stdClass Object

(

[agents_bottom_line] => If you’re considering buying a brand-new home, don’t let misconceptions hold you back. Let’s work together to find a home you’ll love and be proud to call your own.

[assets] => Array

(

)

[banner_image] =>

[can_share] => no

[categories] => Array

(

[0] => stdClass Object

(

[category_type] => standard

[children] =>

[created_at] => 2019-06-03T18:18:43Z

[id] => 5

[name] => For Buyers

[parent] =>

[parent_id] =>

[published_at] => 2019-06-03T18:18:43Z

[slug] => buyers

[status] => public

[translations] => stdClass Object

(

[es] => stdClass Object

(

[name] => Para los compradores

)

)

[updated_at] => 2019-06-03T18:18:43Z

)

[1] => stdClass Object

(

[category_type] => standard

[children] =>

[created_at] => 2024-04-10T16:16:32Z

[id] => 321

[name] => Agent Value

[parent] =>

[parent_id] =>

[published_at] => 2024-04-10T16:17:42Z

[slug] => agent-value

[status] => public

[translations] => stdClass Object

(

[es] => stdClass Object

(

[name] => Valor del agente

)

)

[updated_at] => 2024-04-10T16:17:42Z

)

[2] => stdClass Object

(

[category_type] => standard

[children] =>

[created_at] => 2024-04-10T16:19:38Z

[id] => 323

[name] => Buying Tips

[parent] =>

[parent_id] =>

[published_at] => 2024-04-10T16:19:44Z

[slug] => buying-tips

[status] => public

[translations] => stdClass Object

(

[es] => stdClass Object

(

[name] => Consejos de compra

)

)

[updated_at] => 2024-04-10T16:19:44Z

)

)

[content_type] => blog

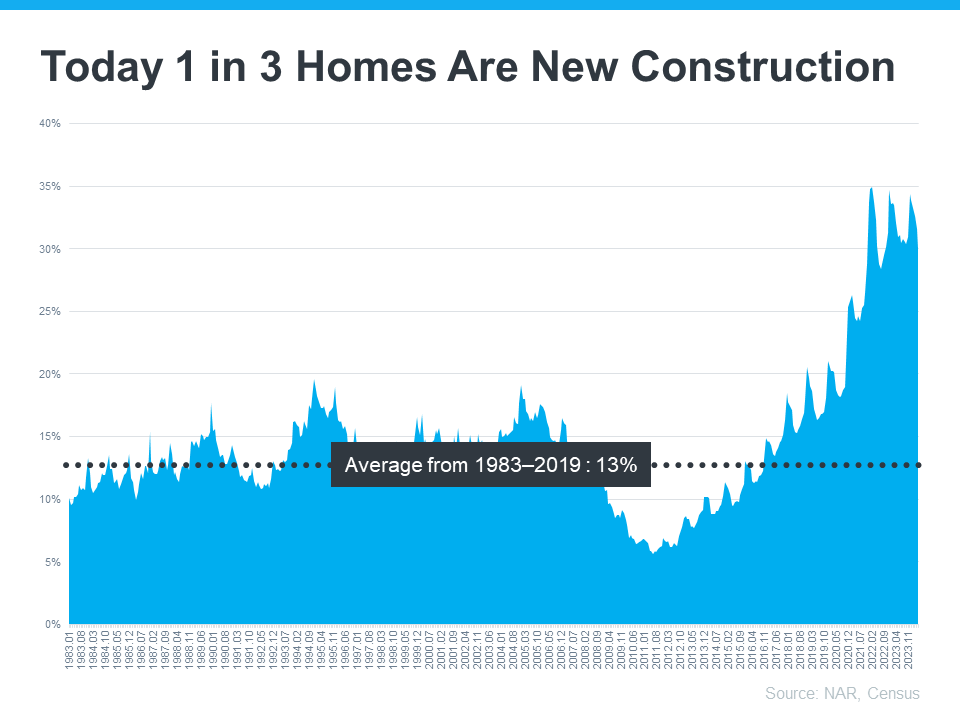

[contents] => For some buyers, there’s a misconception that newly built homes aren’t made to last or fall short of the quality you can find in older homes. Unfortunately, this is turning some buyers away from what may be one of their best options in today’s housing market. As Builder Online says:

“As resale inventory remains limited and the price spread between new and resale homes narrows, new homes are increasingly an attractive value proposition for buyers, with incentives such as rate buydowns a way to help address ongoing affordability challenges.”

So, is there any merit to the myth? Let’s break down the best way to make sure you feel good about looking into new home construction. That way, you’re not missing out on such a great option today.

Choosing the Right Builder

The key to making sure you get a quality newly built home is to choose a good builder. Reputable builders adhere to strict building codes and standards, use advanced construction techniques, and often offer warranties that cover structural issues for several years. That’s why the Mortgage Reports offers this advice:

“When embarking on the journey of buying a new construction home, one of the most important steps is selecting the right builder. This decision can significantly impact the quality and satisfaction you derive from your new home.”

And while you could dig into research about all the builders in your area, there’s an easier option to get the job done: lean on a pro. When you work with a local real estate agent, they already know about the builders and the new home communities under construction in your area.

Beyond that, maybe they’ve even worked with other buyers who opted for a home in one of those neighborhoods. Here are just a few of the things your agent will help you with:

1. The Builder’s Reputation: Your agent will help point you toward builders with strong reputations and positive reviews from previous buyers. Additionally, your agent will make sure the builder is licensed and insured. Membership in professional organizations, such as the National Association of Home Builders (NAHB), is also a good sign of a builder’s commitment to industry standards.

2. Their Model Homes: Your agent will also be able to tell you if the builders have model homes you can tour. And when your agent walks through the model with you, they’ll draw your attention to the little details that matter most. Things like the quality of finishes, layout, and overall feel of the home.

3. Builder Warranties: Your agent will also be able to help you navigate any builder offers or incentives. Reputable builders often provide warranties to cover major structural elements of the home for a significant period of time. This is a testament to their confidence in the quality of their construction.

4. Getting Inspections: Even with new homes, inspections are crucial. Your agent will coordinate the inspections with licensed professionals to ensure the home meets safety and quality standards before you move in.

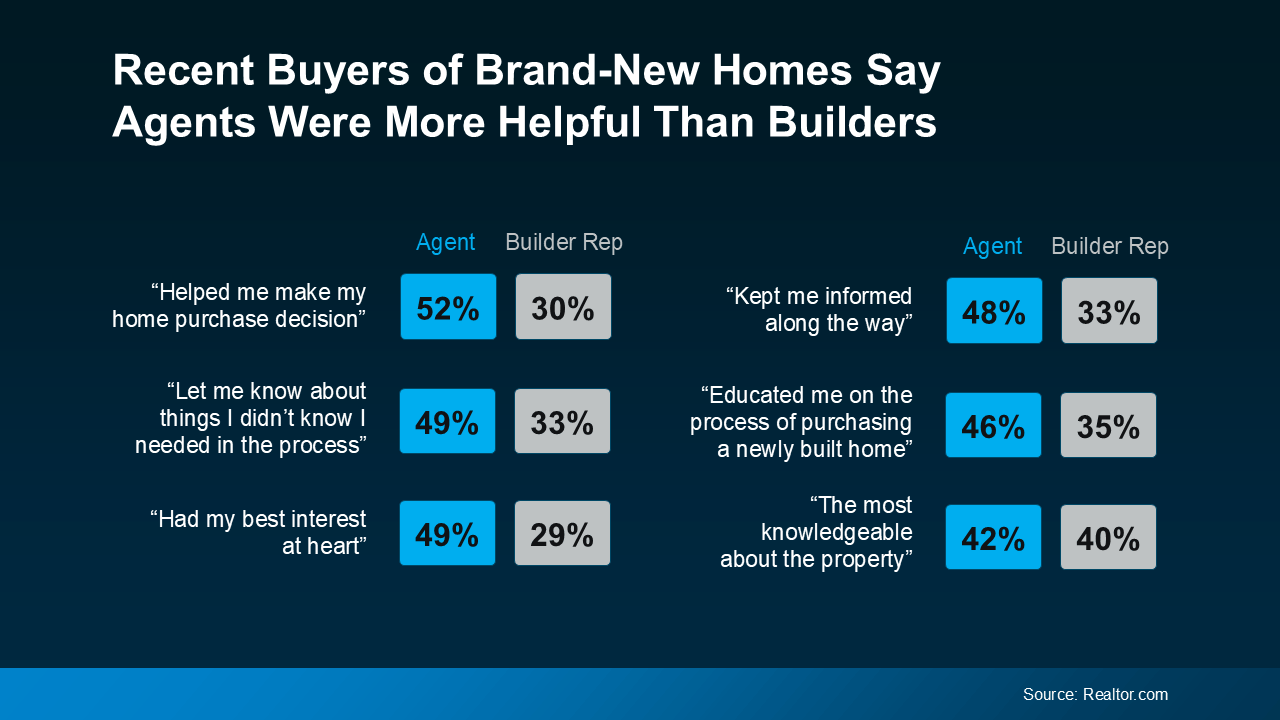

Agents Are the MVP When You’re Buying a Brand-New Home

Maybe that’s why data shows homebuyers unanimously scored their agents higher than their builders when looking back on their recent purchase:

So, you don’t need to worry that they just don’t make them like they used to. By working with a knowledgeable real estate agent to choose a reputable builder, you can feel confident when buying a newly built home today. As Realtor.com says:

So, you don’t need to worry that they just don’t make them like they used to. By working with a knowledgeable real estate agent to choose a reputable builder, you can feel confident when buying a newly built home today. As Realtor.com says:

“If you are interested in buying a new construction . . . You need your own real estate agent from the get-go. Even if it seems like plug and play to sign up with the builder’s on-site agent, you’re going to want someone representing your side of the deal.”

[created_at] => 2024-10-10T14:16:49Z

[description] => For some buyers, there’s a misconception that newly built homes aren’t made to last or fall short of the quality you can find in older homes.

[exclusive_id] =>

[expired_at] =>

[featured_image] => https://files.keepingcurrentmatters.com/KeepingCurrentMatters/content/images/20241010/20241015-Why-an-Agent-Is-Essential-When-Buying-a-Newly-Built-Home-original.png

[id] => 64808

[kcm_ig_caption] => For some buyers, there’s a misconception that newly built homes aren’t made to last or fall short of the quality you can find in older homes. Unfortunately, this is turning some buyers away from what may be one of their best options in today’s housing market.

So, is there any merit to the myth? Let’s break down the best way to make sure you feel good about looking into new home construction. That way, you’re not missing out on such a great option today.

Choosing the Right Builder

The key to making sure you get a quality newly built home is to choose a good builder. Reputable builders adhere to strict building codes and standards, use advanced construction techniques, and often offer warranties that cover structural issues for several years.

Beyond that, maybe they’ve even worked with other buyers who opted for a home in one of those neighborhoods. Here are just a few of the things your agent will help you with:

1. The Builder’s Reputation

2. Their Model Homes

3. Builder Warranties

4. Getting Inspections

Agents Are the MVP When You’re Buying a Brand-New Home

Maybe that’s why data shows homebuyers unanimously scored their agents higher than their builders when looking back on their recent purchase.

So, you don’t need to worry that they just don’t make them like they used to. By working with a knowledgeable real estate agent to choose a reputable builder, you can feel confident when buying a newly built home today.

If you’re considering buying a brand-new home, don’t let misconceptions hold you back. Let’s work together to find a home you’ll love and be proud to call your own.

[kcm_ig_hashtags] => expertanswers,realestate,keepingcurrentmatters

[kcm_ig_quote] => Why an agent is essential when buying a newly built home.

[poll] =>

[public_bottom_line] => If you’re considering buying a brand-new home, don’t let misconceptions hold you back. Work with a local real estate agent to find a home you’ll love and be proud to call your own.

[published_at] => 2024-10-15T10:30:00Z

[related] => Array

(

)

[slug] => why-an-agent-is-essential-when-buying-a-newly-built-home

[status] => published

[tags] => Array

(

[0] => content-hub

)

[title] => Why an Agent Is Essential When Buying a Newly Built Home

[updated_at] => 2024-10-15T10:30:10Z

[url] => /2024/10/15/why-an-agent-is-essential-when-buying-a-newly-built-home/

)

Why an Agent Is Essential When Buying a Newly Built Home

For some buyers, there’s a misconception that newly built homes aren’t made to last or fall short of the quality you can find in older homes.

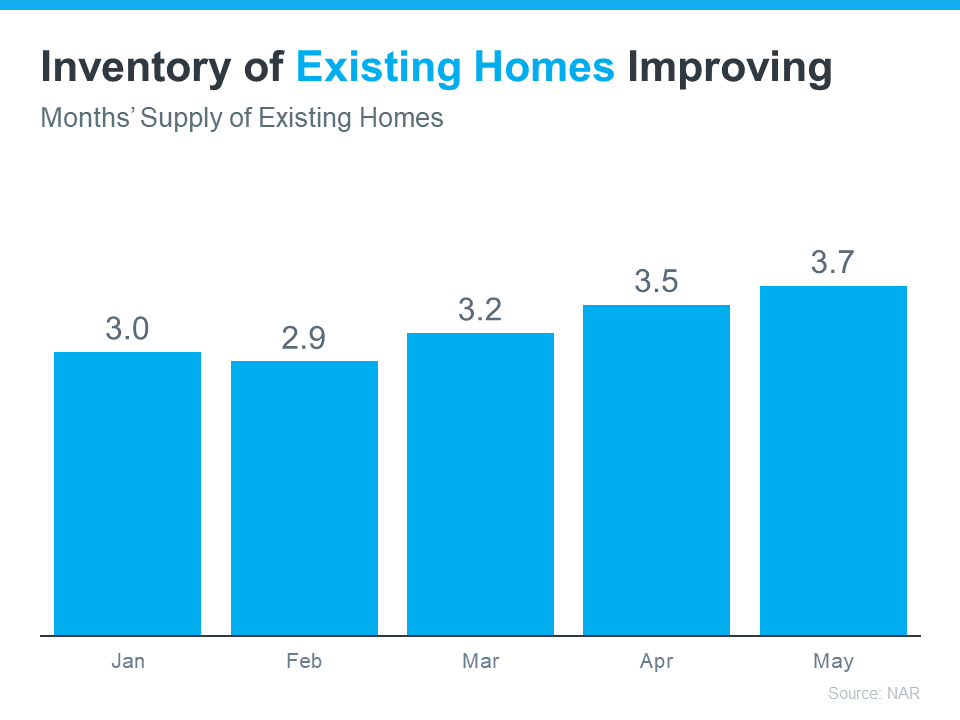

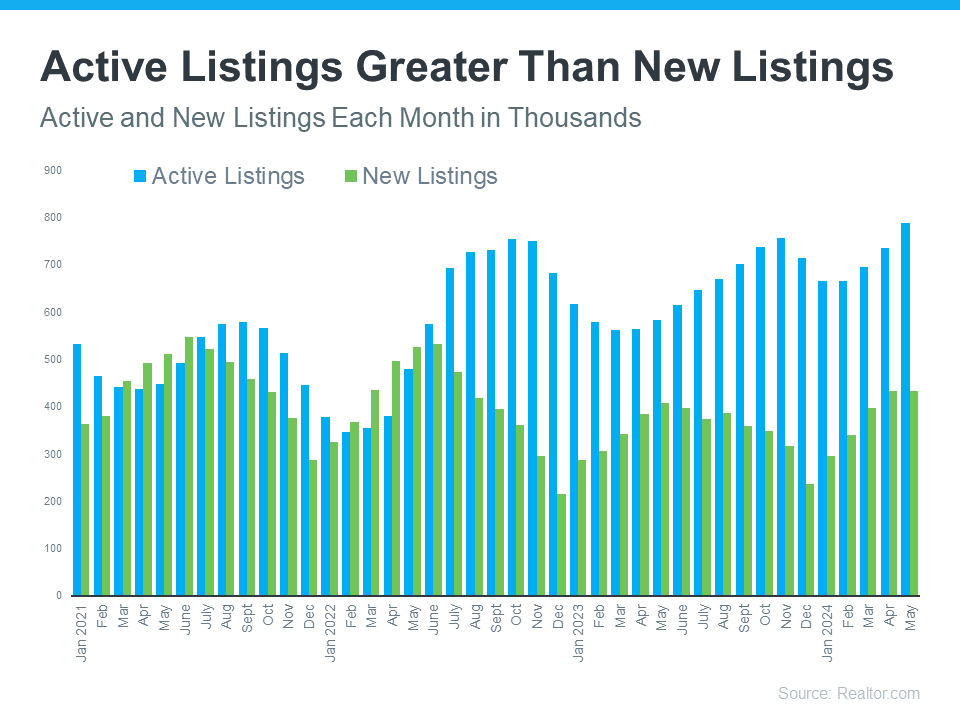

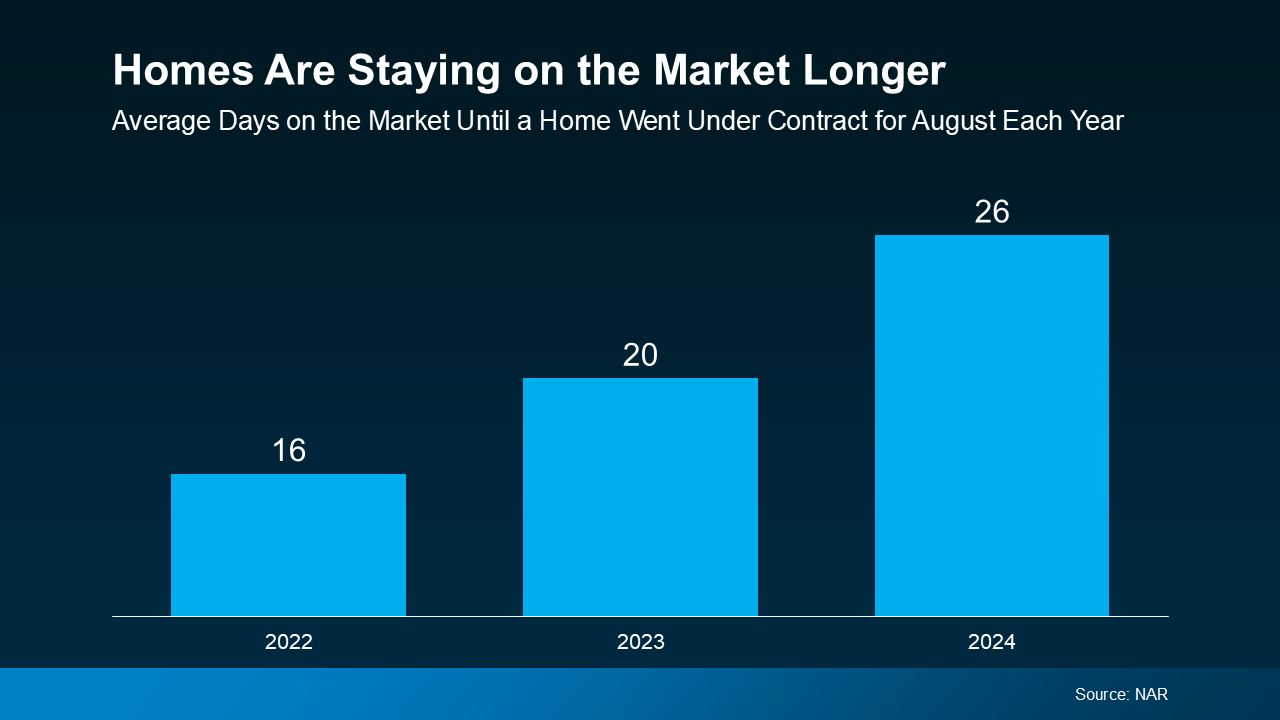

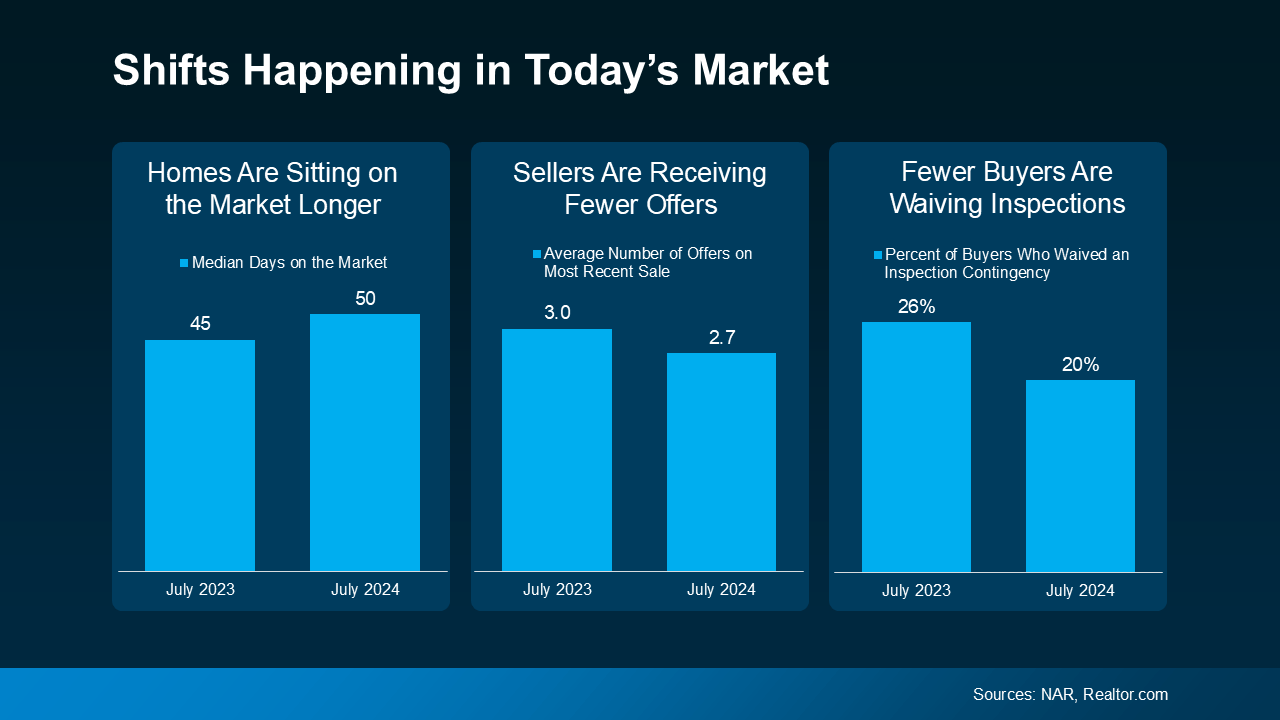

Homes Are Sitting on the Market Longer: Since more homes are on the market, they’re not selling quite as fast. For buyers, this means you may have more time to find the right home. For sellers, it’s important to

Homes Are Sitting on the Market Longer: Since more homes are on the market, they’re not selling quite as fast. For buyers, this means you may have more time to find the right home. For sellers, it’s important to

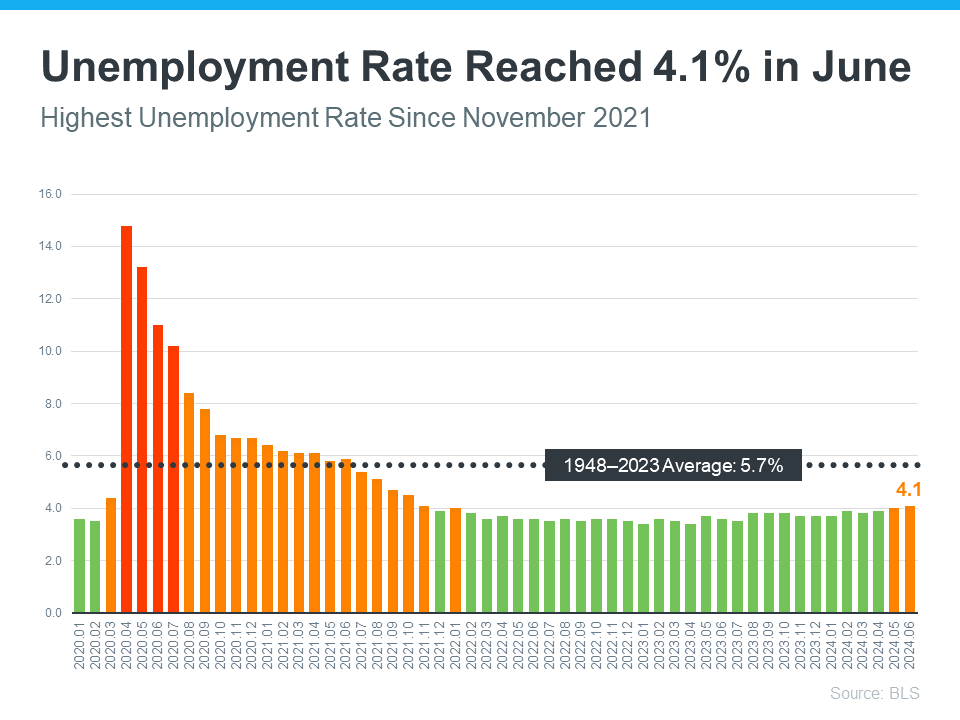

2. How Many Jobs the Economy Is Adding

2. How Many Jobs the Economy Is Adding