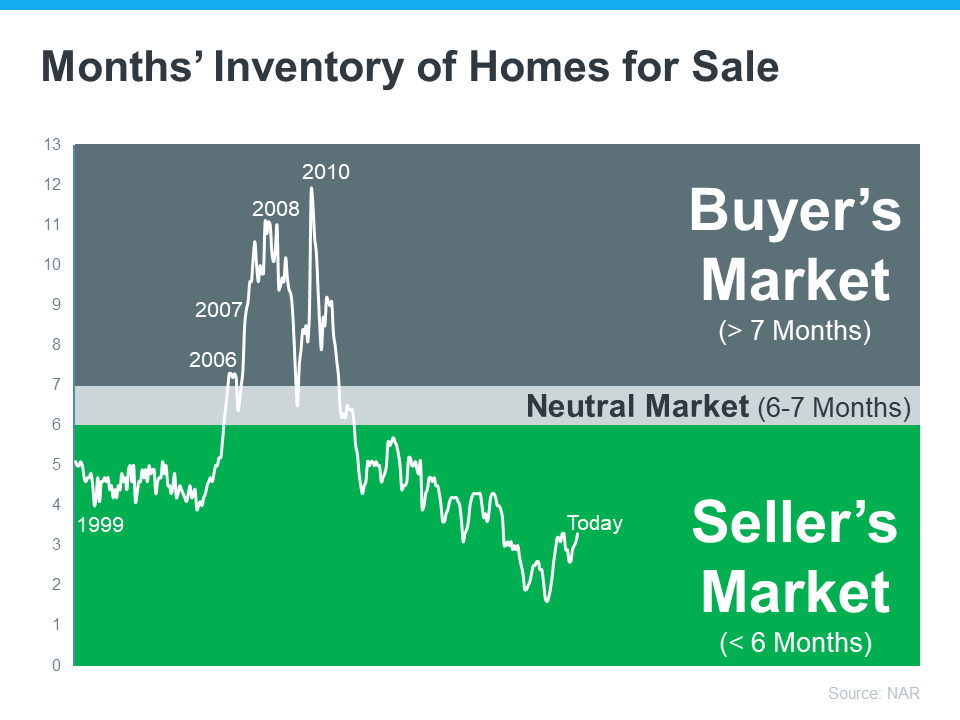

- For buyers: A limited number of homes for sale means you’ll want to seriously consider all of your options, including various areas and housing types. A skilled professional will help you explore all of what’s available and find the home that best fits your needs. They can even coach you through casting a broader net if you need to expand your search.

- For sellers: Today’s low inventory actually offers incredible benefits because your house will stand out. A real estate agent can walk you through why it’s especially worthwhile to sell with these conditions. And since many sellers are also buyers, that agent is also an essential resource to help you stay up to date on the latest homes available for sale in your area so you can find your next dream home.

One question that’s top of mind if you’re thinking about making a move today is: Why is it so hard to find a house to buy?

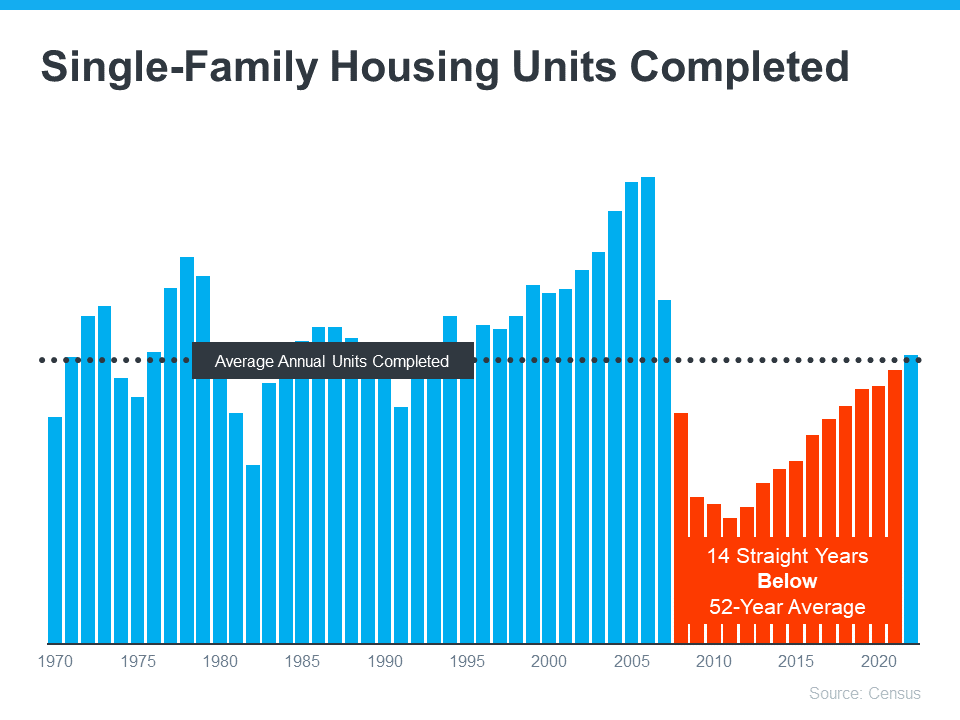

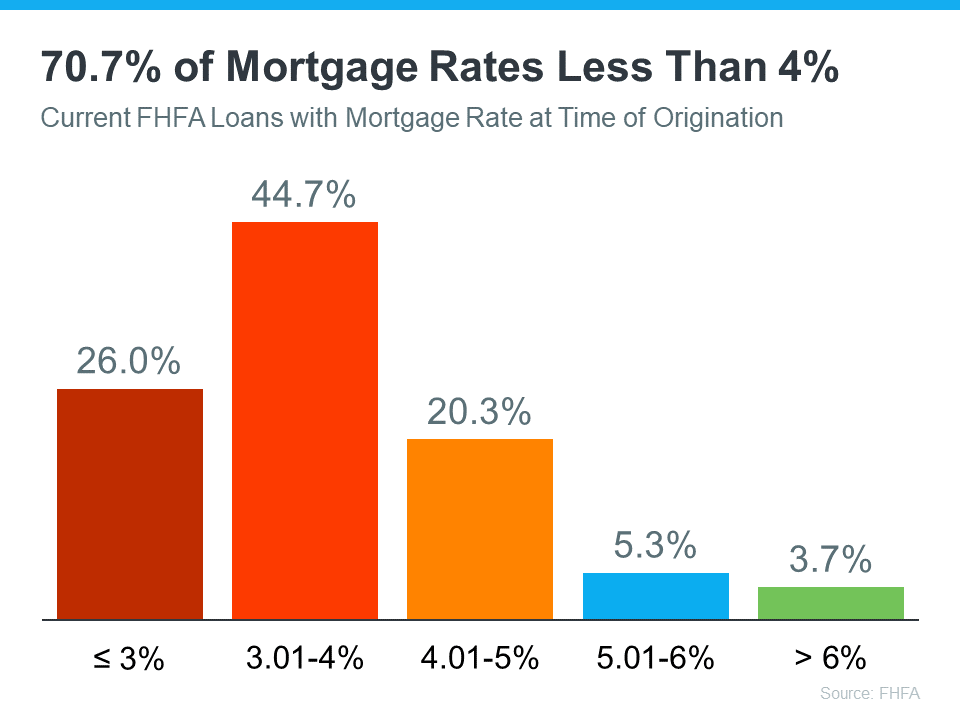

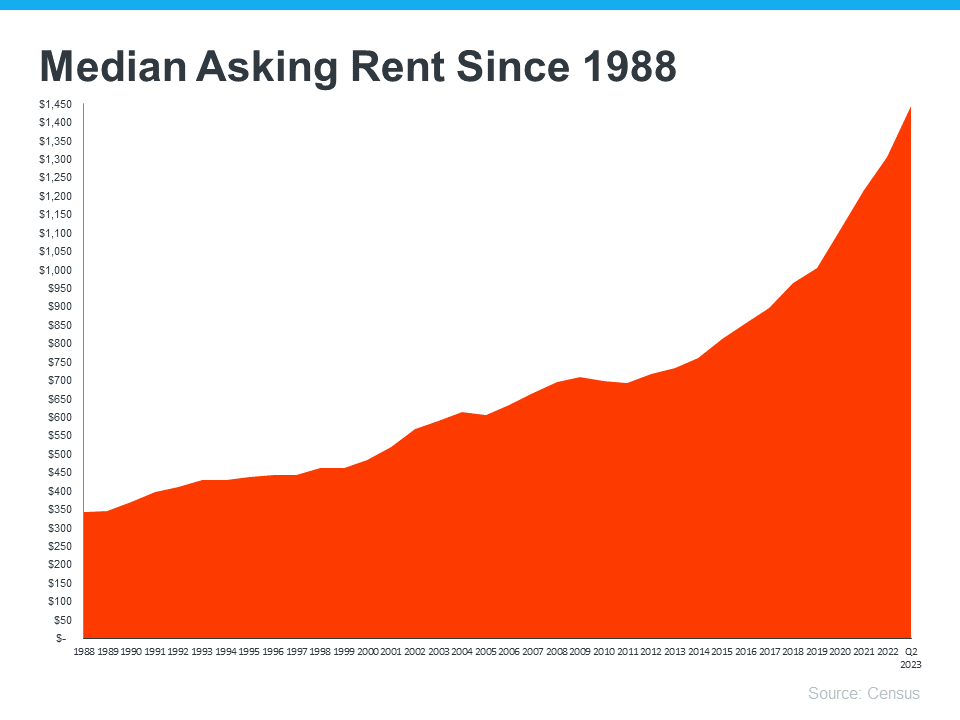

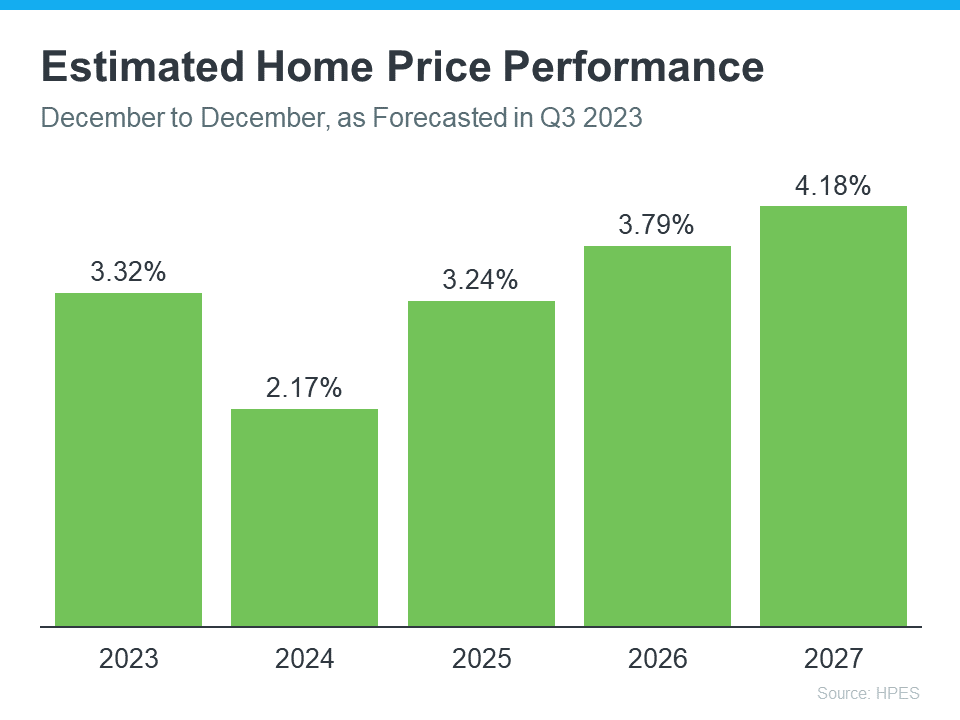

[exclusive_id] => [expired_at] => [featured_image] => https://files.keepingcurrentmatters.com/content/images/20231010/20230914-Why-Is-Housing--Inventory-So-Low.png [featured_image_meta] => [id] => 15511 [kcm_ig_caption] => One question that’s top of mind if you’re thinking about making a move today is: Why is it so hard to find a house to buy? There aren’t enough homes available for sale, but that shortage isn’t just a today problem. It’s been a challenge for years. Let’s take a look at some of the long-term and short-term factors that have contributed to this limited supply. Underbuilding Is a Long-Standing Problem One of the big reasons inventory is low is because builders haven’t been building enough homes in recent years. And while new home construction is back on track and meeting the historical average right now, the long-term inventory problem isn’t going to be solved overnight. Today’s Mortgage Rates Create a Lock-In Effect There are also a few factors at play in today’s market adding to the inventory challenge. The first is the mortgage rate lock-in effect. Basically, some homeowners are reluctant to sell because of where mortgage rates are right now. They don’t want to move and take on a rate that’s higher than the one they have on their current home. Misinformation in the Media Is Creating Unnecessary Fear Another thing that’s limiting inventory right now is the fear that’s been created by the media. How This Impacts You If you’re wondering how today’s low inventory affects you, it depends on if you’re selling or buying a home, or both. The low supply of homes for sale isn’t a new challenge. There are a number of long-term and short-term factors leading to the current inventory deficit. If you’re looking to make a move, DM Me. That way you’ll have an expert on your side to explain how this impacts you and what’s happening with housing inventory in our area. [kcm_ig_hashtags] => realestate,homeownership,homebuying,realestategoals,realestatetips,realestatelife,realestatenews,realestateagent,realestateexpert,realestateagency,realestateadvice,realestateblog,realestatemarket,realestateexperts,realestateagents,instarealestate,instarealtor,realestatetipsoftheday,realestatetipsandadvice,keepingcurrentmatters [kcm_ig_quote] => Why is housing inventory so low? [public_bottom_line] =>The low supply of homes for sale isn’t a new challenge. There are a number of long-term and short-term factors leading to the current inventory deficit. If you’re looking to make a move, connect with a real estate agent. That way you’ll have an expert on your side to explain how this impacts you and what’s happening with housing inventory in your area.

[published_at] => 2023-09-14T10:30:00Z [related] => Array ( ) [slug] => why-is-housing-inventory-so-low [status] => published [tags] => Array ( [0] => content-hub ) [title] => Why Is Housing Inventory So Low? [updated_at] => 2023-10-30T14:40:23Z [url] => /2023/09/14/why-is-housing-inventory-so-low/ )Why Is Housing Inventory So Low?

One question that’s top of mind if you’re thinking about making a move today is: Why is it so hard to find a house to buy?