stdClass Object

(

[agents_bottom_line] => The expected Federal Funds Rate cut, driven by improving inflation and slower job growth, is likely to have a positive, though gradual, impact on mortgage rates. That could help unlock opportunities for you. When you’re ready, let’s connect. That way you’ll be prepared to take action when the time is right for you.

[assets] => Array

(

)

[banner_image] =>

[can_share] => no

[categories] => Array

(

[0] => stdClass Object

(

[category_type] => standard

[children] =>

[created_at] => 2019-06-03T18:18:43Z

[id] => 35

[name] => Mortgage Rates

[parent] =>

[parent_id] =>

[published_at] => 2019-06-03T18:18:43Z

[slug] => mortgage-rates

[status] => public

[translations] => stdClass Object

(

[es] => stdClass Object

(

[name] => Tasas de interés

)

)

[updated_at] => 2019-06-03T18:18:43Z

)

[1] => stdClass Object

(

[category_type] => standard

[children] =>

[created_at] => 2024-04-10T16:16:32Z

[id] => 321

[name] => Agent Value

[parent] =>

[parent_id] =>

[published_at] => 2024-04-10T16:17:42Z

[slug] => agent-value

[status] => public

[translations] => stdClass Object

(

[es] => stdClass Object

(

[name] => Valor del agente

)

)

[updated_at] => 2024-04-10T16:17:42Z

)

)

[content_type] => blog

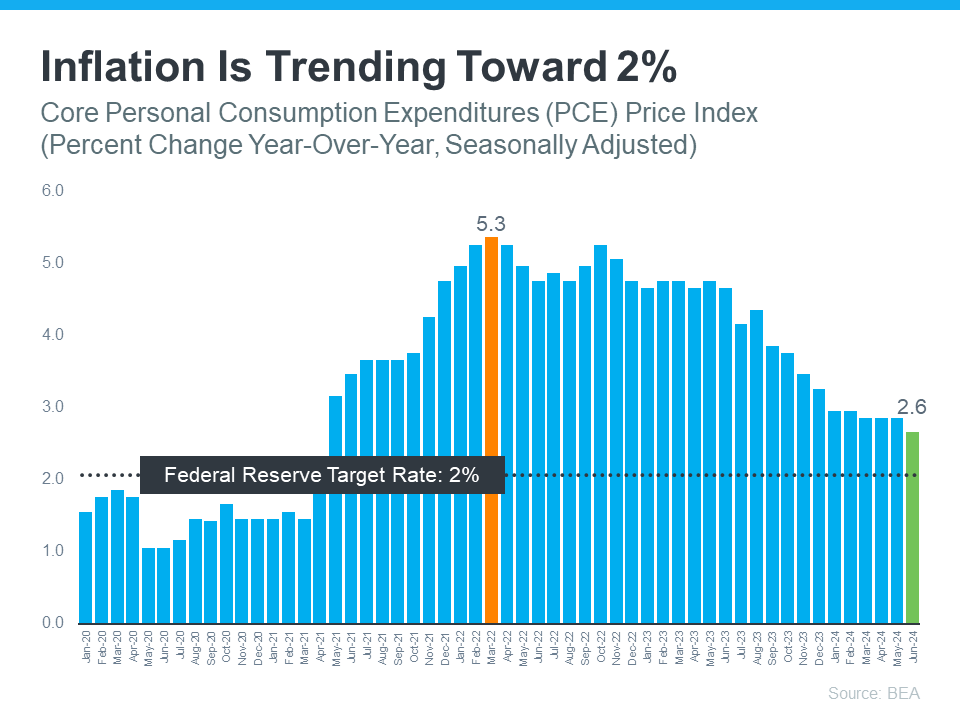

[contents] => Now that it’s September, all eyes are on the Federal Reserve (the Fed). The overwhelming expectation is that they’ll cut the Federal Funds Rate at their upcoming meeting, driven primarily by recent signs that inflation is cooling, and the job market is slowing down. Mark Zandi, Chief Economist at Moody’s Analytics, said:

“They’re ready to cut, just as long as we don’t get an inflation surprise between now and September, which we won’t.”

But what does this mean for the housing market, and more importantly, for you as a potential homebuyer or seller?

Why a Federal Funds Rate Cut Matters

The Federal Funds Rate is one of the key factors that influences mortgage rates – things like the economy, geopolitical uncertainty, and more also have an impact.

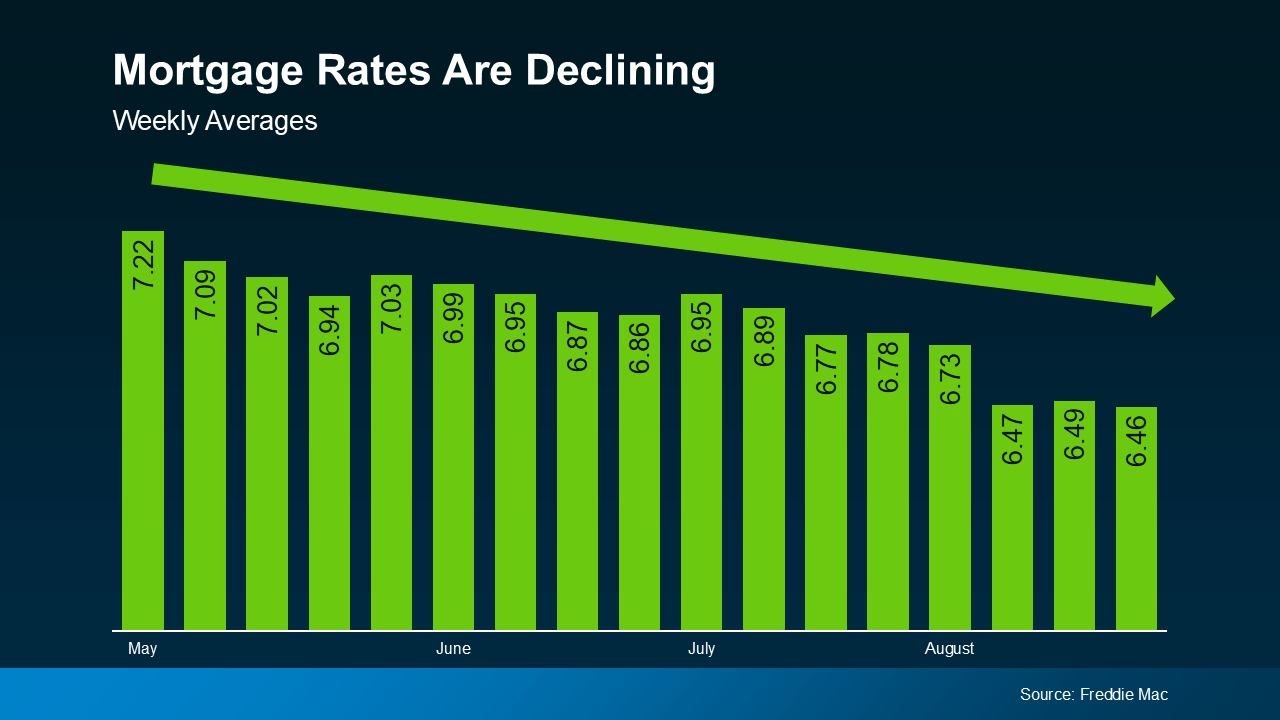

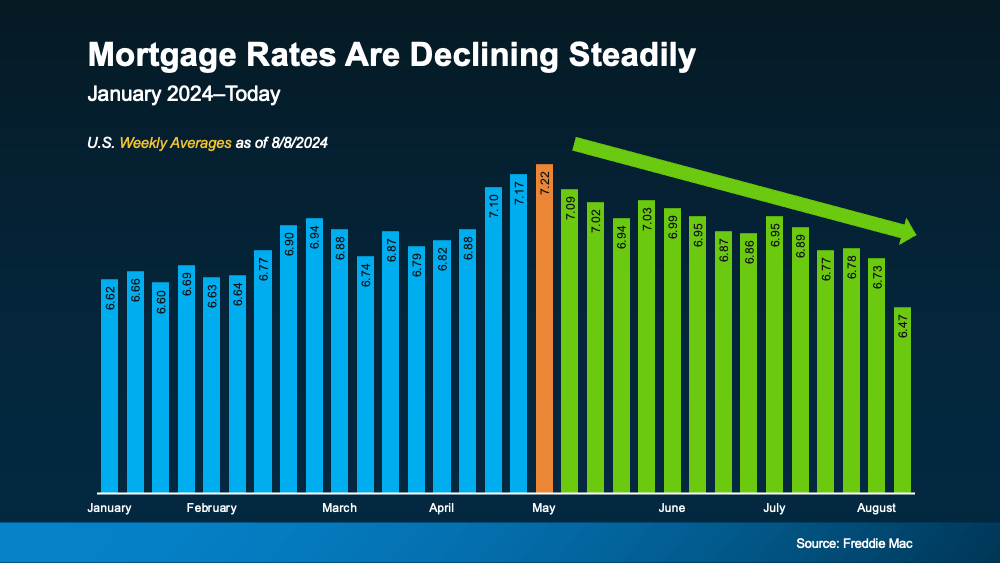

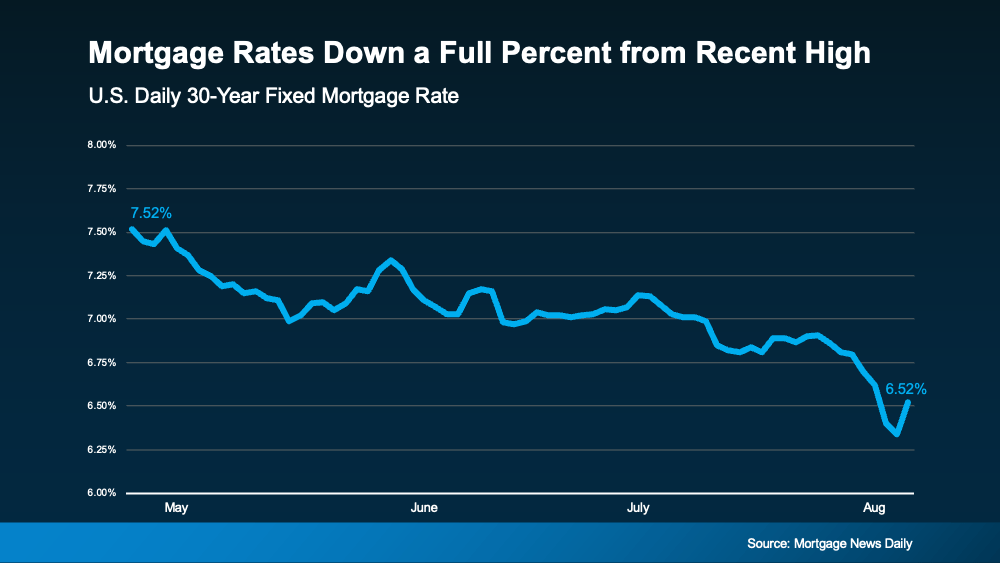

When the Fed cuts the Federal Funds Rate, it signals what’s happening in the broader economy, and mortgage rates tend to respond. While a single rate cut might not lead to a dramatic drop in mortgage rates, it could contribute to the gradual decline that’s already happening.

As Mike Fratantoni, Chief Economist at the Mortgage Bankers Association (MBA), points out:

“Once the Fed kicks off a rate-cutting cycle, we do expect that mortgage rates will move somewhat lower.”

And any upcoming Federal Funds Rate cut likely won’t be a one-time event. Lawrence Yun, Chief Economist at the National Association of Realtors (NAR), says:

“Generally, the rate-cutting cycle is not one-and-done. Six to eight rounds of rate cuts all through 2025 look likely.”

The Projected Impact on Mortgage Rates

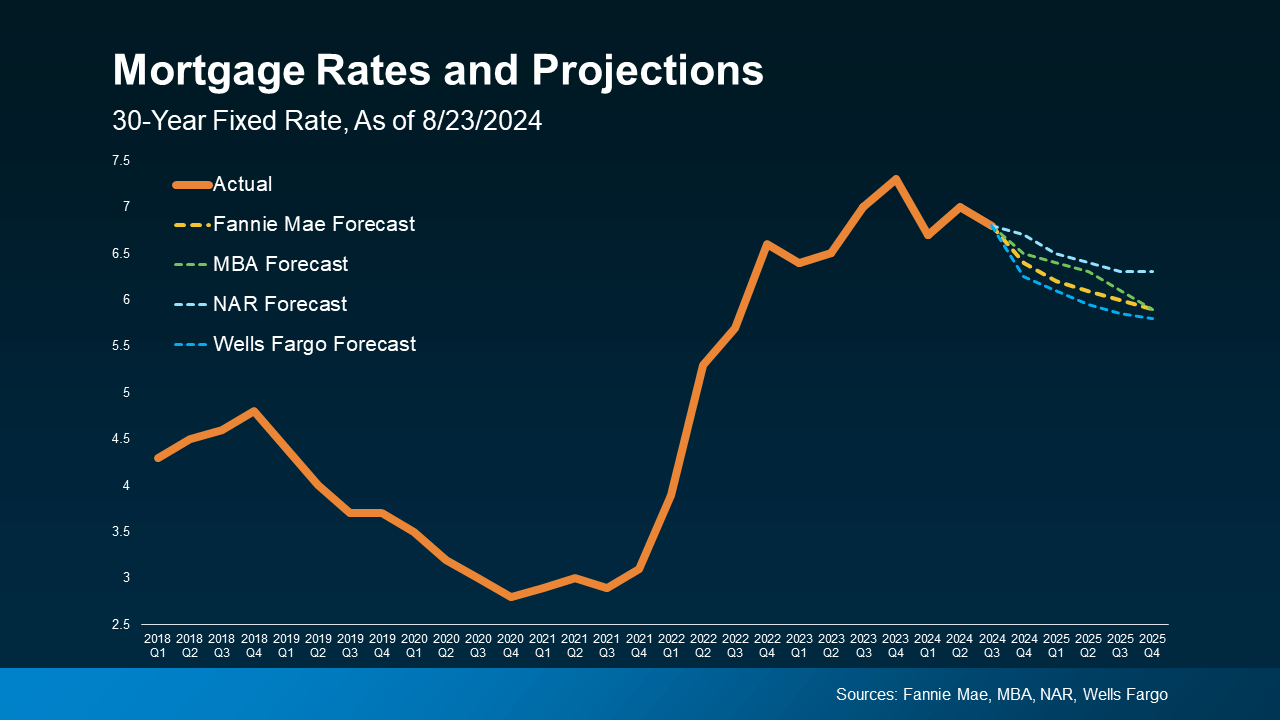

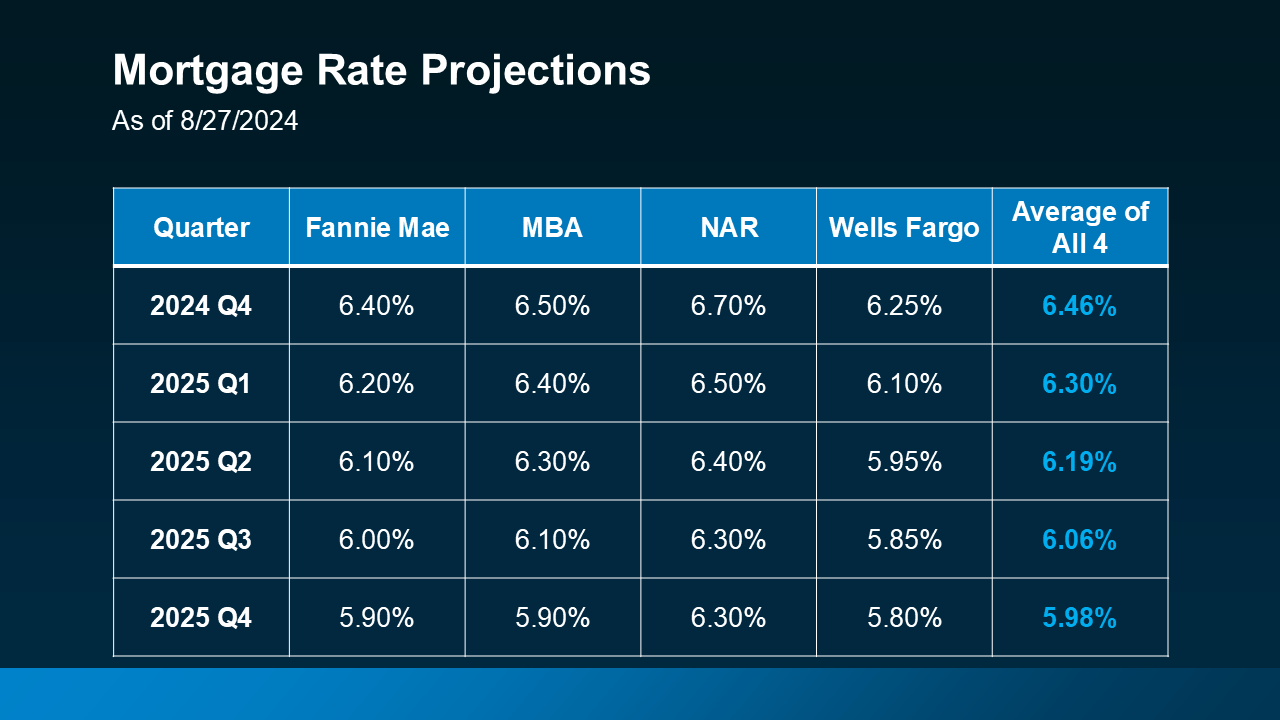

Here’s what experts in the industry project for mortgage rates through 2025. One contributing factor to this ongoing gradual decline is the anticipated cuts from the Fed. The graph below shows the latest forecasts from Fannie Mae, MBA, NAR, and Wells Fargo (see graph below):

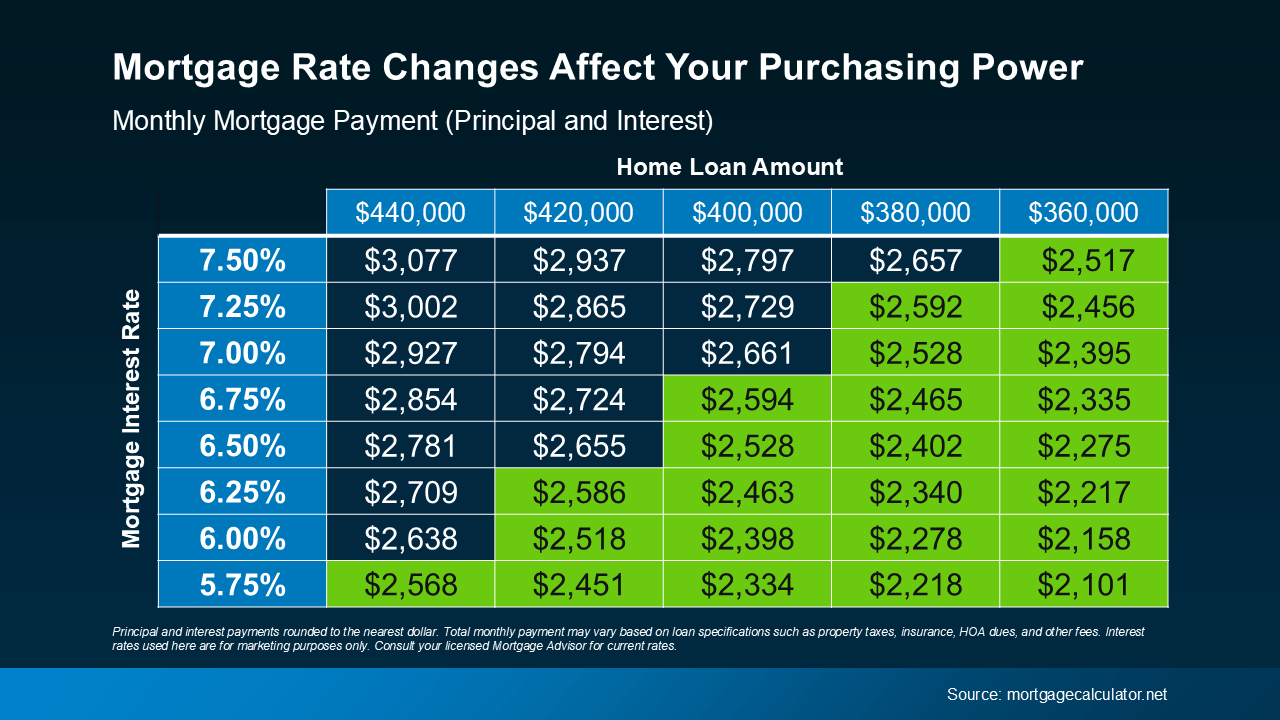

So, with recent improvements in inflation and signs of a cooling job market, a Federal Funds Rate cut is likely to lead to a moderate decline in mortgage rates (shown in the dotted lines). Here are two big reasons why that’s good news for both buyers and sellers:

So, with recent improvements in inflation and signs of a cooling job market, a Federal Funds Rate cut is likely to lead to a moderate decline in mortgage rates (shown in the dotted lines). Here are two big reasons why that’s good news for both buyers and sellers:

1. It Helps Alleviate the Lock-In Effect

For current homeowners, lower mortgage rates could help ease the lock-in effect. That’s where people feel stuck within their current home because today’s rates are higher than what they locked in when they bought their current house.

If the fear of losing your low-rate mortgage and facing higher costs has kept you out of the market, a slight reduction in rates could make selling a bit more attractive again. However, this isn’t expected to bring a flood of sellers to the market, as many homeowners may still be cautious about giving up their existing mortgage rate.

2. It Should Boost Buyer Activity

For potential homebuyers, any drop in mortgage rates will provide a more inviting housing market. Lower mortgage rates can reduce the overall cost of homeownership, making it more feasible for you if you’ve been waiting to make a move.

What Should You Do?

While a Federal Funds Rate cut is not expected to lead to drastically lower mortgage rates, it will likely contribute to the gradual decrease that’s already happening.

And while the anticipated rate cut represents a positive shift for the future of the housing market, it’s important to consider your options right now. Jacob Channel, Senior Economist at LendingTree, sums it up well:

“Timing the market is basically impossible. If you’re always waiting for perfect market conditions, you’re going to be waiting forever. Buy now only if it’s a good idea for you.”

[created_at] => 2024-08-30T14:57:19Z

[description] => Now that it’s September, all eyes are on the Federal Reserve (the Fed).

[exclusive_id] =>

[expired_at] =>

[featured_image] => https://files.keepingcurrentmatters.com/KeepingCurrentMatters/content/images/20240830/20240904-How-the-Federal-Reserve-s-Next-Move-Could-Impact-the-Housing-Market-original.png

[id] => 60343

[kcm_ig_caption] => Now that it’s September, all eyes are on the Federal Reserve (the Fed). The overwhelming expectation is that they’ll cut the Federal Funds Rate at their upcoming meeting, driven primarily by recent signs that inflation is cooling, and the job market is slowing down.

Why a Federal Funds Rate Cut Matters

The Federal Funds Rate is one of the key factors that influences mortgage rates – things like the economy, geopolitical uncertainty, and more also have an impact.

When the Fed cuts the Federal Funds Rate, it signals what’s happening in the broader economy, and mortgage rates tend to respond.

As Mike Fratantoni, Chief Economist at the Mortgage Bankers Association (MBA), points out: “Once the Fed kicks off a rate-cutting cycle, we do expect that mortgage rates will move somewhat lower.”

And any upcoming Federal Funds Rate cut likely won’t be a one-time event. Lawrence Yun, Chief Economist at the National Association of Realtors (NAR), says: “Generally, the rate-cutting cycle is not one-and-done. Six to eight rounds of rate cuts all through 2025 look likely.”

What Should You Do?

While a Federal Funds Rate cut is not expected to lead to drastically lower mortgage rates, it will likely contribute to the gradual decrease that’s already happening.

The expected Federal Funds Rate cut, driven by improving inflation and slower job growth, is likely to have a positive, though gradual, impact on mortgage rates. That could help unlock opportunities for you. When you’re ready, let’s connect. That way you’ll be prepared to take action when the time is right for you.

[kcm_ig_hashtags] => expertanswers,stayinformed,keepingcurrentmatters

[kcm_ig_quote] => How the Federal Reserve’s next move could impact the housing market.

[poll] =>

[public_bottom_line] => The expected Federal Funds Rate cut, driven by improving inflation and slower job growth, is likely to have a positive, albeit gradual, impact on mortgage rates. That could help unlock opportunities for you. When you’re ready, connect with a local real estate agent so you’re prepared to take action.

[published_at] => 2024-09-04T10:30:00Z

[related] => Array

(

)

[slug] => how-the-federal-reserves-next-move-could-impact-the-housing-market

[status] => published

[tags] => Array

(

[0] => content-hub

)

[title] => How the Federal Reserve’s Next Move Could Impact the Housing Market

[updated_at] => 2024-09-04T10:30:27Z

[url] => /2024/09/04/how-the-federal-reserves-next-move-could-impact-the-housing-market/

)

How the Federal Reserve’s Next Move Could Impact the Housing Market

Now that it’s September, all eyes are on the Federal Reserve (the Fed).

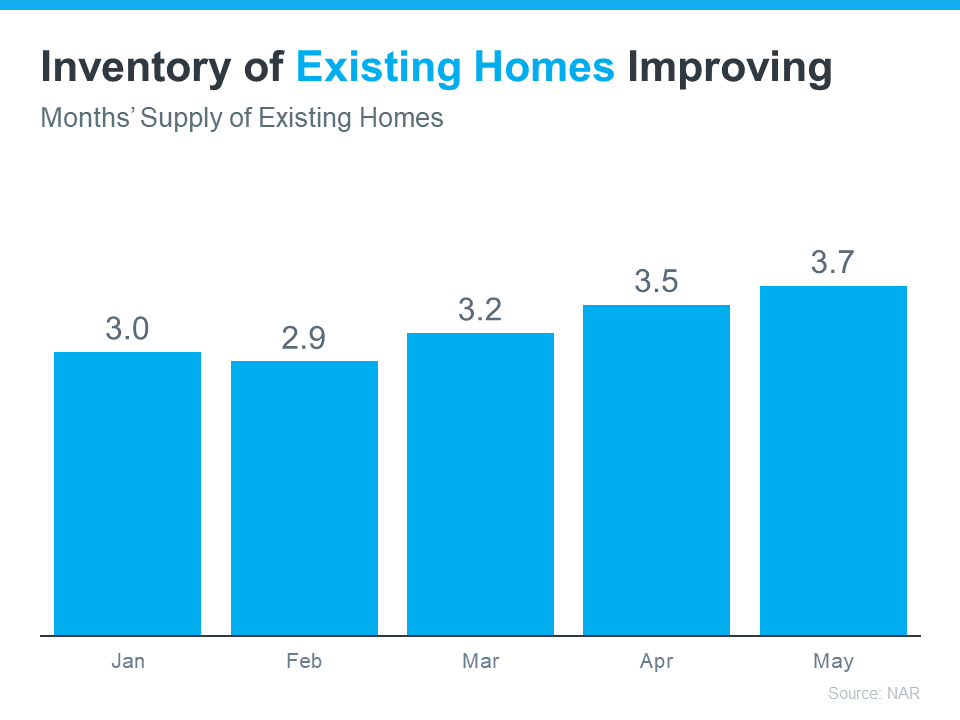

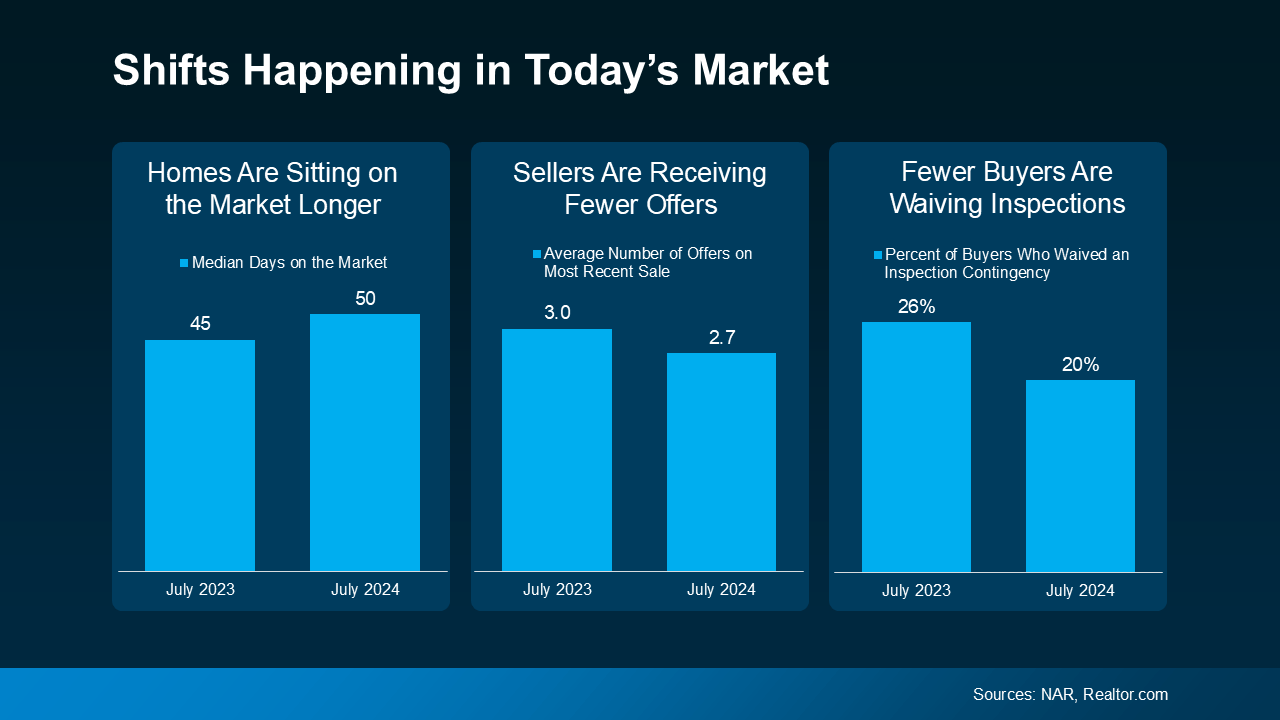

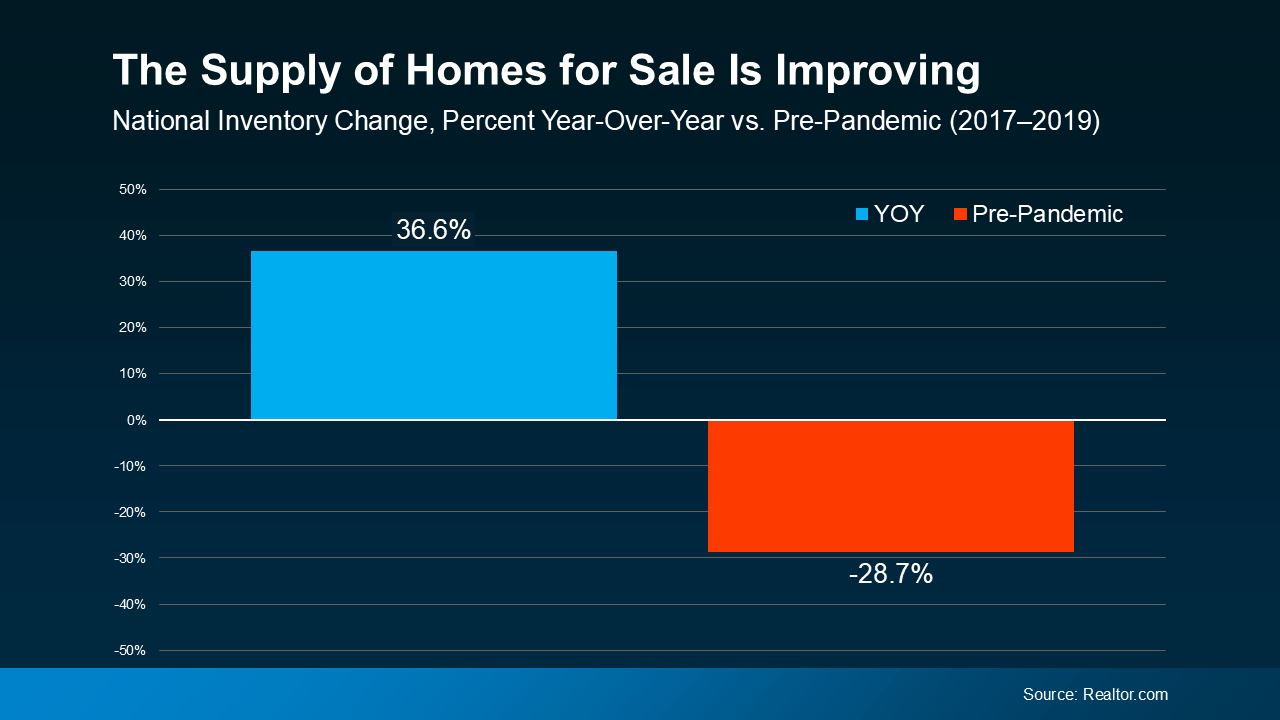

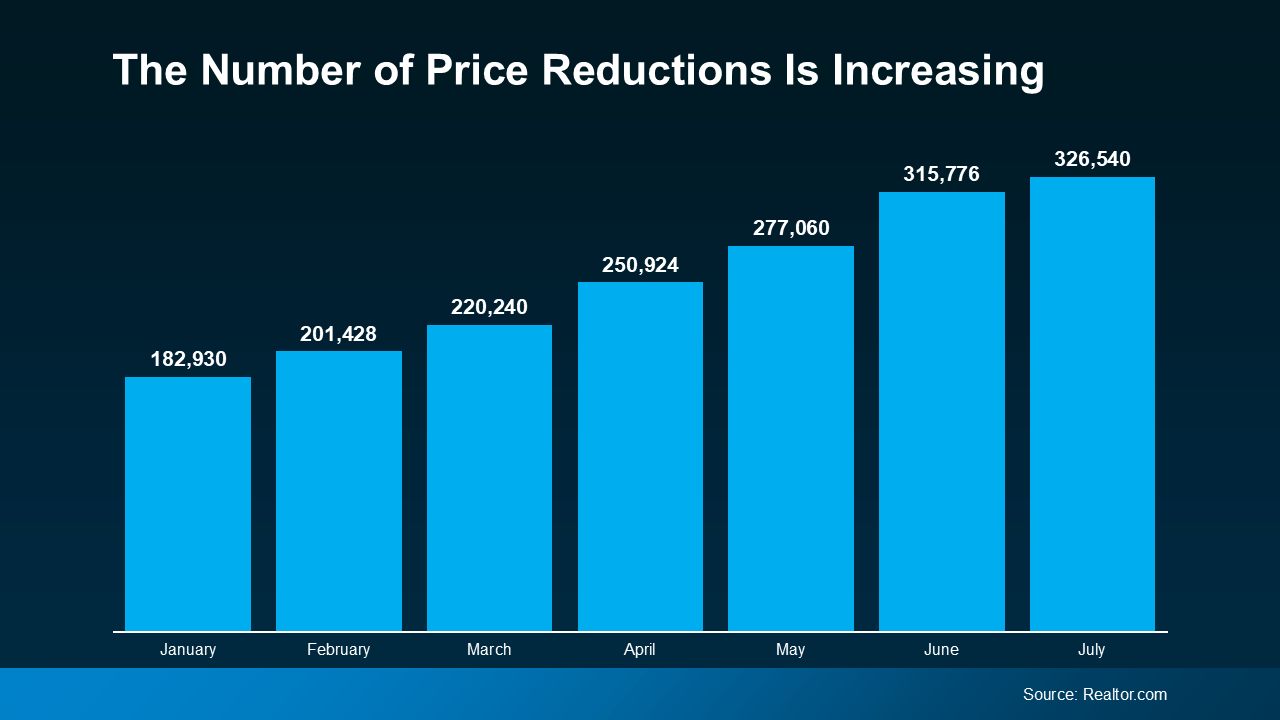

Homes Are Sitting on the Market Longer: Since more homes are on the market, they’re not selling quite as fast. For buyers, this means you may have more time to find the right home. For sellers, it’s important to

Homes Are Sitting on the Market Longer: Since more homes are on the market, they’re not selling quite as fast. For buyers, this means you may have more time to find the right home. For sellers, it’s important to

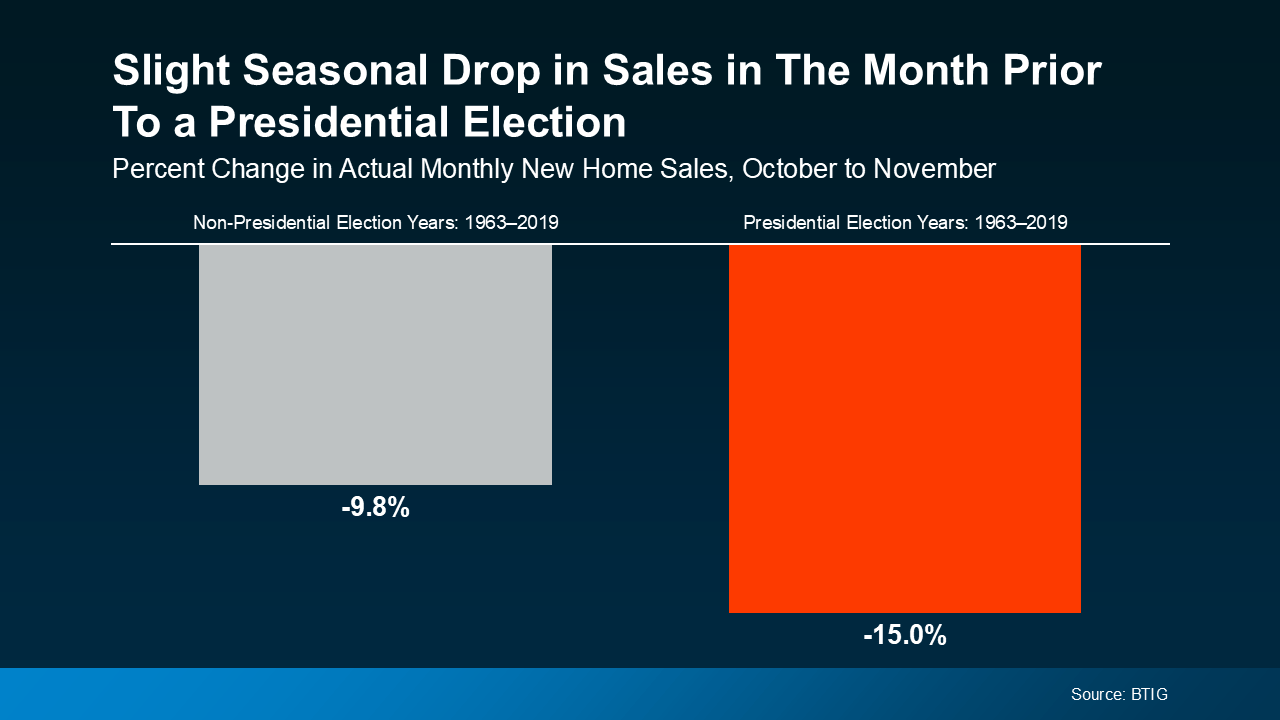

Some consumers will simply wait it out before they make their purchase decision.

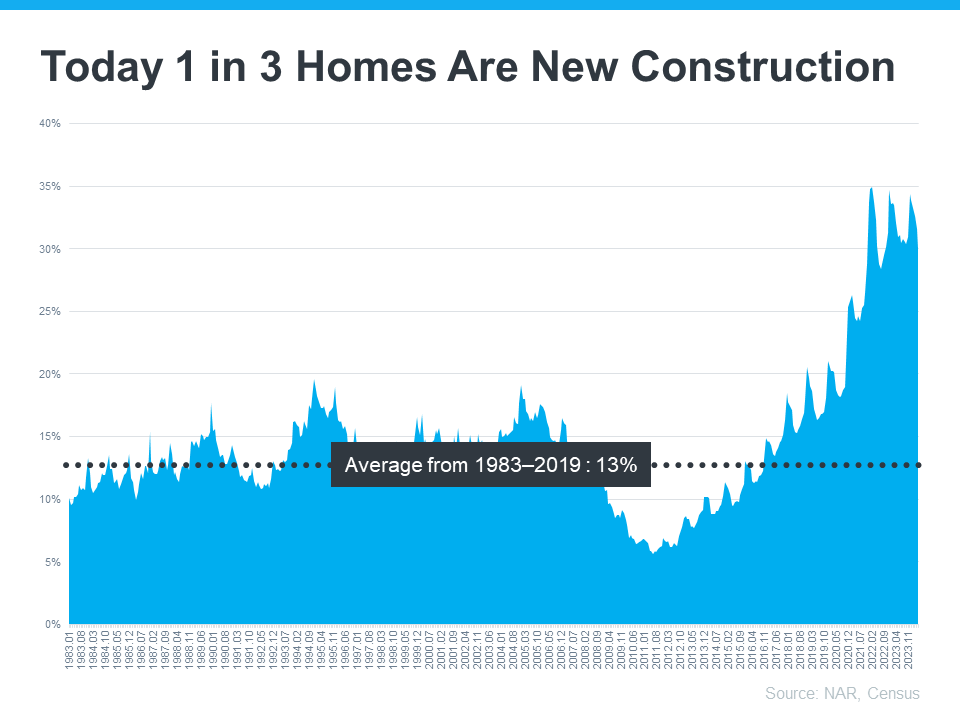

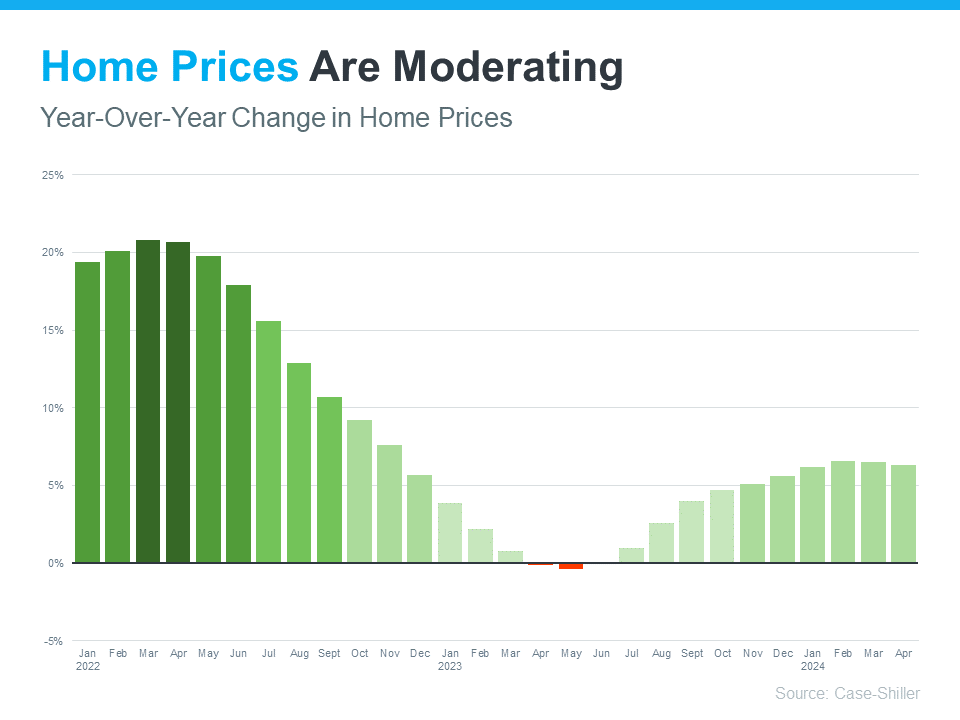

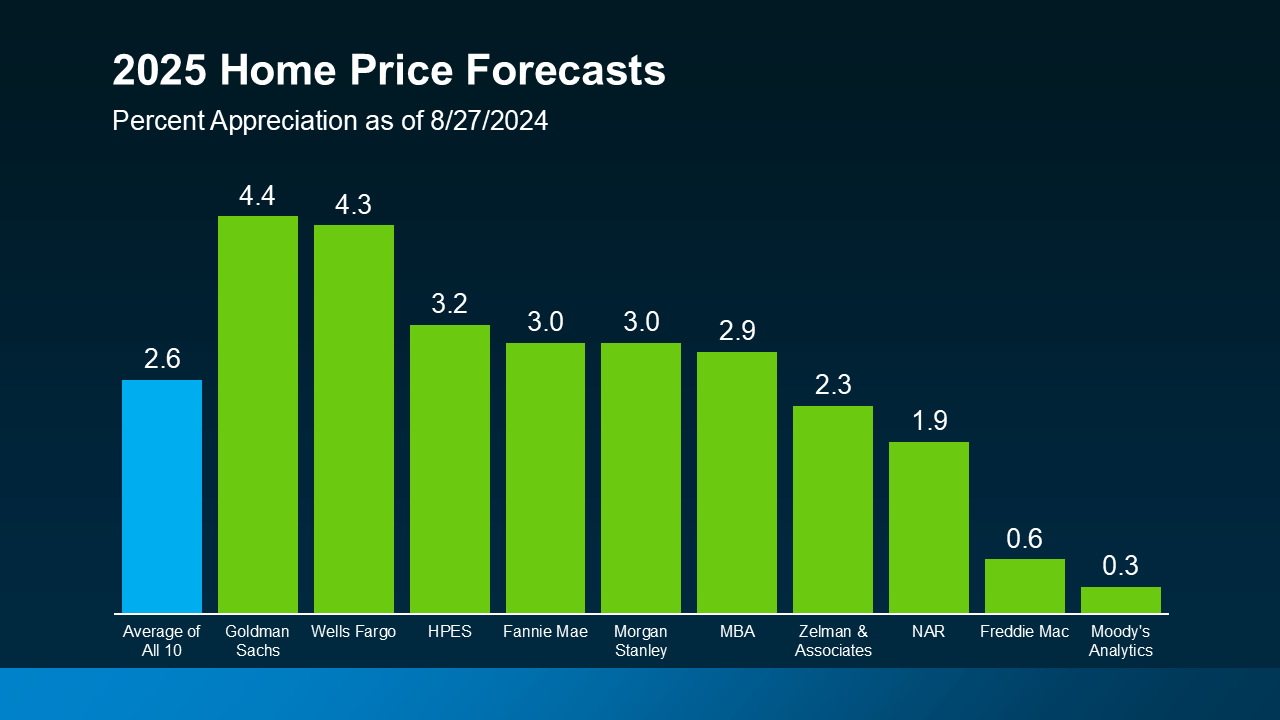

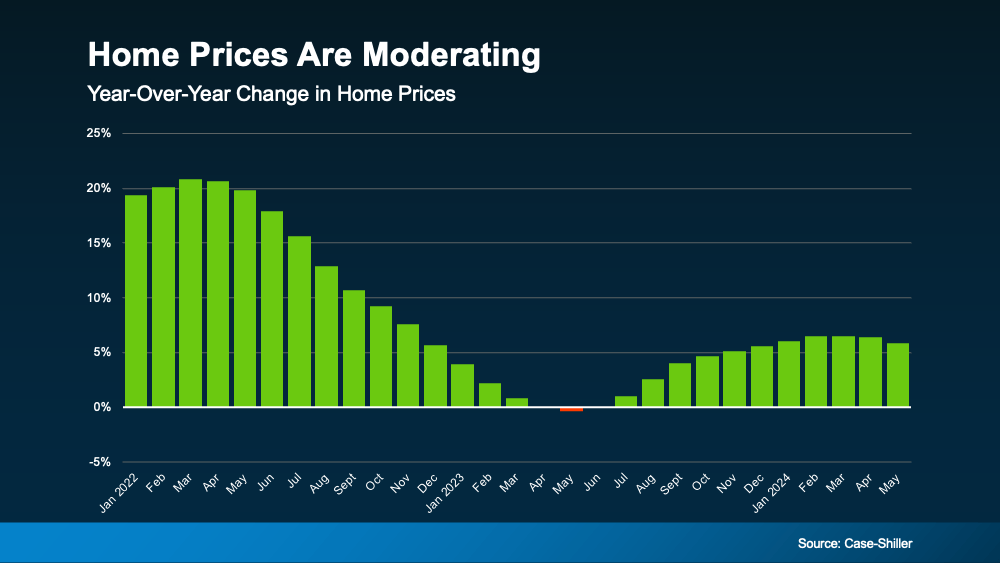

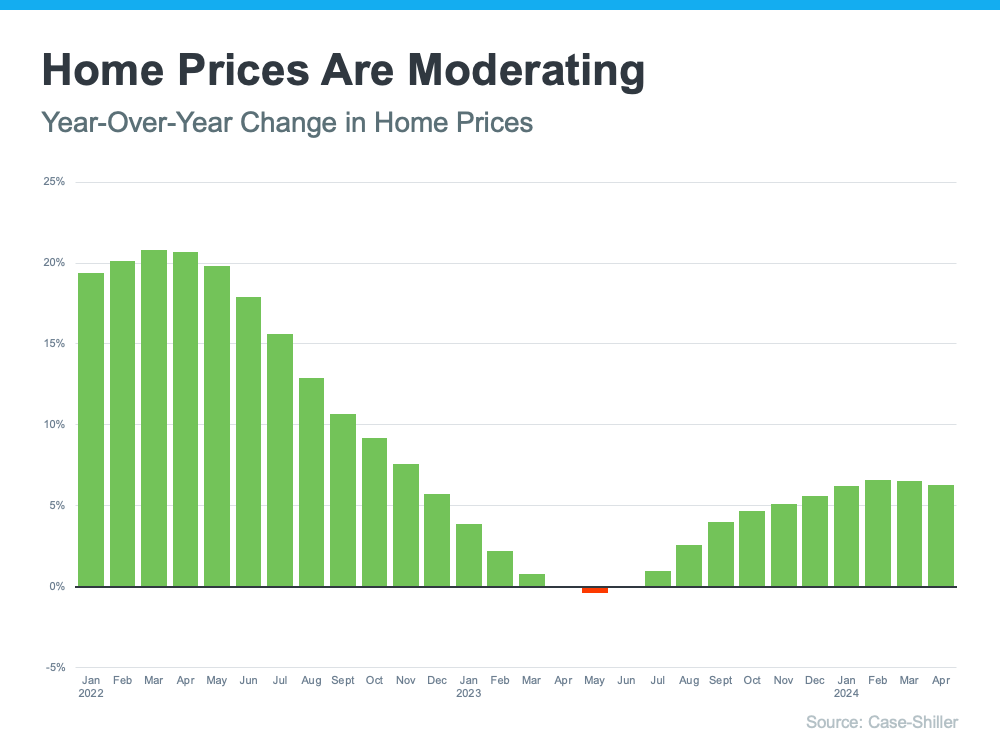

Some consumers will simply wait it out before they make their purchase decision. Home Prices

Home Prices

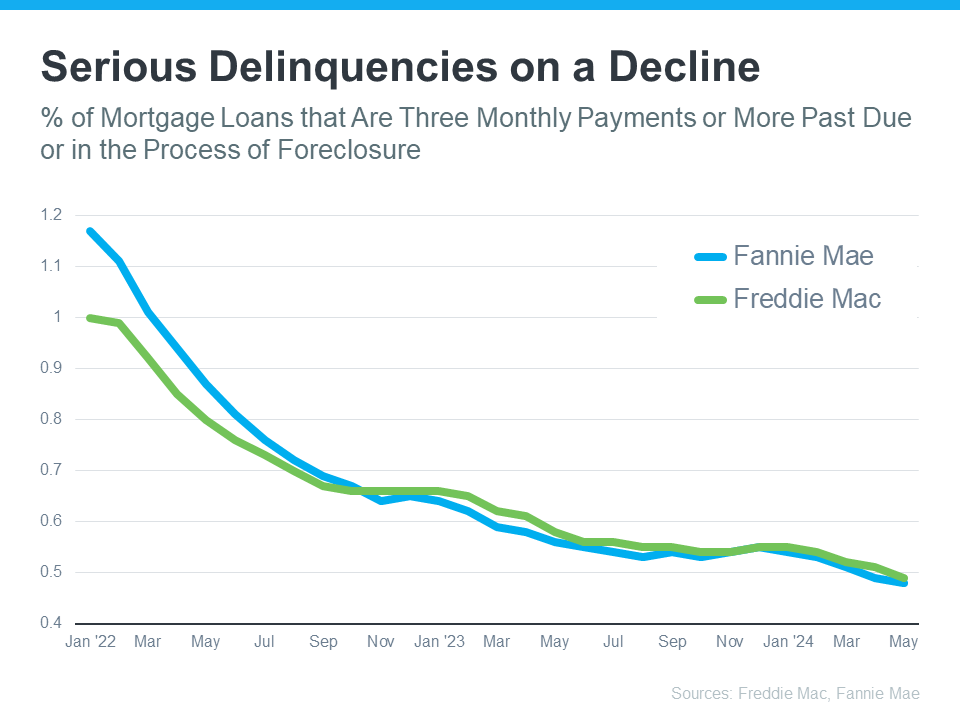

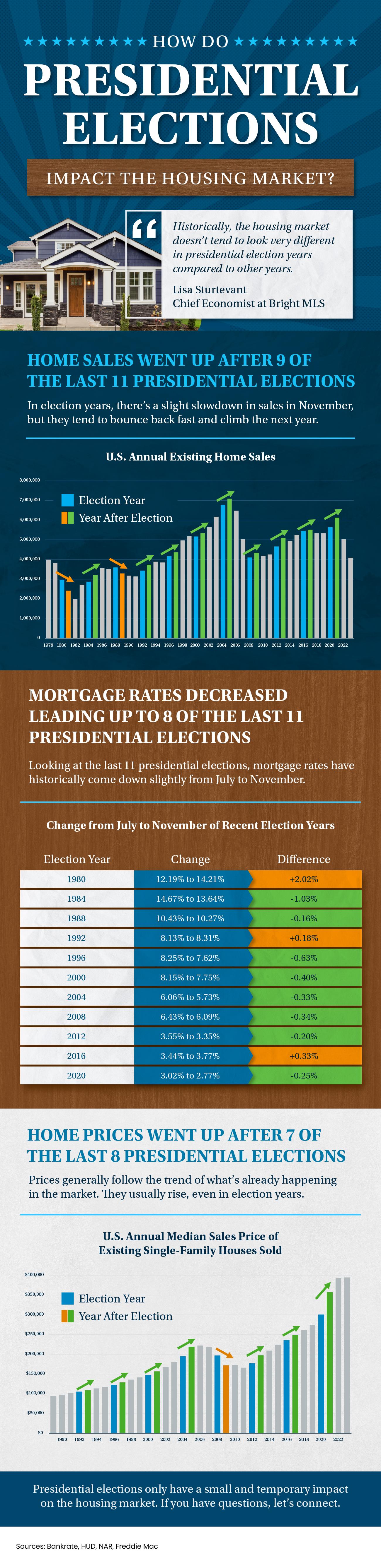

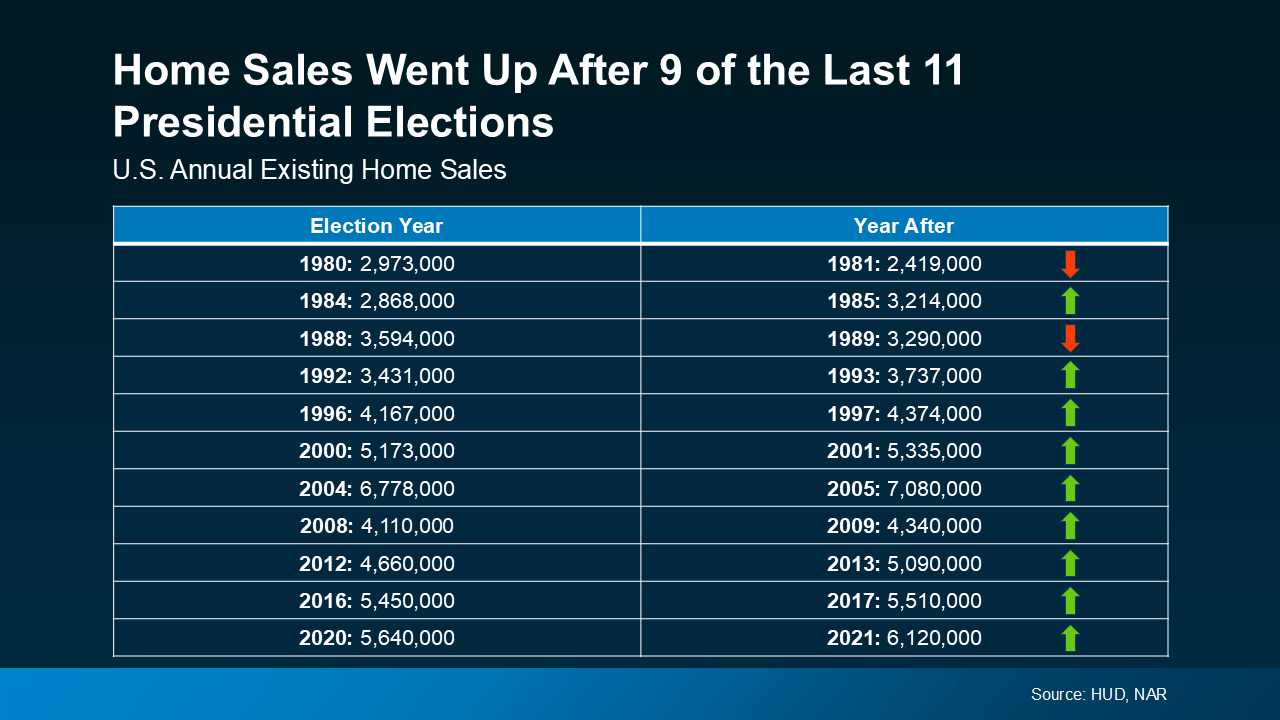

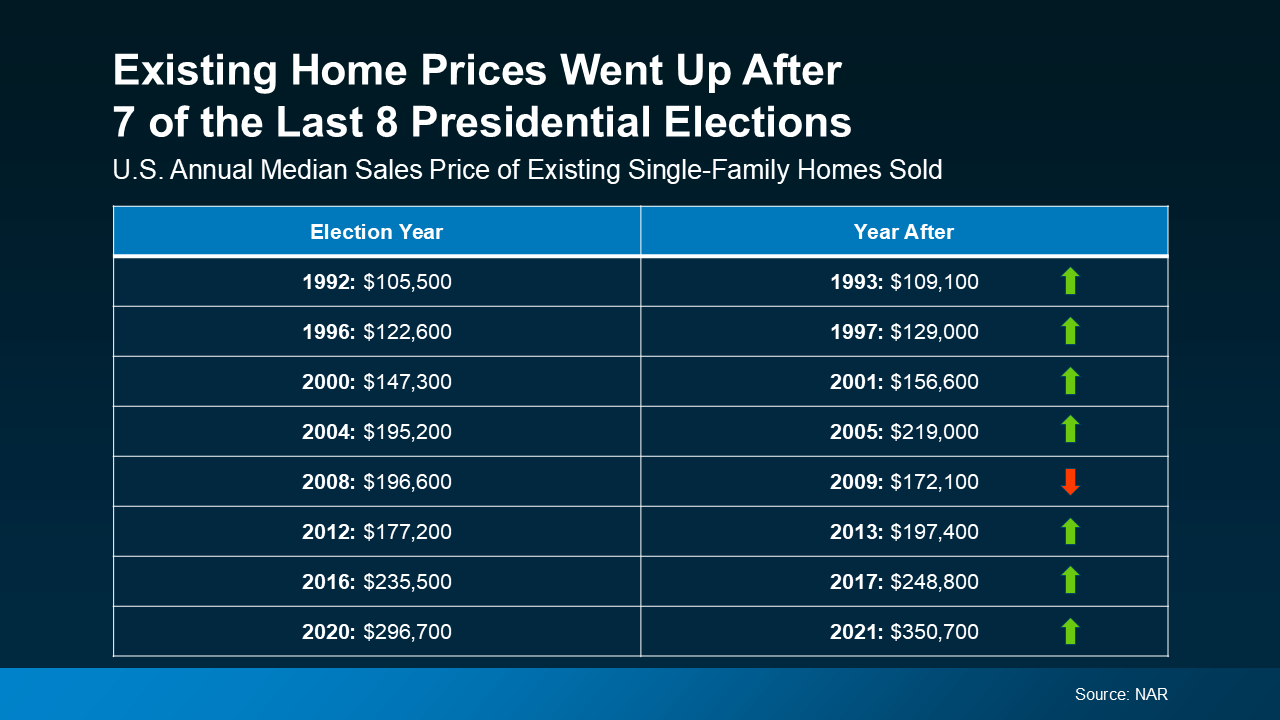

Impact on the Housing Market

Impact on the Housing Market

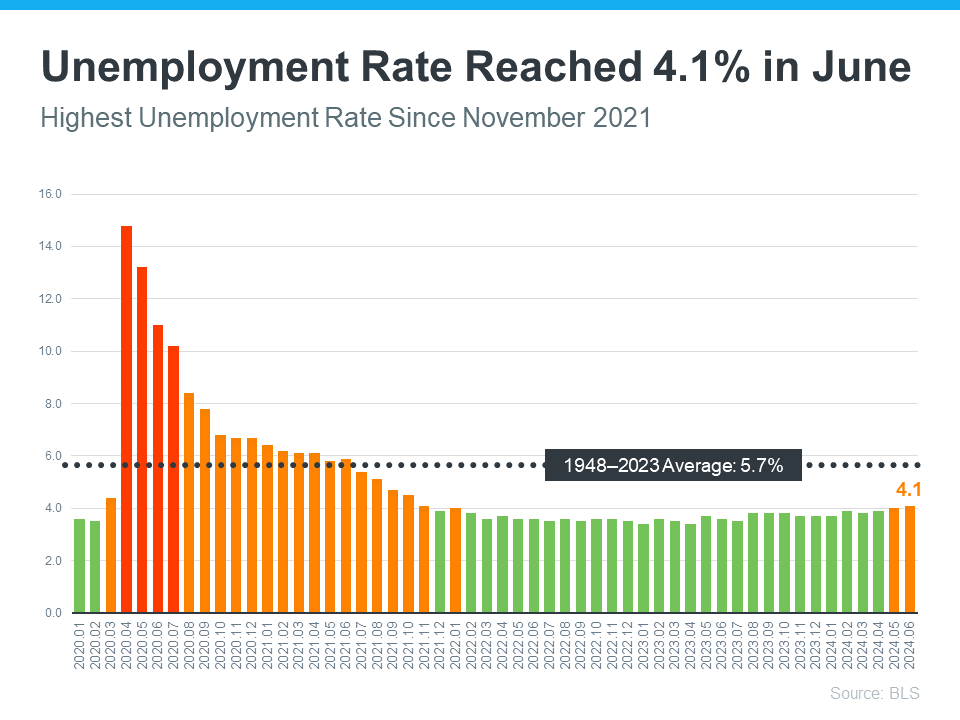

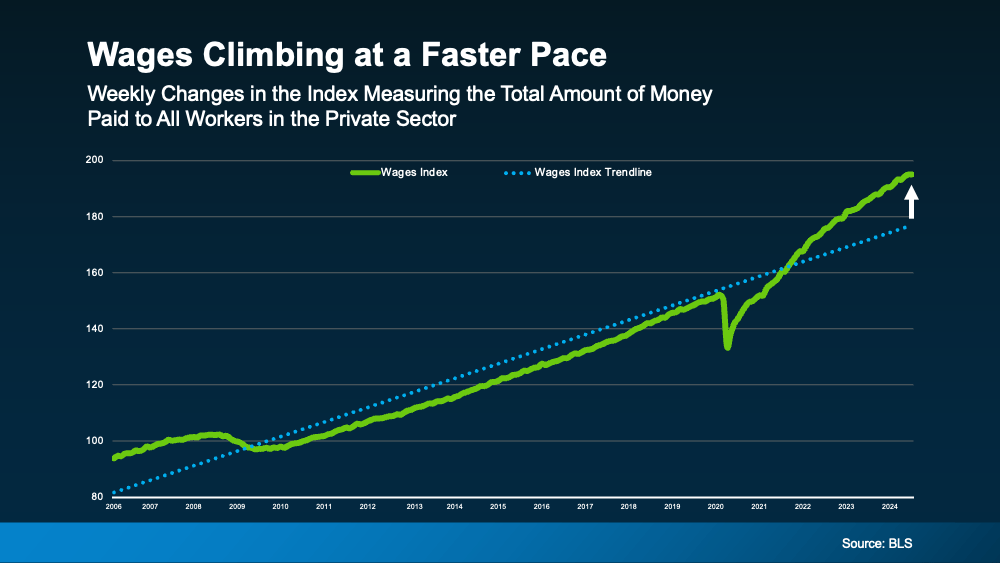

2. How Many Jobs the Economy Is Adding

2. How Many Jobs the Economy Is Adding