stdClass Object

(

[agents_bottom_line] => With more million-dollar homes on the market and prices going up, you have luxury options to choose from and a chance to build significant long-term wealth. Want to see the best homes in our area? Let’s get in touch today.

[assets] => Array

(

)

[banner_image] =>

[can_share] => no

[categories] => Array

(

[0] => stdClass Object

(

[category_type] => standard

[children] =>

[created_at] => 2019-06-03T18:18:43Z

[id] => 5

[name] => For Buyers

[parent] =>

[parent_id] =>

[published_at] => 2019-06-03T18:18:43Z

[slug] => buyers

[status] => public

[translations] => stdClass Object

(

[es] => stdClass Object

(

[name] => Para los compradores

)

)

[updated_at] => 2019-06-03T18:18:43Z

)

[1] => stdClass Object

(

[category_type] => standard

[children] =>

[created_at] => 2019-06-03T18:18:43Z

[id] => 52

[name] => Luxury / Vacation

[parent] =>

[parent_id] =>

[published_at] => 2024-04-10T16:04:55Z

[slug] => luxury--vacation

[status] => public

[translations] => stdClass Object

(

[es] => stdClass Object

(

[name] => Mercado de lujo

)

)

[updated_at] => 2024-04-10T16:04:55Z

)

[2] => stdClass Object

(

[category_type] => standard

[children] =>

[created_at] => 2024-04-10T16:19:38Z

[id] => 323

[name] => Buying Tips

[parent] =>

[parent_id] =>

[published_at] => 2024-04-10T16:19:44Z

[slug] => buying-tips

[status] => public

[translations] => stdClass Object

(

[es] => stdClass Object

(

[name] => Consejos de compra

)

)

[updated_at] => 2024-04-10T16:19:44Z

)

)

[content_type] => blog

[contents] => Luxury living is about more than just stunning views and cutting-edge smart home technology—it's about elevating your lifestyle. And if you're in the market for a million-dollar home, now is an excellent time to explore the thriving luxury market. Here's why.

The Number of Luxury Homes Is Growing

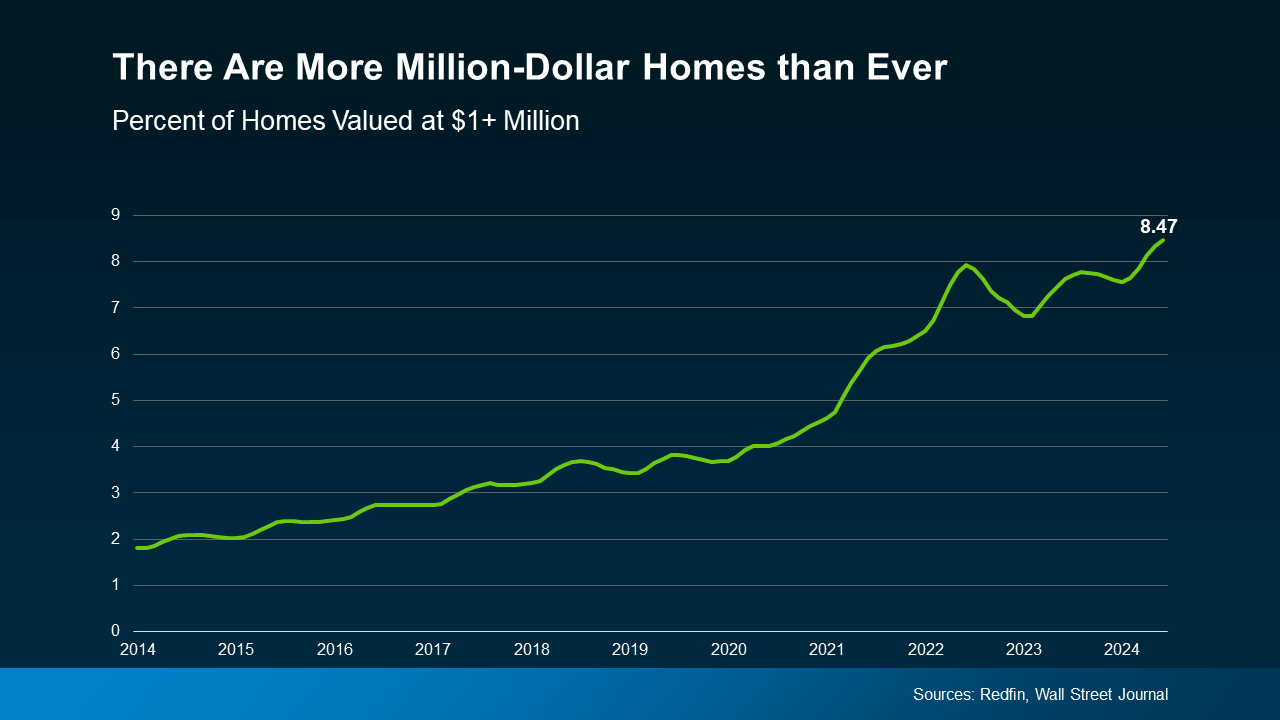

The top of the market, or luxury homes, can mean different things depending on where you live. But in general, these are homes that are in the top 5% price range in any area. According to a recent report from Redfin, the average value of those homes has risen to over one million dollars:

“The median sale price for U.S. luxury homes, defined as the top 5% of listings, rose 9% year-over-year to a record $1.18 million during the second quarter.”

That same report goes on to show the percentage of homes valued at a million dollars or more has risen to an all-time high (see graph below):

That means, if this is your desired price range, you have options to choose from, each with different features and styles.

That means, if this is your desired price range, you have options to choose from, each with different features and styles.

Whether you're looking for the latest designs, like modern kitchens with high-end appliances, exclusive amenities, or enhanced privacy and security, the market that fits this lifestyle is growing.

Your Luxury Home Is an Investment

In addition, a luxury home could help you build significant long-term wealth. As the Redfin quote mentioned earlier says, luxury home prices are rising. That may be the reason there are a lot of people investing in luxury real estate right now. According to the August Luxury Market Report:

“By the end of July, the overall growth in the volume of sales in 2024 stood at 14.82% for single-family homes and 11.35% for attached homes compared to the same period in 2023.”

[created_at] => 2024-09-04T13:12:40Z

[description] => Luxury living is about more than just stunning views and cutting-edge smart home technology—it's about elevating your lifestyle.

[exclusive_id] =>

[expired_at] =>

[featured_image] => https://files.keepingcurrentmatters.com/KeepingCurrentMatters/content/images/20240904/20240905-The-Latest-on-the-Luxury-Home-Market-original.png

[id] => 60696

[kcm_ig_caption] => Luxury living is about more than just stunning views and cutting-edge smart home technology—it's about elevating your lifestyle. And if you're in the market for a million-dollar home, now is an excellent time to explore the thriving luxury market. Here's why.

The Number of Luxury Homes Is Growing

The top of the market, or luxury homes, can mean different things depending on where you live. But in general, these are homes that are in the top 5% price range in any area. According to a recent report from Redfin, the average value of those homes has risen to over one million dollars: “The median sale price for U.S. luxury homes, defined as the top 5% of listings, rose 9% year-over-year to a record $1.18 million during the second quarter.”

That same report goes on to show the percentage of homes valued at a million dollars or more has risen to an all-time high.

Your Luxury Home Is an Investment

In addition, a luxury home could help you build significant long-term wealth. As the Redfin quote mentioned earlier says, luxury home prices are rising. That may be the reason there are a lot of people investing in luxury real estate right now. According to the August Luxury Market Report: “By the end of July, the overall growth in the volume of sales in 2024 stood at 14.82% for single-family homes and 11.35% for attached homes compared to the same period in 2023.”

With more million-dollar homes on the market and prices going up, you have luxury options to choose from and a chance to build significant long-term wealth. Want to see the best homes in our area? Let’s get in touch today.

[kcm_ig_hashtags] => dreamhome,housegoals,keepingcurrentmatters

[kcm_ig_quote] => The latest on the luxury home market.

[poll] =>

[public_bottom_line] => With more million-dollar homes on the market and prices going up, you have luxury options to choose from and a chance to build significant long-term wealth. Want to see the best homes in your area? Get in touch with a local real estate agent today.

[published_at] => 2024-09-05T10:30:00Z

[related] => Array

(

)

[slug] => the-latest-on-the-luxury-home-market

[status] => published

[tags] => Array

(

)

[title] => The Latest on the Luxury Home Market

[updated_at] => 2024-09-05T10:30:28Z

[url] => /2024/09/05/the-latest-on-the-luxury-home-market/

)

The Latest on the Luxury Home Market

Luxury living is about more than just stunning views and cutting-edge smart home technology—it's about elevating your lifestyle.

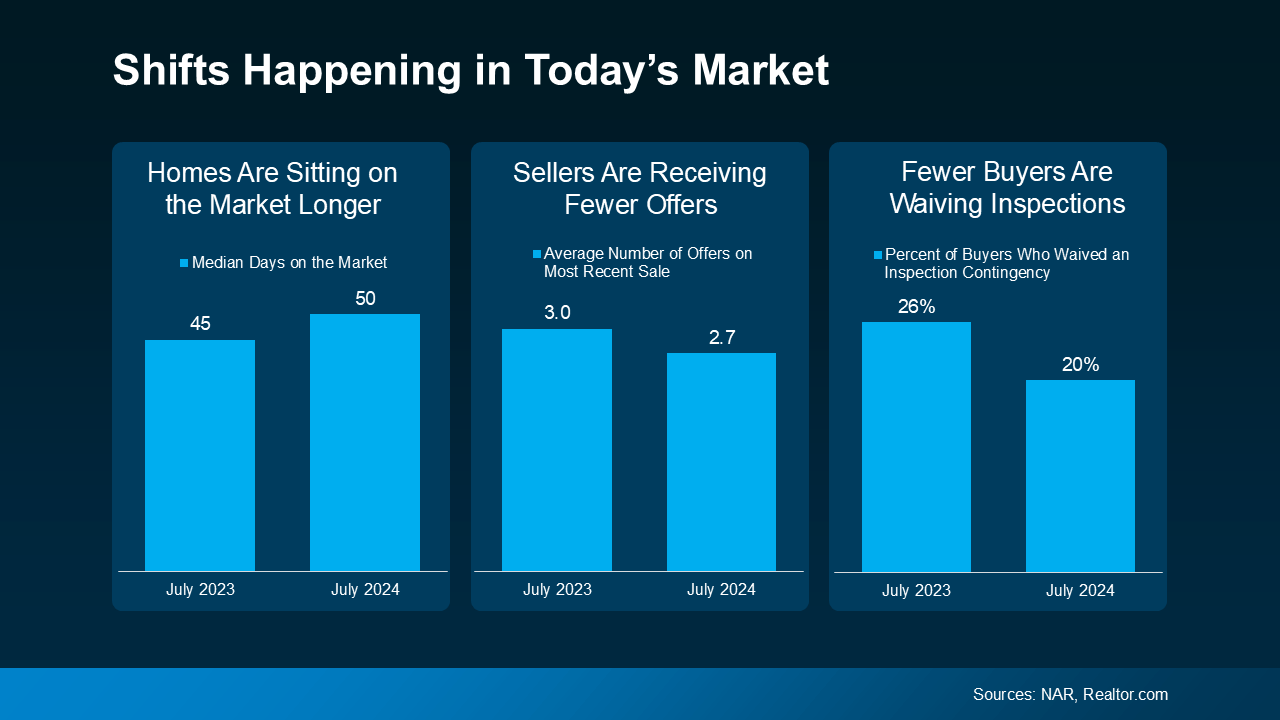

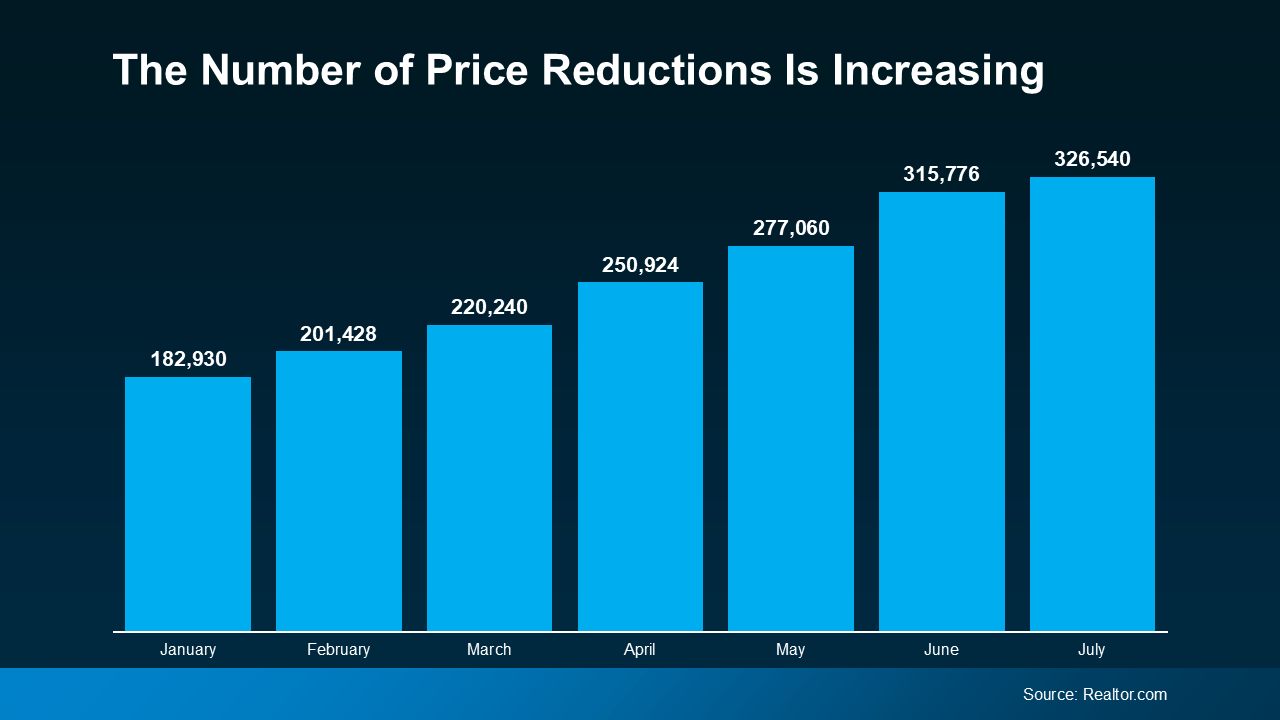

Homes Are Sitting on the Market Longer: Since more homes are on the market, they’re not selling quite as fast. For buyers, this means you may have more time to find the right home. For sellers, it’s important to

Homes Are Sitting on the Market Longer: Since more homes are on the market, they’re not selling quite as fast. For buyers, this means you may have more time to find the right home. For sellers, it’s important to

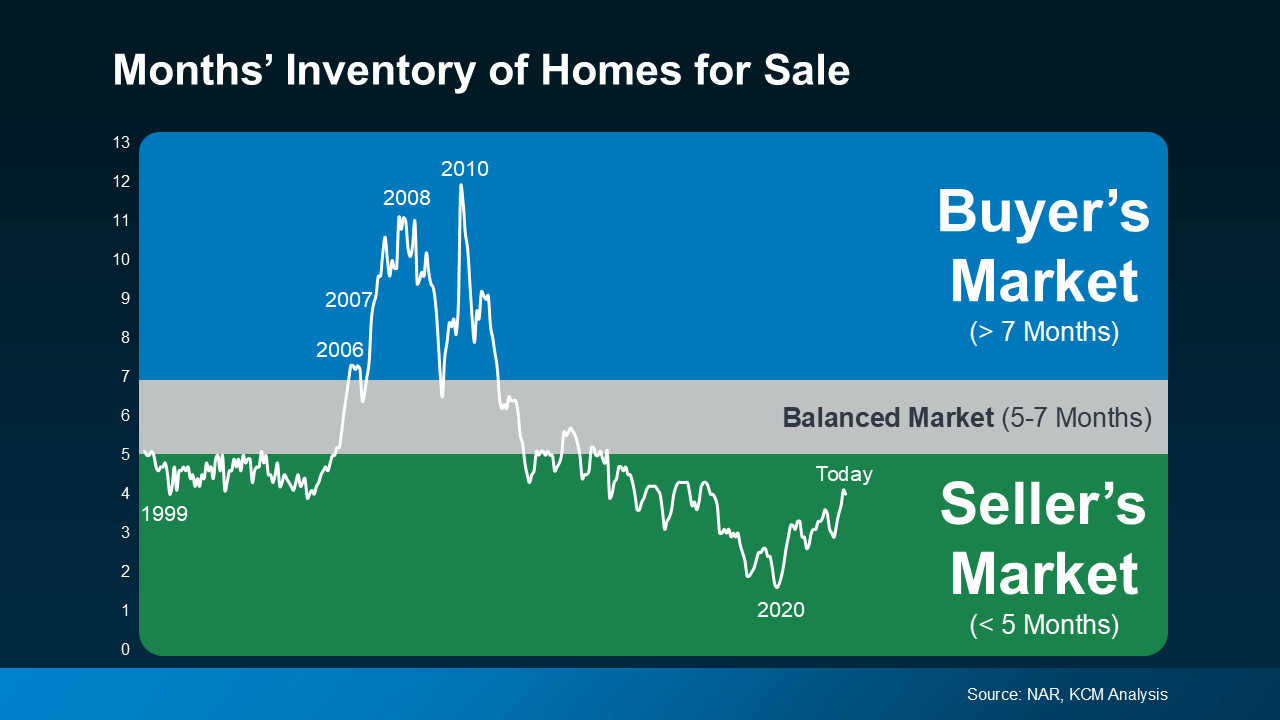

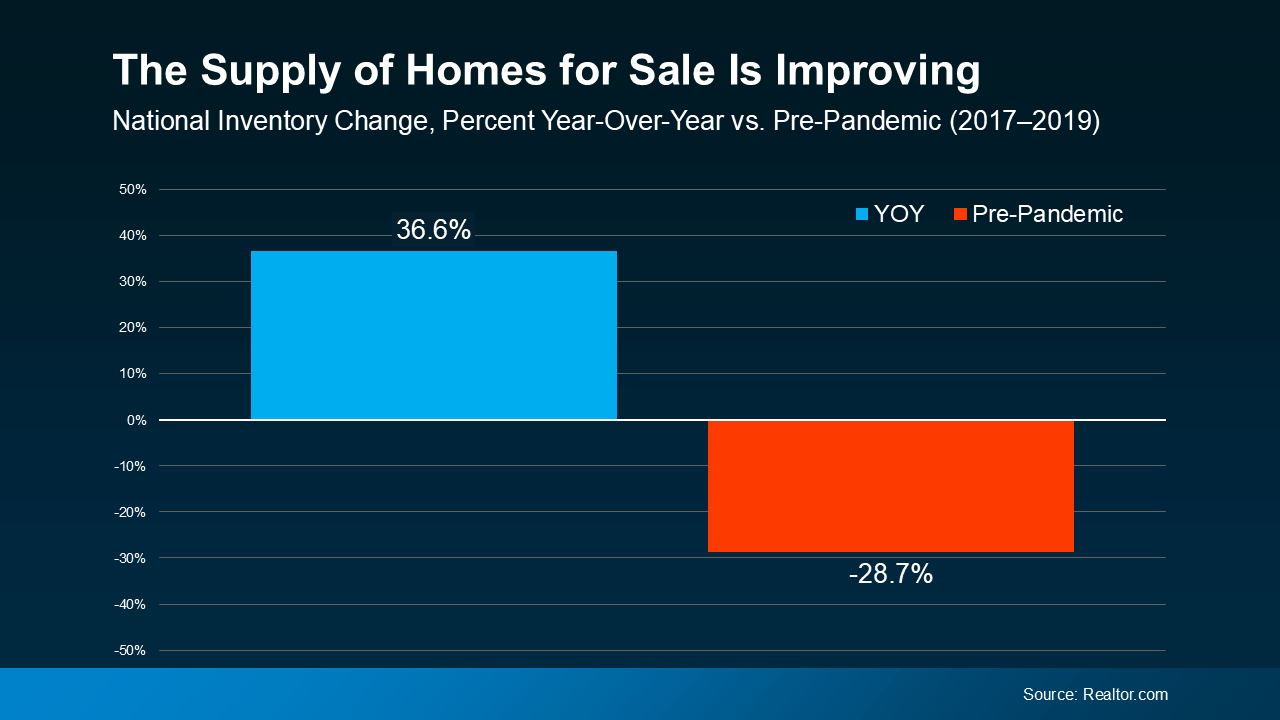

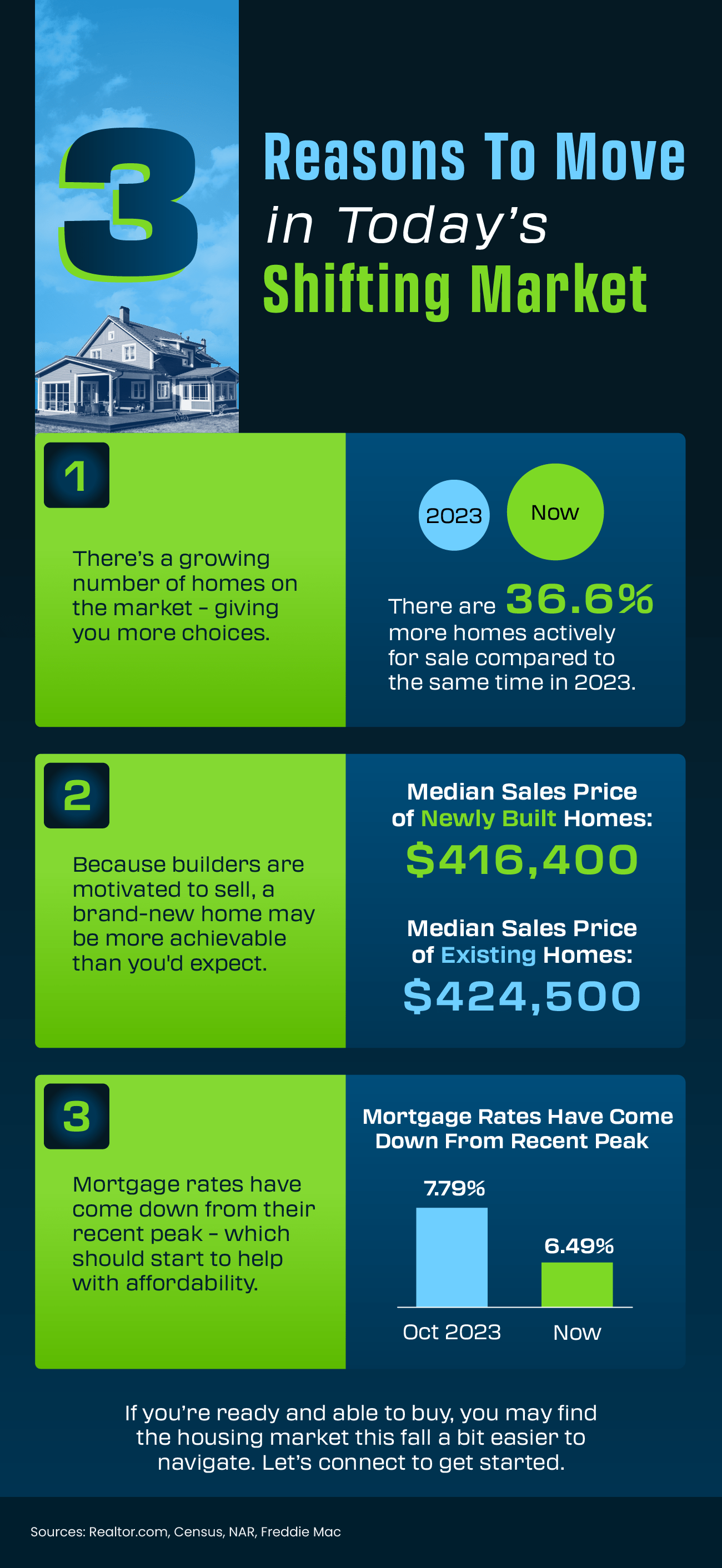

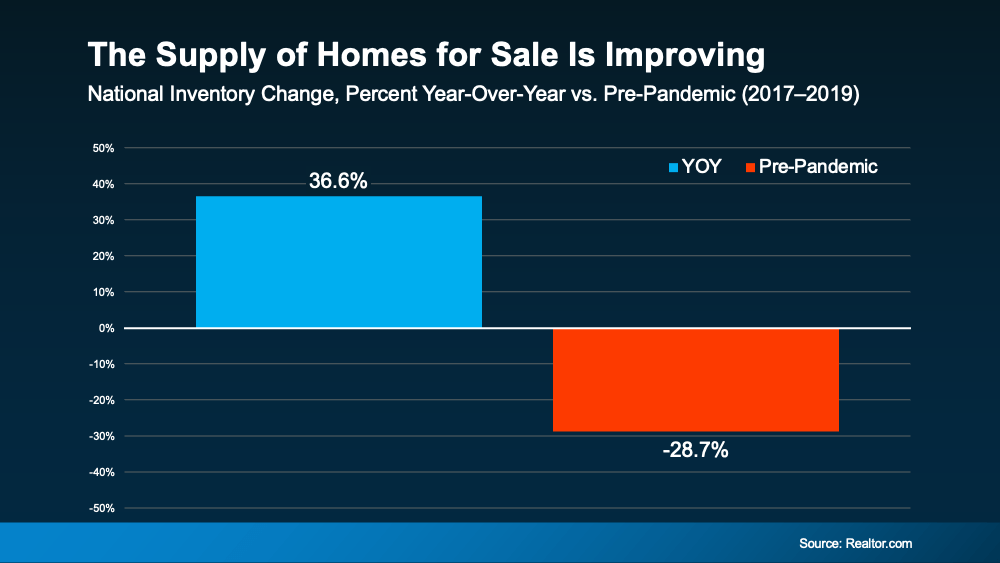

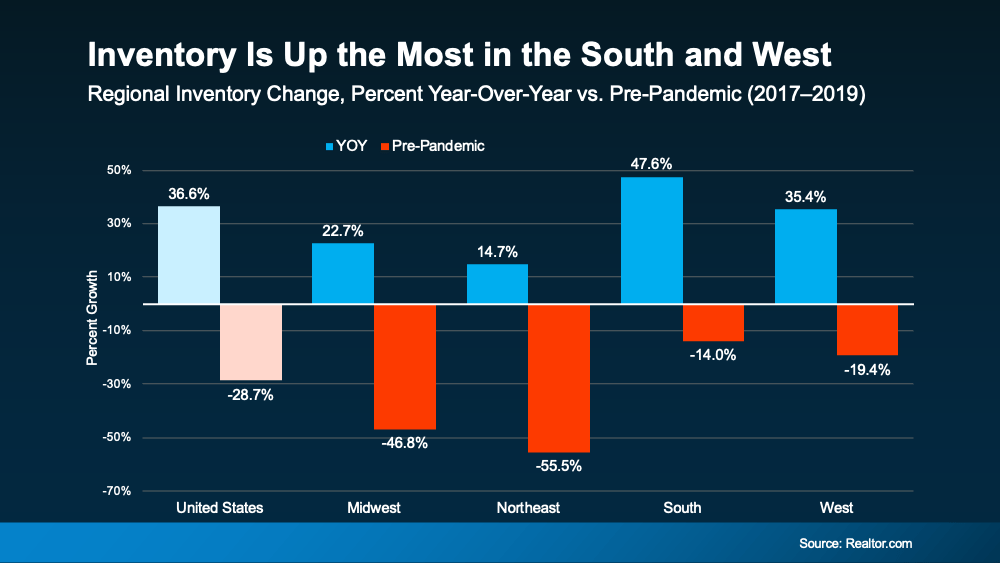

So, while we’re up by almost 37% year-over-year, we’re still not back to how much inventory there’d be in a normal market.

So, while we’re up by almost 37% year-over-year, we’re still not back to how much inventory there’d be in a normal market.

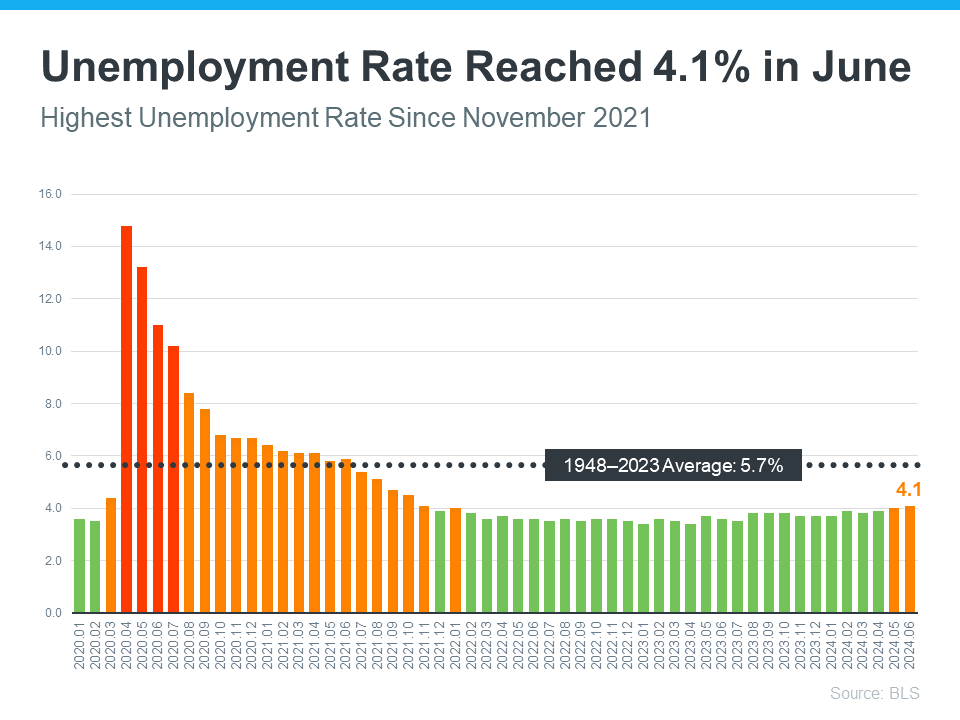

2. How Many Jobs the Economy Is Adding

2. How Many Jobs the Economy Is Adding