Navigating Mortgage Rates: A Guide for Real Estate Agents and Their Clients

Not sure how to talk about mortgage rates with your clients right now? Yeah, we get it. They’re up. They’re down. They’re up again. This rollercoaster of volatility that seems to be going on and on can be difficult for the average consumer to understand.

That means you need to be able to explain mortgage rates and their impact on affordability right now, so your clients have the whole picture on what’s really happening. This way, they’re set up to truly make their best buying and selling decisions.

In this article, we’ll walk through how you can talk to your clients about mortgage rates, leveraging key insights and tools to help show them the bigger picture.

What rate would motivate people to move right now?

Before diving into discussions about rates, it’s essential to meet your clients where they are. A recent survey conducted by John Burns Real Estate Consulting in partnership with Keeping Current Matters uncovered a key insight:

45% of real estate agents believe a mortgage rate between 5% and 6% would make homeowners feel comfortable selling their current home and buying their next one.

Here’s why this is important. While rates are lower than they were a year ago, people are still eagerly anticipating mortgage rates will come down even more – and many of them are pausing their plans until rates get there.

And what a lot of consumers may not be factoring in when they decide to wait for lower rates is that it’s going to be a bumpy ride. Ultimately, what happens with rates will depend on things like inflation, employment, the Fed’s decisions, and more.

But here’s the catch. Experts also project that, nationally, home prices will continue to appreciate in the months ahead. Why? Because as more people start to jump back into the market, that’s going to put upward pressure on prices in areas that are already tight on inventory. That means buyers may end up paying more for the house if they try and wait it out for that magic rate.

With so many factors to consider, the best way to get your clients to understand the full context of what’s happening is to show them, not just tell them, about the purchasing power they have right now.

How To Get the Conversation Started

Since mortgage rates play such a pivotal role in determining the overall cost of homeownership, that means your sphere is looking to you for answers.

Yes, mortgage rates are one piece of the affordability puzzle – but they aren’t the only piece.

A lot of consumers are getting stuck looking at the first number of a mortgage rate, instead of fully understanding what a small change could mean. Let’s be honest – the difference between where rates are today and where your clients want them to be might not add up to as much of a monthly payment change as they might think. And now you can show them why.

That’s where the KCM Purchasing Power Tool comes in. It’s your go-to resource to explain to your clients exactly how rate changes affect their buying power, and it can help shift their focus from the rate itself to what they can actually afford.

Here’s how it works.

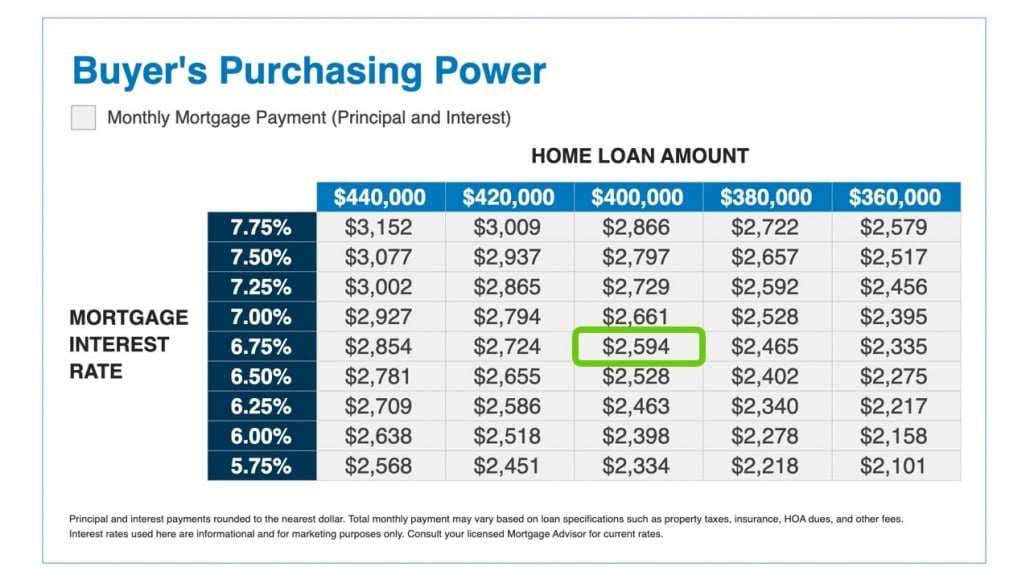

For simplicity’s sake, let’s focus on a $400,000 home loan. In the visual below, we can see that at 6.75%, the monthly principal and interest would be around $2,594.

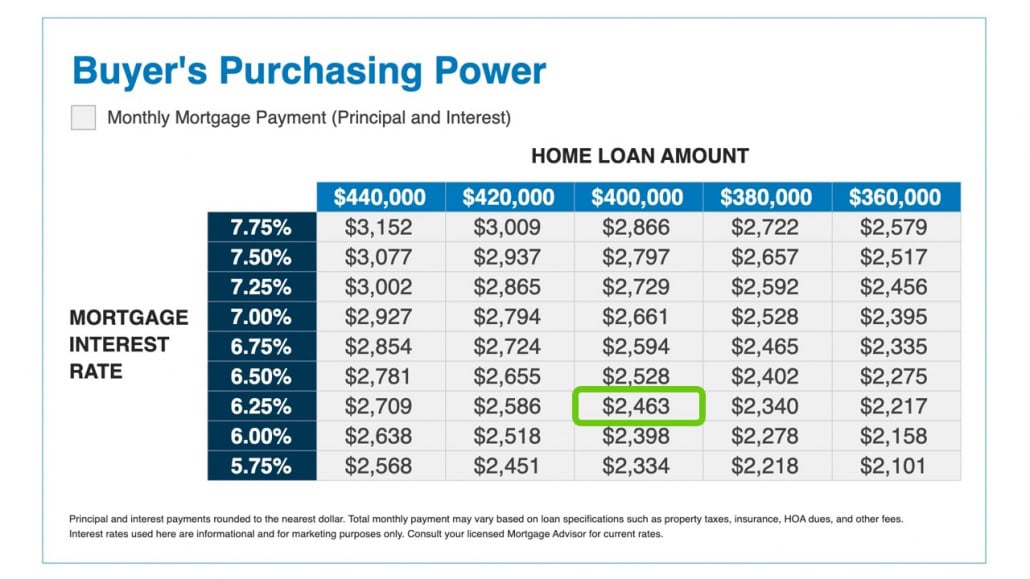

Okay, now let’s look at what the payment would be if that mortgage rate drops to 6.25%. The change would mean a decrease of $131 per month compared to the 6.75% mortgage rate. It’s a notable difference, but depending on your client’s circumstances or financial situation, it may not be a dealbreaker.

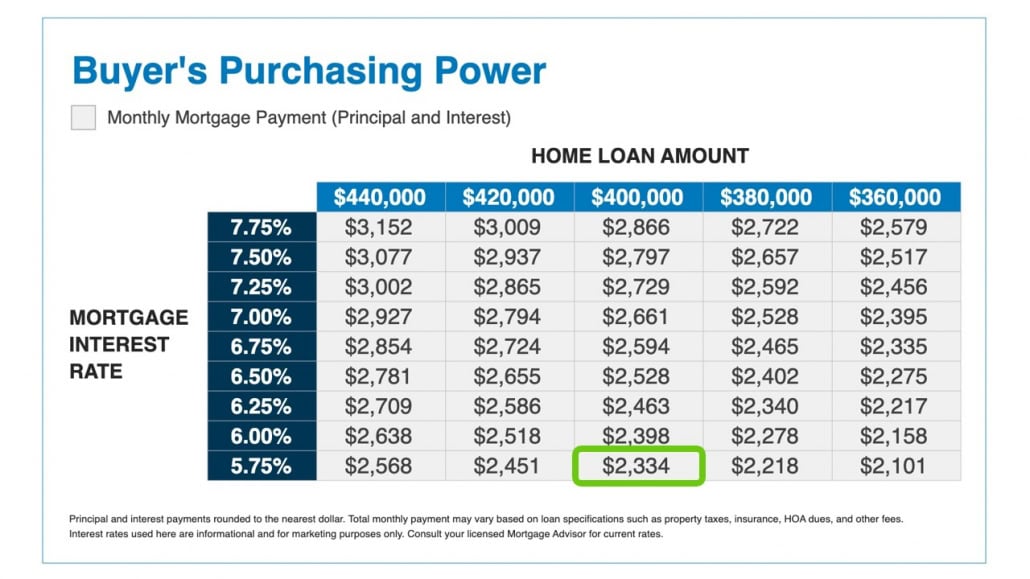

And if rates dip into the high 5’s at 5.75%, which is what the experts currently forecast we may not see until closer to the end of 2025, the difference is only $260. That’s less than $300 per month. And while you should never pressure anyone to buy if they’re not ready and able to do so, making sure they know how the numbers add up so they can make the best decision is key.

With people so focused on getting to rates below 6% right now, this context is extra important.

Plus, if you add in the fact that home prices are expected to continue rising over the next five years, your clients may lose out on the mortgage rate savings they are hoping for as prices go up. It could mean they end up paying more each month for essentially the same house.

By showing them how the math shakes out with this Purchasing Power Tool, you can help your clients make informed decisions that align with their budget and their goals. So, instead of getting stuck on the anxiety of a specific mortgage rate, show them how the change they may be waiting for might not make as much of a difference as they think.

How the Purchasing Power Tool Empowers Your Clients

Now that you know how it works, remember that KCM’s Purchasing Power Tool is your secret weapon in today’s market. It lets you clearly show your clients how even a small change in rates can impact their buying power.

- Plug in the home loan range your client is looking at.

- Show them how different mortgage rates impact what they can afford.

- Generate a custom chart with your branding that spells it all out.

This tool doesn’t just give your clients information—it empowers them to make informed decisions. When they can see how the numbers work, they’ll feel more in control and more confident about their options.

Tips for Effective Communication

And while you’re at it, don’t forget that effective communication is key when discussing mortgage rates with your clients. Here are some practical tips you can use:

- Educate: Take the time to educate your clients about how mortgage rates impact their monthly payment and overall budget using the Purchasing Power Tool. Empower them to understand the financial implications of different rate scenarios, and how slight the shifts might actually be.

- Stay Informed: Stay on top of current mortgage rate trends and economic factors that influence rates. Provide your clients with accurate and up-to-date information that builds trust and confidence in your expertise.

- Customize Discussions: Tailor conversations about mortgage rates to each client’s preference and financial situation. When you understand their priorities, you can offer personalized guidance that meets their needs.

- Discuss Options: Present your clients with various mortgage rate scenarios (like above), highlighting the pros and cons of each one. Let them know they have options and encourage them to connect with a loan officer for more specifics.

- Address Concerns: Be prepared to address your clients’ concerns about mortgage rates. Providing clear guidance can alleviate anxiety and foster trust in the decision-making process.

- Work With a Trusted Lender: Make sure your clients know to work with an experienced loan officer. Advise them to gather multiple loan quotes to compare rates and terms. And help your clients understand the impact of their credit score on the mortgage rate they’ll qualify for to get the best rate possible.

Bottom Line

Navigating mortgage rates is a crucial aspect of the homebuying process right now, and you play a vital role as you guide your clients to success.

The first step is to understand where your clients are, and then effectively communicate the context they need to fully understand the impact of mortgage rates that are constantly changing. This will empower them to make informed decisions that align with their goals.

By prioritizing education and personalized guidance, you can truly make a difference.

For the insights and tools that’ll help you explain big market topics like mortgage rates, try out KCM Membership today.