The Biggest Questions Clients Are Asking This Holiday Season (And FREE Slides to Answer Them)

‘Tis the season for friendly gatherings, and you know what that means. Everyone is going to be asking you questions about the real estate market.

The fact of the matter is, there’s a lot of speculation about what’s happening in housing right now, and everyone’s got an opinion on it.

It’s your job to be prepared for that inevitable table talk so you can show (and tell) your sphere the latest expert insights. That way when you’re at a New Years’ party and someone asks a question, you don’t drop the ball during the ball drop.

So, sit back, sip some hot chocolate, and get the answers to the top questions you’ll need to answer this holiday season (plus free slides).

What Will Happen with Home Prices?

As more and more media headlines suggest doom and gloom for the housing market and our economy, the question “Will home prices fall?” is probably top-of-mind for many people right now.

While we can’t fully forecast the future, you can do your best to provide a well-rounded opinion based on data, insights and expert quotes.

The most important piece to note is that this is a dynamic market that is changing, and it is changing quickly. When we see shifts in housing like this, it can seem impossible to keep up with all of it, but here is what you can tell anyone who asks this question.

Yes, homes are staying on the market longer. We’re not seeing a large influx of new listings, suggesting we’re returning back to the seasonal norms we typically see this time of year. But it is still a sellers’ market. Why? Because prices are driven by supply and demand, and we still have a low supply of homes on the market. This means continued upward pressure on home prices.

And for the naysayers who are calling for a housing crisis, this quote from Redfin sums it up best:

“For those bearish folks eagerly awaiting the home price crash, you’ll have to keep waiting. As much as demand is pulling back, supply is as well. And that’s reducing downward pressure on prices in the short run.”

Looking at the latest update on the home price forecasts for next year we see this: some experts are projecting slight appreciation, and others are calling for slight depreciation.

When we average these together, we see relatively neutral or flat home price appreciation for 2023. So, with that in mind, bringing in these national insights as well as what’s happening in your market will help you, your kin and your clients understand the bigger picture of what’s ahead for real estate.

This is where layering in that local data becomes more important than ever, because what we’re feeling right now is some of those overheated markets where prices went up so rapidly during the pandemic are starting to see more of a shift in prices than some of the other markets that may be holding steady.

What’s Going to Happen with Mortgage Rates?

More than anything else, this year’s housing market has been defined by rapidly rising mortgage rates. And they haven’t just risen. They have more than doubled in less than a year, something that has never been seen before.

To put that into context, the average monthly mortgage payment is about $1000 more than it was a year ago.

But the biggest question that you need you to be able to answer is why, and the answer to that is inflation. The FED has been making moves to slow the economy down and real estate plays a big part in our economy.

So, as inflation stays high, mortgage rates will stay high. And as history tells us, when inflation starts to ease, mortgage rates should too. As people ask about what will happen going forward, the answer is to just keep an eye on what’s happening with inflation.

Then there’s the other piece of this, the dreaded “r” word: recession.

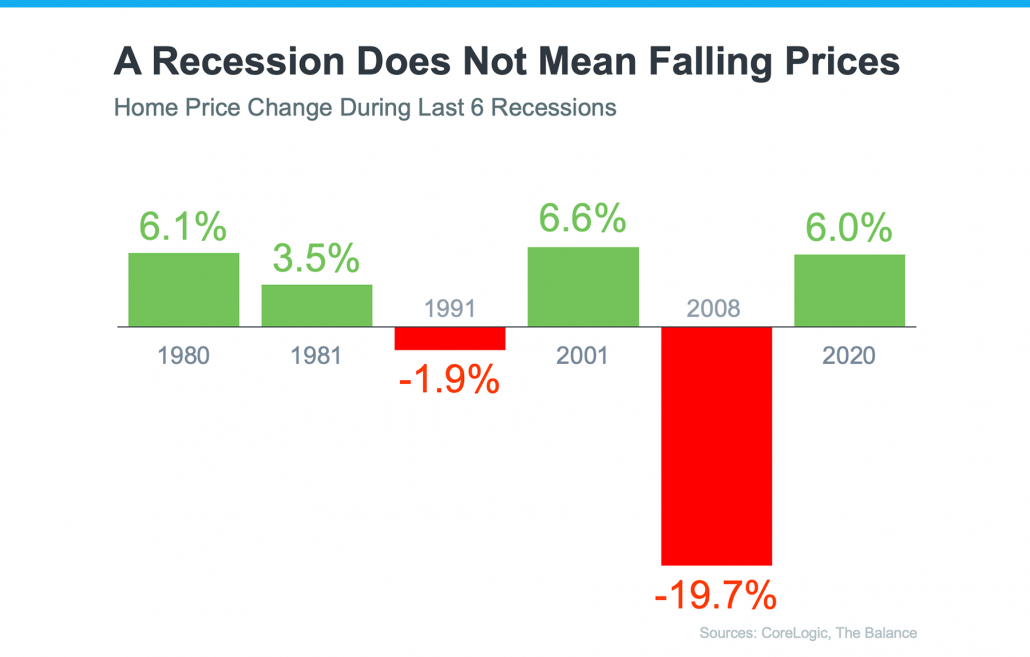

The biggest question here is if a recession is called, how will it impact the housing market? For most buyers and sellers, they think that a recession means a full-on housing market collapse like what happened in 2008. And in most instances, the truth couldn’t be further from that.

For example, a recession does not mean falling home prices. In the past 6 recessions, only 2 of them saw a decrease in home prices.

But bringing it back to mortgage rates, a recession may not always cause home prices to fall, but it usually means mortgage rates will. Download our free holiday slides so you can show how mortgage rates came down in each of the last six recessions.

Should I Buy a Home Right Now?

Ultimately, both of those questions lead to this one.

To be able to answer it effectively, we have to remember our number one job as a real estate agent. We’re not here to convince people that they should buy or sell a home. We’re here to present all the facts, insights, and data so they can make confident and informed decisions.

To put it simply, it’s our job to be a housing market expert. That is your most powerful and effective tool in a challenging market because what you’re up against is scarier than anything else: misinformation.

“In the absence of trustworthy, up-to-date information, real estate decisions are increasingly being driven by fear, uncertainty, and doubt. These decisions can be hugely consequential for consumers and businesses,” said Jason Lewis, co-founder & chief data officer of Parcl.

So, is it a good time to buy a home right now? The answer may be different for every client you work with.

For first-time homebuyers, the biggest factor to consider is rising rent costs around the country. Homeownership presents the opportunity for a stable monthly payment as well as the ability to build wealth and make a financial investment. It offers security and a sense of accomplishment that renting can’t.

The next piece of this is that life happens. Personal situations change, jobs require relocation, aging parents may need to move in, etc. These can all play a big part in someone’s need to buy or sell a home right now or in the near future.

The best way you can answer this question is to:

1) Figure out their motivation to buy or sell a home right now so you can understand their needs.

2) Put on your knowledge broker hat, take all of the national and local market data you have and present it to them so they can decide on what’s best for their next move.

At the end of the day, while the market may be changing, there are many financial and non-financial benefits of homeownership that stand the test of time. It’s one of the biggest ways to build wealth in this country.

“If you can find a house that meets your financial expectations for a monthly payment and it is a good time for you to buy, then do that…And if you wait for prices to fall and they never do, you may discover the hard way that the house you found a year ago that you really loved, that you could afford but you passed on, is more expensive next year,” Odessa Kushi, deputy chief economist of First American.

So, painting the full picture and backing that up with visuals so you’re not just telling, but showing them what you’re talking about is the best way to answer this question.

Bottom Line

As loved ones gather this holiday season, there’s bound to be some shop talk about what’s happening in housing.

In order to remain the housing market expert in your circle, you need to be able to provide relevant and educated responses that are backed by facts.

You know how this industry works. Every little interaction, no matter how big or small, can make an impression. What may seem like small talk at a holiday party could mean big business come the new year.

But you’ll need more than just answers to prove you’re the market expert. These top slides cover all the most important questions and will help back up your advice with data and facts.

Download them to your phone so you can share them with your whole sphere: on social media, emails, in-person, listing presentations and more.