How to Answer Your Clients’ Biggest Questions Right Now

People are scared. And to be honest, they have every right to be.

All those frightening headlines have people fearing the worst about the real estate market, and they need your help.

This is the time to step up, educate and communicate so your clients know that, as the trusted advisor, you have their best interest at heart.

Here are the biggest questions your clients need answers for right now.

How Long Will it Take the Economy to Recover from COVID-19?

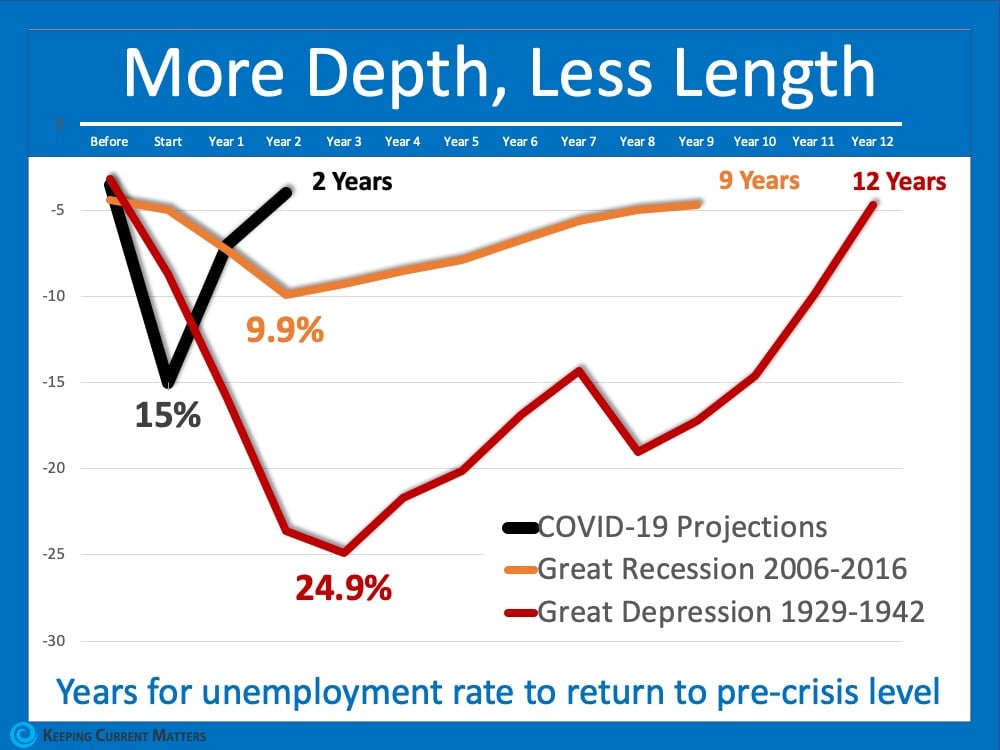

No one can predict how long COVID-19 will last, and with nothing in recent history to compare it with, economists are stumped on a timeline for economic recovery.

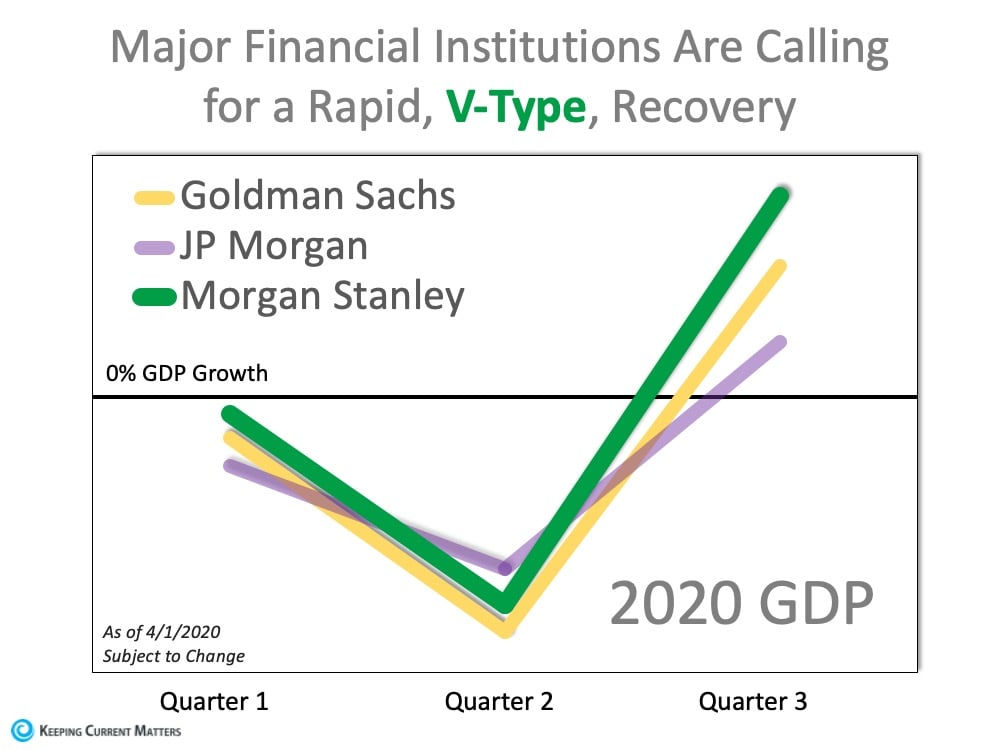

Data released from Goldman Sachs, JP Morgan and Morgan Stanley predict that the GDP will see a rebound in the third fiscal quarter, with the experts saying it will most likely resemble a «V» type recovery.

A recent study from John Burns Consulting also noted that past pandemics have created V-Shaped Economic Recoveries and had minimal impact on housing prices.

Business owners are also optimistic about a fast turnaround of the economy, with a study by PricewaterhouseCoopers finding that 90% believe business will return to normal within 1 to 3 months of the pandemics passing.

From major financial institutions to business leaders across the U.S., optimism that the economy will bounce back is high.

Will COVID-19 Cause a Recession?

By its technical definition, a recession is “a period of temporary economic decline during which trade and industrial activity are reduced, generally identified by a fall in GDP in two successive quarters.”

Taking into account the number of businesses and industries that have had to close trying to flatten the curve of the COVID-19 pandemic, it is likely we will see a recession.

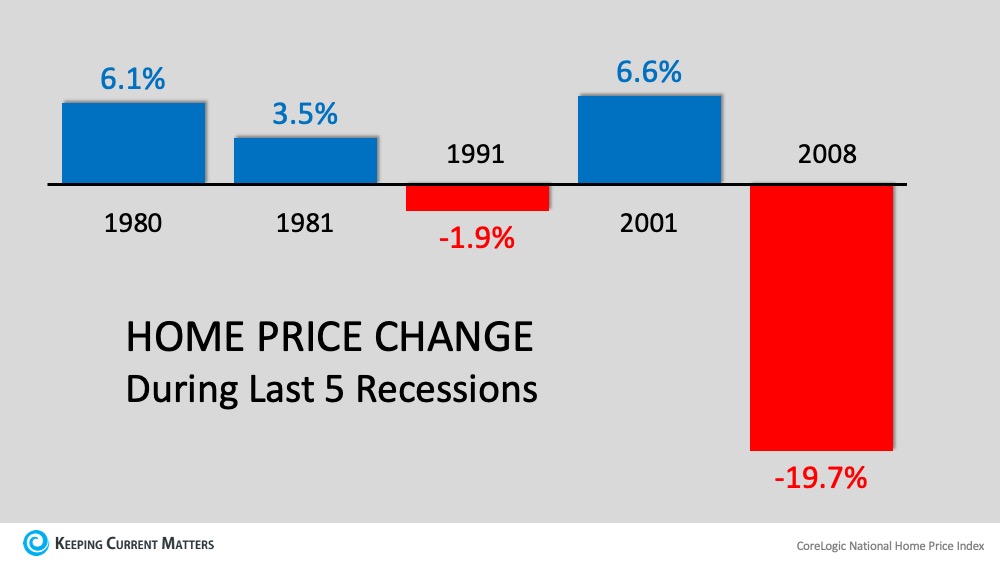

The part that it’s important to communicate with your clients is that a recession does not equal a housing crisis.

If a Recession Happens, Are We Looking at 2008 all Over Again?

The financial collapse that led to the housing crash and Great Recession of 2008 is still very much fresh in American’s minds. And for that reason, many people associate a recession with a housing crisis. This is what your clients are most likely thinking right now, and they’re looking to you for the answers, whether they’re actively asking them or not.

This is what we know:

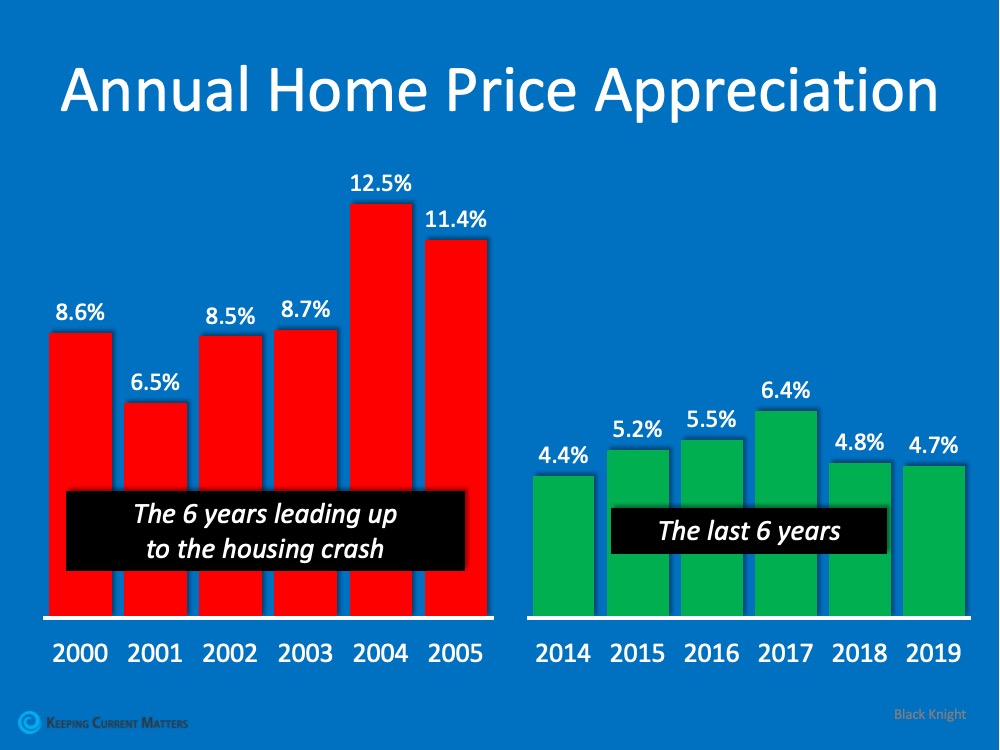

The factors leading up to the housing bubble were a very unique perfect storm that ultimately led to the collapse of the financial market.

Risky mortgages, inflated home values, maxed out equity and excessive inventory led to a wave of short sales and foreclosures that depreciated home values by almost 25%.

Today’s market looks nothing like 2008

With American’s holding more equity in their homes, stricter mortgage lending regulations and an inventory shortage rather than surplus, the housing market is nothing like 2008.

This means that despite the turbulent economy right now, the real estate is in a strong place and will likely bounce back quickly, if it’s affected much at all.

Home values are unlikely to be affected

If we are headed into a recession, it’s important to remember that it doesn’t necessarily mean home values will be affected. Zelman & Associates, a leading housing market analyst, recently updated their home price appreciation estimates for 2020.

Pre-COVID-19, their analysis was that prices would appreciate 4.7% in 2020. Post Covid-19, they are still predicting appreciation, just at a lower rate of 3%.

Will COVID-19 Cause a Surge in Foreclosures?

Over 25 million Americans have lost their jobs since mandatory «stay-at-home» orders were put into effect, with more predicted to file for unemployment in the coming weeks. Many people fear that this will cause a wave of foreclosures circa 2008 that will take down the housing market.

There’s no denying that the massive wave of job losses caused by COVID-19 isn’t serious, but economist believe that the effects won’t be for long. Mortgage companies have taken this unique situation into account, with many offering the option to defer payments for those who have been affected.

Plus, Americans are in a much better equity situation than they were in 2008, with 37% of homeowners having no mortgage at all. And looking at data from the last 30 years, there appears to be no direct correlation between unemployment rates and home sale rates. For example, unemployment rates have dropped significantly in the past 5 years while home sales have remained steady.

Should I Buy or Sell a Home Right Now?

All of the above questions ultimately lead to this one. Many Americans have halted their home search or selling plans because of the uncertainty surrounding everything going on right now.

While the COVID-19 pandemic has disrupted the way we do business, real estate as a whole has not stopped. Some markets have slowed while others are now heating up.

Every market is different. So, it’s up to you to combine local market insights with big-picture economic information to choose the best plan of action for your clients.

Sometimes clearing the air about a recession, home values and foreclosures can be enough to move a hesitant buyer or seller off the fence in a market that’s still seeing activity.

Bottom Line

While we can’t predict the future, we can look to data to answer many of the big questions on buyers’ and seller’s minds right now.

Many people may be putting off their real estate plans because they think a recession will bring down home values or that buyers aren’t looking right now.

By communicating facts, you are showing them you’re a trusted advisor that has their best interest in mind.

Those are the types of agents that people want to work with.

Things are moving fast, and if you’re struggling to stay on top of it all, you’re not alone. That’s why we’ve put together a Resource Page where real estate agents can tools and insights to help educate their clients. It’s updated throughout the week! So be sure to check back often.