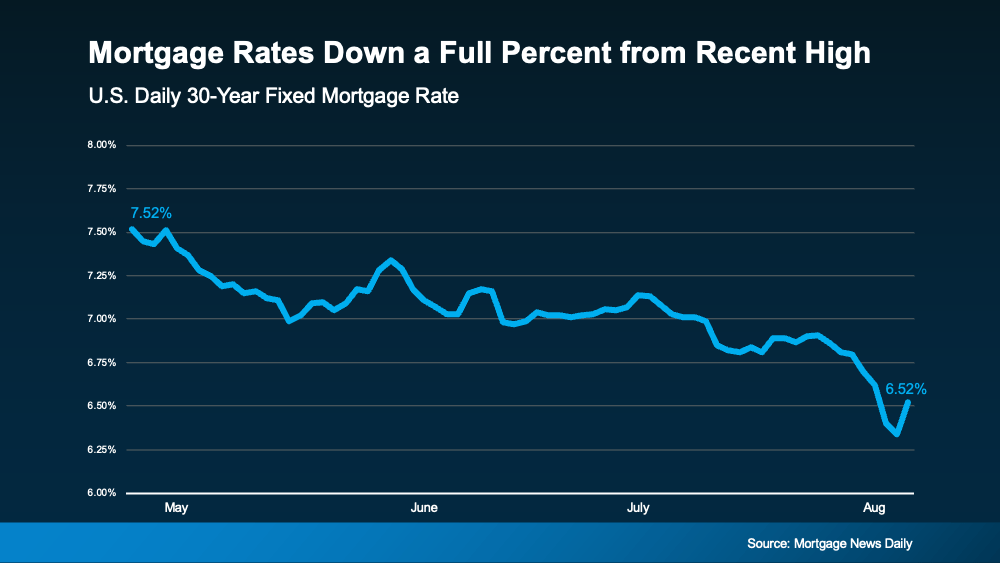

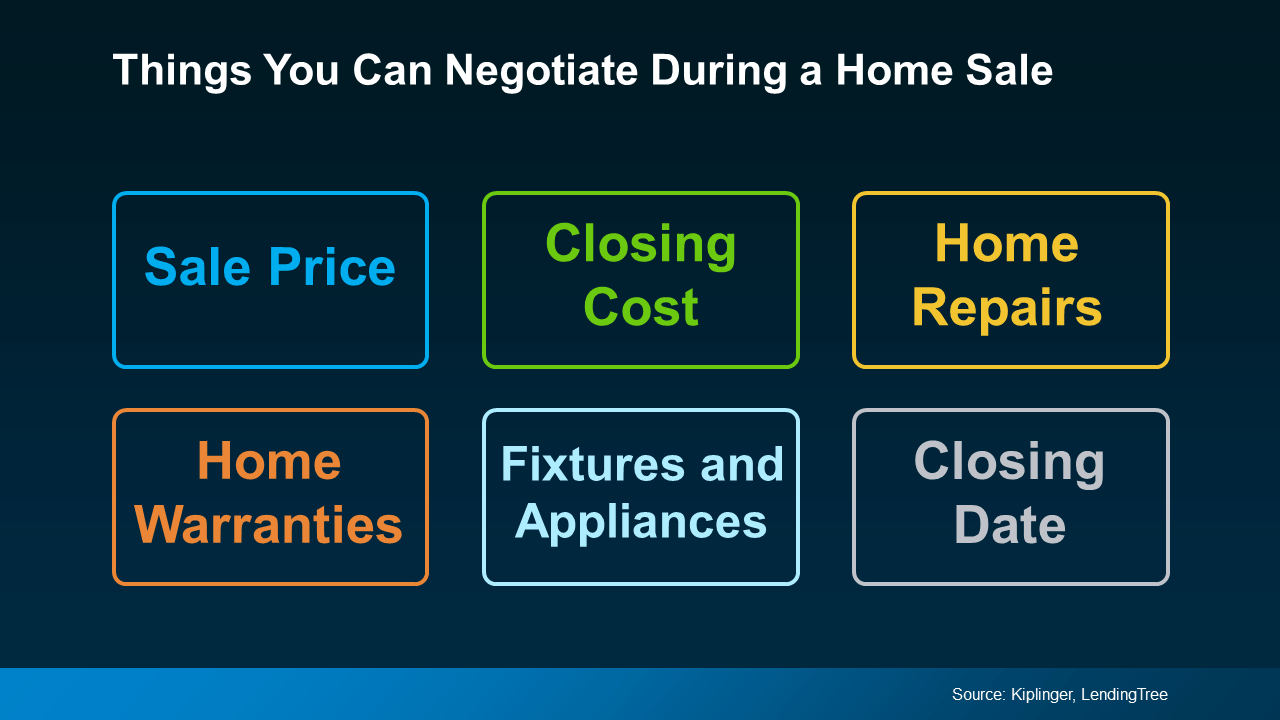

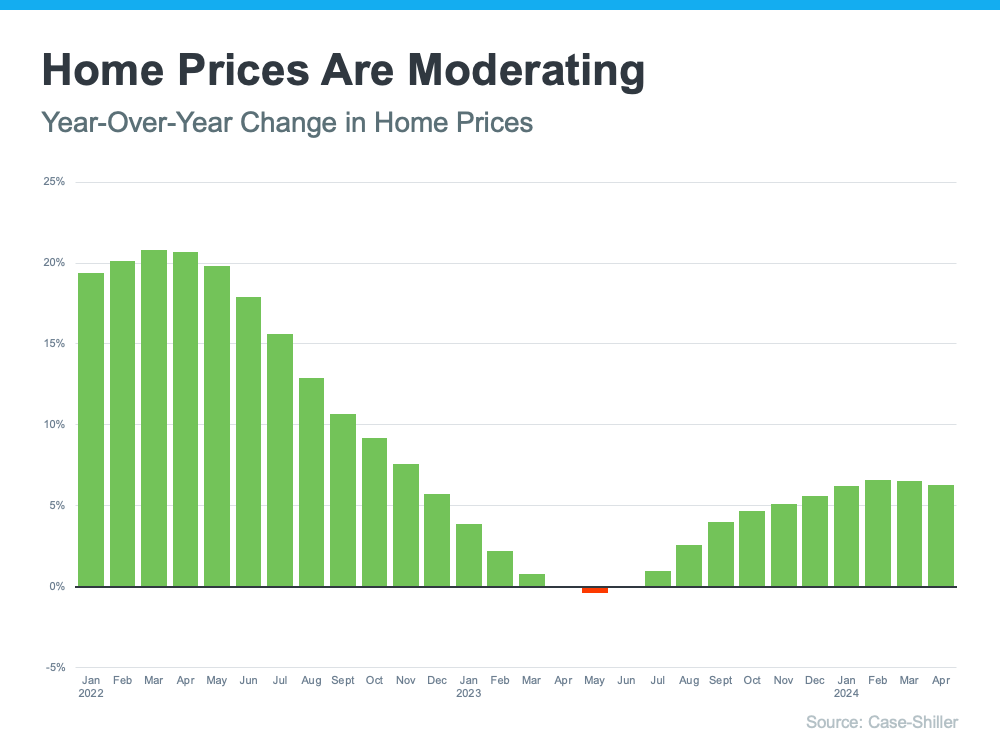

- The biggest missteps are pricing a house too high, skipping repairs, not being objective, and not being willing to negotiate.

- And the best way to avoid falling into any of these traps is to partner with a trusted real estate agent who knows exactly what to do. Let’s connect so you have someone to lean on for advice.

Want to know some of the top mistakes sellers are making today and how to make sure they don’t happen to you too?

[exclusive_id] => [expired_at] => [featured_image] => https://files.keepingcurrentmatters.com/KeepingCurrentMatters/content/images/20240827/20240830-How-To-Avoid-Todays-Top-Seller-Mistakes-KCM-Share-original.jpg [id] => 60067 [kcm_ig_caption] => Want to know some of the top mistakes sellers are making today and how to make sure they don’t happen to you too? The biggest missteps are pricing a house too high, skipping repairs, not being objective, and not being willing to negotiate. And the best way to avoid falling into any of these traps is to partner with a trusted real estate agent who knows exactly what to do. Let’s connect so you have someone to lean on for advice. [kcm_ig_hashtags] => sellyourhouse,justsold,keepingcurrentmatters [kcm_ig_quote] => How to avoid today's top seller mistakes. [poll] => [public_bottom_line] =>- Want to know some of the top mistakes sellers are making today and how to make sure they don’t happen to you too?

- The biggest missteps are pricing a house too high, skipping repairs, not being objective, and not being willing to negotiate.

- And the best way to avoid falling into any of these traps is to partner with a real estate agent and lean on them for advice.

How To Avoid Today's Top Seller Mistakes

Want to know some of the top mistakes sellers are making today and how to make sure they don’t happen to you too?