What’s Ahead for the Housing Market for the Rest of 2024?

As we enter the second half of 2024, there’s one big question on everyone’s minds right now: what’s ahead for the housing market?

With an upcoming Presidential election, affordability challenges, and a whole lot of confusing headlines out there, there are a lot of mixed feelings about the state of the housing market this year.

But no matter what’s happening in real estate, this will always remain true: the most powerful tool you have to beat your competition is knowledge.

So, let’s take a deep dive into the latest housing market projections so you have the confidence to educate your clients and crush your goals this year.

Second Half of 2024 Housing Market Projections

The past year has been full of volatility and misleading information about what’s happening or what’s going to happen in real estate. As we continue to struggle with inflation, high mortgage rates, and rising home prices, there are a lot of people asking themselves, “Does it still make sense to buy or sell a home?”

Taking all of that into consideration, here’s what industry experts anticipate for the 2024 housing market.

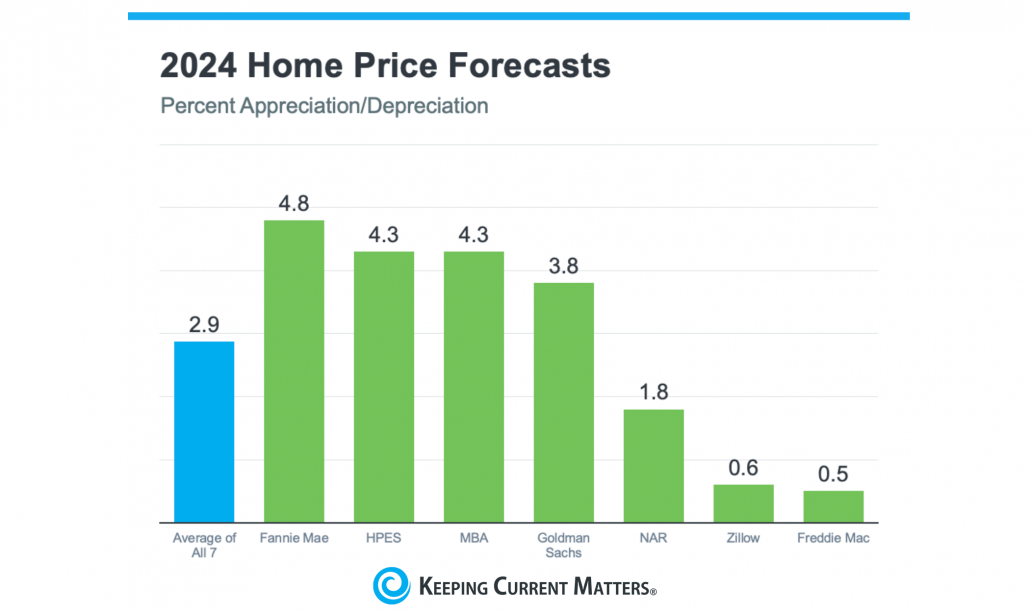

Will Home Prices Go Up or Down?

Over the past 12 months, there’s been a lot of mixed information about what will happen with home prices in the near future. Homes are staying on the market longer. We’re seeing more new and existing inventory, suggesting we’re returning back to more normal levels than we’ve seen in years.

Plus, the newest data shows an uptick in price reductions for active listings in recent months.

So, what does the future hold for home prices? Will home prices fall?

With the latest expert projections, this is what we can gather: home prices will continue to climb moderately for most markets around the country.

Why are home prices still going up? It all comes down to the number of homes for sale. Jessica Lautz, Deputy Chief Economist at the National Association of Realtors (NAR), puts it simply:

“One thing that seems to be pretty solid is that home prices are going to continue to go up, and the reason is that we don’t have housing inventory.”

While there are more homes on the market compared to the past couple of years, it’s still not enough overall to meet today’s buyer demand. This will keep pushing prices up.

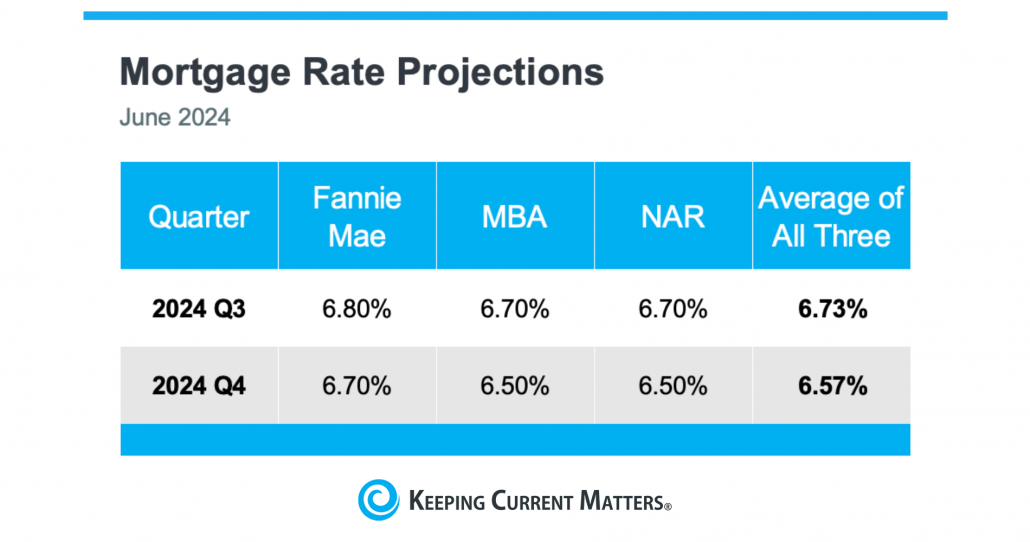

What’s Going to Happen with Mortgage Rates?

This is probably the biggest question on everyone’s mind right now.

The biggest piece of advice you can give to anyone who asks is this: if they’re waiting for rates to go back down to where they were in 2020-2022, they’ll be waiting a long time.

But there is good news: experts project mortgage rates should come down later this year as inflation continues to cool.

Want a deeper dive into the mortgage rate forecast? Download our free 2024 Housing Market Forecast eGuide.

What Will Happen with Home Sales in 2024?

There’s no doubt that high mortgage rates and climbing home prices have played a big part in people’s decisions to hold off on buying or selling over the past few years.

But with more homes available, we’re expecting a few more sales this year compared to 2023.

Lawrence Yun, Chief Economist at NAR, said this:

“In the second half of 2024, look for moderately lower mortgage rates, higher home sales, and stabilizing home prices.”

It won’t be a massive uptick, but it does show that the market is holding steady.

Will the Housing Market Crash This Year?

With a lot of confusion and uncertainty surrounding the housing market, some people are raising concerns that we’re destined for a repeat of the crash we saw in 2008. But in truth, there are many reasons why today’s housing market is nothing like 2008.

Ultimately, it comes down to supply and demand.

While you may have seen some recent headlines that say a crash is possible, context is important.

As Business Insider says:

“Though many Americans believe the housing market is at risk of crashing, the economists who study housing market conditions overwhelmingly do not expect a crash in 2024 or beyond.”

Although we’ve seen an uptick in inventory over the past year, we’re still under supply. When the housing market crashed in 2008, there was an oversupply of homes. So, rest easy. There won’t be a crash, and you can use this information to ease any clients’ worries that one could be on the horizon.

What Does this Mean for Buyers & Sellers for 2024?

The 2024 market underwent a major shift as economic uncertainty and higher mortgage rates reduced buyer demand, slowed the pace of home sales, and moderated home prices.

But what about the rest of this year?

With experts projecting a rise in inventory and a decline in mortgage rates so long as inflation continues to ease, data suggests we’re heading for a more stable and predictable market than we’ve seen in the last few years.

There is still a lot of motivation for buyers and sellers in the market who are ready, willing, and able, and that’s not expected to change in the six months.

Bottom Line

If we’ve learned anything over the past couple of years, it’s that while we can project the future, we can’t predict it.

Industry experts don’t expect any major shifts for the rest of the year. In fact, we’re looking at a steady decline in mortgage rates and a moderate, more normal climb in home prices and sales.

However, projections do adjust with economic shifts. Ultimately, your most important role for the rest of this year is to be the educated agent, and we have the perfect eGuide to help you do that.

With a combination of data, insights, and an action plan, our free 2024 Housing Market Forecast is the perfect tool to help you fight misinformation and be the trusted expert your clients need right now.

Download it today.