3 Biggest Questions Agents Need to Answer Right Now

Throughout 2023, the media flooded us with negative headlines. As a result, some consumers became hesitant about buying or selling a home.

The single most important thing we can do is help consumers understand the worry they may feel has been caused by headlines and predictions that have now been proven wrong. What they need is someone to shine a light on the truth, using real data.

Lighthouses are a symbol of hope and security in treacherous waters. You need to be the same thing for your clients. It’s time to reclaim the narrative to eliminate the fear and confusion.

That’s why we’ve given you what you need to be able to answer the top questions out there right now.

Are We About To See a Lot More Foreclosures?

Both you and your clients have probably come across headlines highlighting the increase in foreclosure filings. It’s important to help your clients understand the truth about those foreclosure numbers.

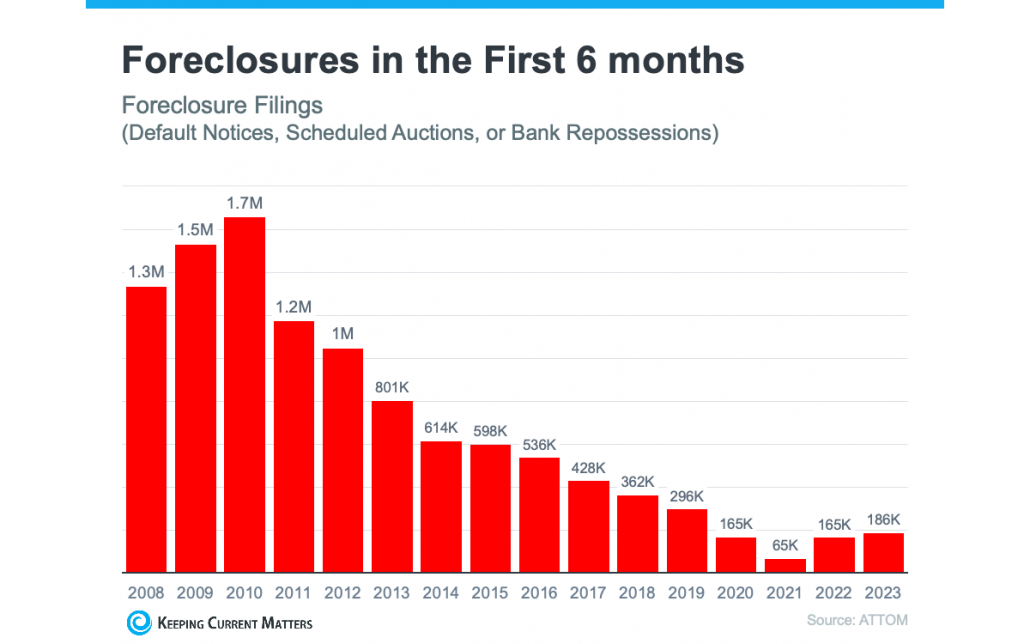

A report using data from ATTOM, a property data provider, says foreclosure filings have risen by 187%. Some headlines took this stat and ran with it without giving all of the much-needed context. That created fear. But a closer look at the actual data shows there isn’t any reason to worry because that’s compared to a time when foreclosures weren’t really happening.

Over the past few years, foreclosure stats dropped to record lows. That’s because, through 2020 and 2021, the forbearance program and other homeowner relief measures helped countless people stay in their homes and avoid foreclosure. As the moratorium ended, there was an expected rise in foreclosure filings. As Clare Trapasso, Executive News Editor at Realtor.com, points out:

“Many of these foreclosures would have occurred during the pandemic, but were put off due to federal, state, and local foreclosure moratoriums designed to keep people in their homes . . . . It’s not that scores of homeowners suddenly can’t afford their mortgage payments. Rather, many lenders are now catching up. The foreclosures would have happened during the pandemic if moratoriums hadn’t halted the proceedings.”

To further prove the point, take a look at this graph comparing foreclosure filings from the first half of each year since 2008. This shows foreclosure activity has been consistently lower since the crash:

While filings are up compared to recent years, it’s clear foreclosure activity now is nothing like it was back then. In addition to all the factors mentioned above, that’s also largely because buyers today are more qualified, less likely to default on their loans, and many have enough equity to sell rather than face foreclosure.

So, if the headlines have your clients worried, you can reassure them a flood of foreclosures isn’t likely – and you have the data to prove it.

What’s Happening with Mortgage Rates?

As you come across headlines about mortgage rates, you’ll see references to recent decisions by the Federal Reserve (the Fed). The question is, how do the Fed’s decisions impact your clients, particularly your buyers? Let’s shed some light on this.

The Fed is committed to fighting inflation. While inflation has dropped from its peak, recent data shows it’s still higher than the 2% target. That’s why the Fed decided to do another interest rate hike in their last meeting. As Jerome Powell, Chairman of the Fed, says:

“We remain committed to bringing inflation back to our 2 percent goal and to keeping longer-term inflation expectations well anchored.”

Even though Federal Fund Rate increases don’t directly determine mortgage rates, they do have an impact. As a recent article from Fortune states:

“The federal funds rate is an interest rate that banks charge other banks when they lend one another money … When inflation is running high, the Fed will increase rates to increase the cost of borrowing and slow down the economy. When it’s too low, they’ll lower rates to stimulate the economy and get things moving again.”

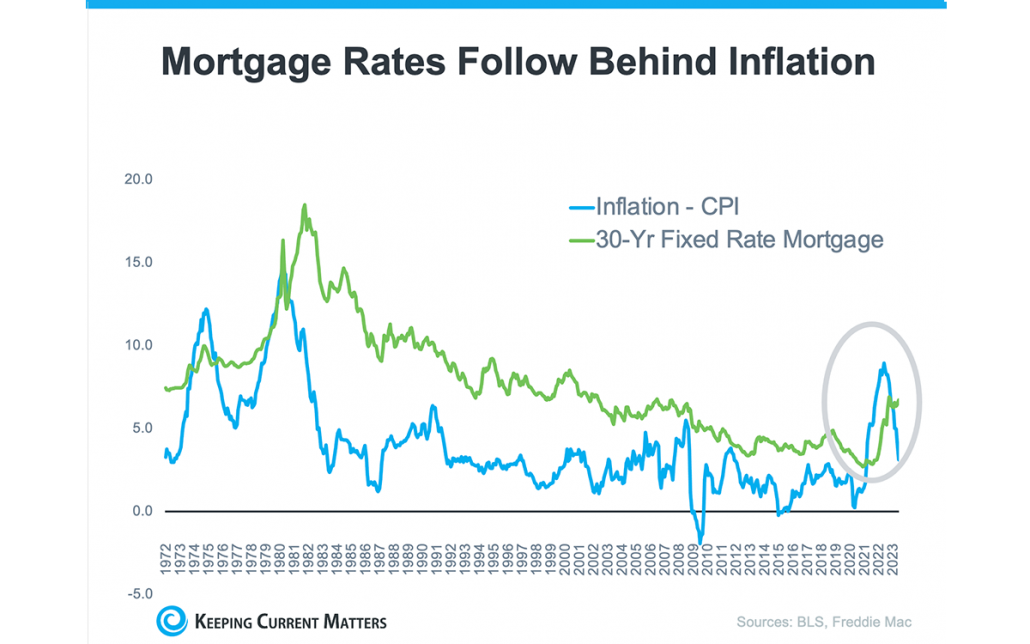

To put it simply, when inflation is high, mortgage rates are also high. However, if the Fed manages to bring down inflation, it could result in lower mortgage rates, making it more affordable for your clients to buy a home.

The graph below illustrates this relationship by showing how a decrease in inflation usually leads to a decline in mortgage rates:

As the graph shows, inflation (shown in the blue line) is trending down right now. And, based on historical patterns, mortgage rates (shown in the green line) are likely to follow, just on a lag.

By keeping your clients informed and sharing historical context like this, you can help them understand what could happen if inflation continues to cool. This’ll help them make an informed decision based on the best information we have right now.

What’s Happening with Home Prices?

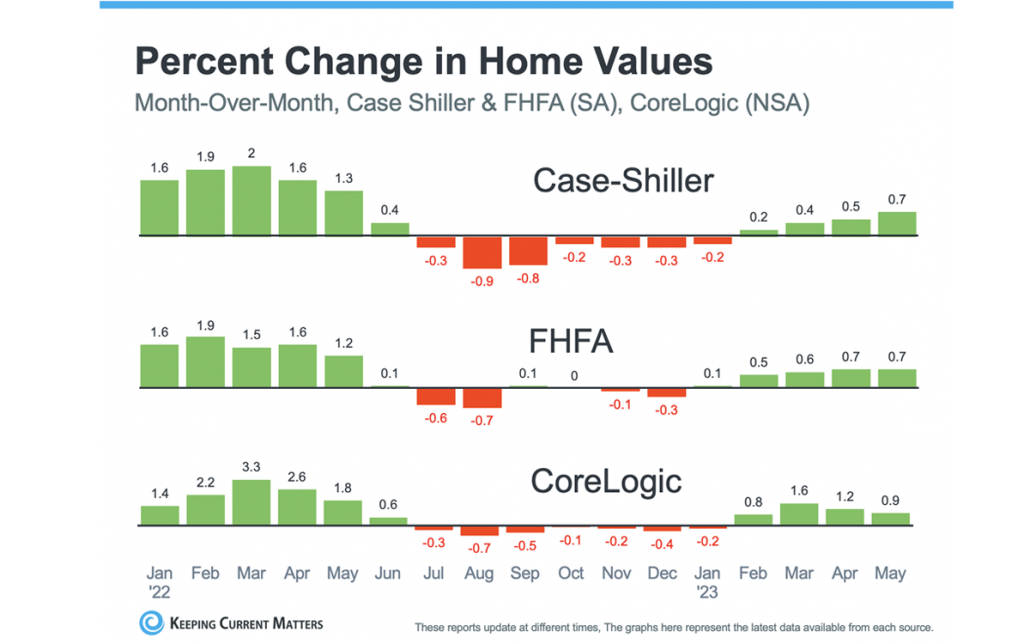

If your clients have been postponing their plans to move due to a fear of falling home values, it’s time to revisit those conversations. The most recent data shows home prices have bottomed out and are back on the rise.

While home prices always vary by local market, we’re seeing home price appreciation again nationally.

The graphs below use the latest monthly data available from three sources to show the worst home price declines are behind us:

In the first half of 2022, home prices rose rapidly. However, starting in July, prices began to go down (marked in red in the graphs above). By around September, the trend started to stabilize. More importantly, the latest data for 2023 shows a rebound in home prices.

Doug Duncan, Senior VP and Chief Economist at Fannie Mae, explains home price growth is exceeding expectations thanks to ongoing strong buyer demand:

“. . . housing prices continue to show stronger growth than what was previously expected . . . Housing’s performance is a testimony to the strength of demographic-related demand . . .”

Your clients can rest assured that, whether they’re looking to buy or sell, nationally, home prices are on the rise. That means sellers can breathe easy knowing home values are climbing and buyers can find comfort in knowing they’re buying before prices increase more.

Bottom Line

As we move toward the end of year, both your national insights and local perspective will anchor consumers, providing a guiding light to any feeling lost or confused by the media headlines.

The key to success in this real estate market is staying educated and making sure you’re keeping the most important thing, the most important thing: Helping your clients feel confident when buying and selling a home.

The best way to do that right now is to share trustworthy data-bound information that helps buyers and sellers make powerful and confident decisions.

That’s why we’ve composed the most important scripts, so you can easily answer the biggest questions in the housing market right now.