stdClass Object

(

[agents_bottom_line] =>

If you’re a homeowner getting ready for retirement, part of that transition likely includes deciding where you’ll live. Let’s connect so you can understand your options and explore your downsizing opportunities.

[assets] => Array

(

)

[can_share] => no

[categories] => Array

(

[0] => stdClass Object

(

[category_type] => standard

[children] =>

[created_at] => 2019-06-03T18:18:43Z

[id] => 5

[name] => For Buyers

[parent] =>

[parent_id] =>

[published_at] => 2019-06-03T18:18:43Z

[slug] => buyers

[status] => public

[translations] => stdClass Object

(

[es] => stdClass Object

(

[name] => Para los compradores

)

)

[updated_at] => 2019-06-03T18:18:43Z

)

[1] => stdClass Object

(

[category_type] => standard

[children] =>

[created_at] => 2019-06-03T18:18:43Z

[id] => 6

[name] => For Sellers

[parent] =>

[parent_id] =>

[published_at] => 2019-06-03T18:18:43Z

[slug] => sellers

[status] => public

[translations] => stdClass Object

(

[es] => stdClass Object

(

[name] => Para los vendedores

)

)

[updated_at] => 2019-06-03T18:18:43Z

)

)

[content_type] => blog

[contents] => Many people are reaching the point in their lives when they need to decide where they want to live when they retire. If you’re a homeowner approaching this stage, you have several options to explore. Jessica Lautz, Deputy Chief Economist and Vice President of Research at the National Association of Realtors (NAR), says:

“As we see the transition of the large Baby Boomer generation age into retirement, it will be interesting to see if they move in with their Millennial and Gen Z children or if they stay put in their own homes.”

Lautz lists two options: move into a multigenerational home with loved ones, or stay in your current house. Multigenerational living is rising in popularity, but it isn’t an option for everyone. And staying put may fit fewer and fewer of your needs. There’s a third option though, and for some, it’s the best one: downsizing.

When you sell your house and purchase a smaller one, it’s known as downsizing. Sometimes smaller homes are more suited to your changing needs, and moving means you can also land in your ideal location.

In addition to the personal benefits, downsizing might be more cost effective, too. The New York Times (NYT) shares:

“Many downsizers expect to improve their retirement income stream if their new home costs less than what their old house sells for. Lower utility costs, insurance and property taxes — as well as investment returns on the proceeds — can also improve the bottom line.”

Being in a strong financial position is one of the most important parts of retirement, and downsizing can make a big difference.

A key part of why downsizing is still cost effective today, even when mortgage rates are higher than they were a year ago, is the record-high level of equity homeowners have. Leveraging your equity when you downsize can lower or maybe even eliminate the mortgage payment on your next home.

So, not only is the upkeep of a smaller home likely more affordable, but leveraging your home equity could make a big difference too. Your local real estate advisor is the best resource to help you understand how much equity you may have in your current home and what options it can provide for your next move.

Bottom Line

If you’re a homeowner getting ready for retirement, part of that transition likely includes deciding where you’ll live. Let’s connect so you can understand your options and explore your downsizing opportunities.

[created_at] => 2023-02-21T18:17:46Z

[description] => Many people are reaching the point in their lives when they need to decide where they want to live when they retire. If you’re a homeowner approaching this stage, you have several options to explore. Jessica Lautz, Deputy Chief Economist and Vice President of Research at the National Association of Realtors (NAR), says:

[exclusive_id] =>

[expired_at] =>

[featured_image] => https://api.simplifyingthemarket.com/wp-content/uploads/2023/02/a-smaller-home-could-be-your-best-option-KCM.jpg

[id] => 4615

[kcm_ig_caption] => Many people are reaching the point in their lives when they need to decide where they want to live when they retire. If you’re a homeowner approaching this stage, you have several options to explore.

Sometimes smaller homes are more suited to your changing needs, and moving means you can also land in your ideal location.

In addition to the personal benefits, downsizing might be more cost effective, too. The New York Times (NYT) shares:

“Many downsizers expect to improve their retirement income stream if their new home costs less than what their old house sells for. Lower utility costs, insurance and property taxes — as well as investment returns on the proceeds — can also improve the bottom line.”

Being in a strong financial position is one of the most important parts of retirement, and downsizing can make a big difference.

A key part of why downsizing is still cost effective today, even when mortgage rates are higher than they were a year ago, is the record-high level of equity homeowners have. Leveraging your equity when you downsize can lower or maybe even eliminate the mortgage payment on your next home.

So, not only is the upkeep of a smaller home likely more affordable, but leveraging your home equity could make a big difference too. Your local real estate advisor is the best resource to help you understand how much equity you may have in your current home and what options it can provide for your next move.

If you’re a homeowner getting ready for retirement, part of that transition likely includes deciding where you’ll live. DM me so you can understand your options and explore your downsizing opportunities.

[kcm_ig_hashtags] => Sellyourhouse,downsizing,dreamhome,realestate,homeownership,realestategoals,realestatetips,realestatelife,realestatenews,realestateagent,realestateexpert,realestateagency,realestateadvice,realestateblog,realestatemarket,realestateexperts,instarealestate,instarealtor,realestatetipsoftheday,realestatetipsandadvice,justsold,keepingcurrentmatters

[kcm_ig_quote] => A smaller home could be your best option.

[public_bottom_line] => If you’re a homeowner getting ready for retirement, part of that transition likely includes deciding where you’ll live. Work with a trusted advisor to understand your options and explore your downsizing opportunities.

[published_at] => 2023-02-22T11:30:49Z

[related] => Array

(

)

[slug] => a-smaller-home-could-be-your-best-option

[status] => published

[tags] => Array

(

)

[title] => A Smaller Home Could Be Your Best Option

[updated_at] => 2023-02-22T11:33:19Z

[url] => /2023/02/22/a-smaller-home-could-be-your-best-option/

)

New Search

If you are not happy with the results below please do another search

2689 search results for: want to buy a home now may be the time

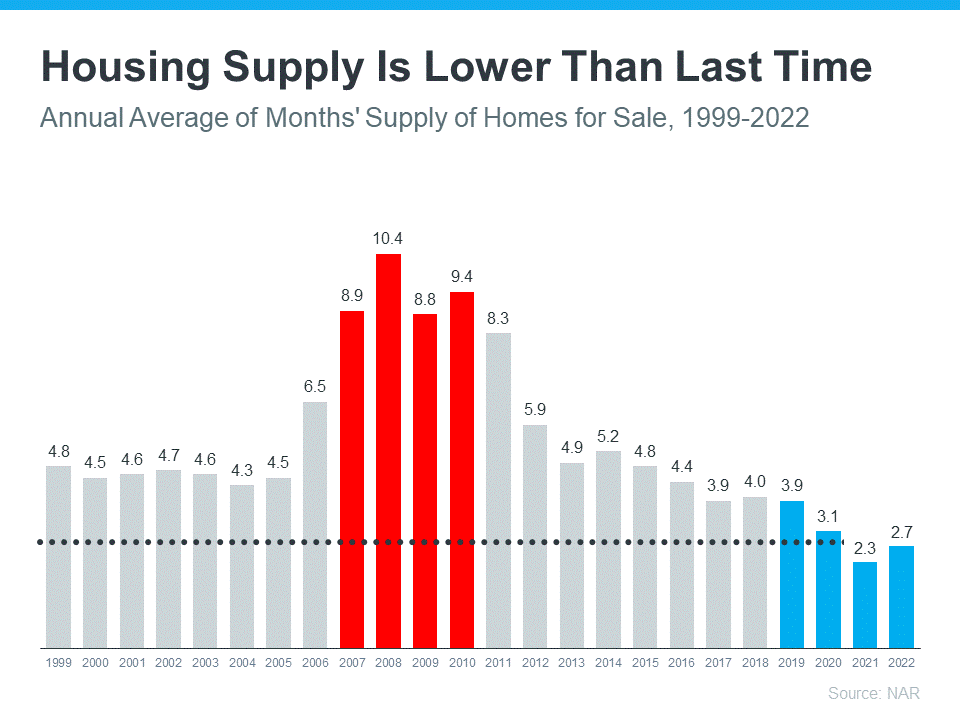

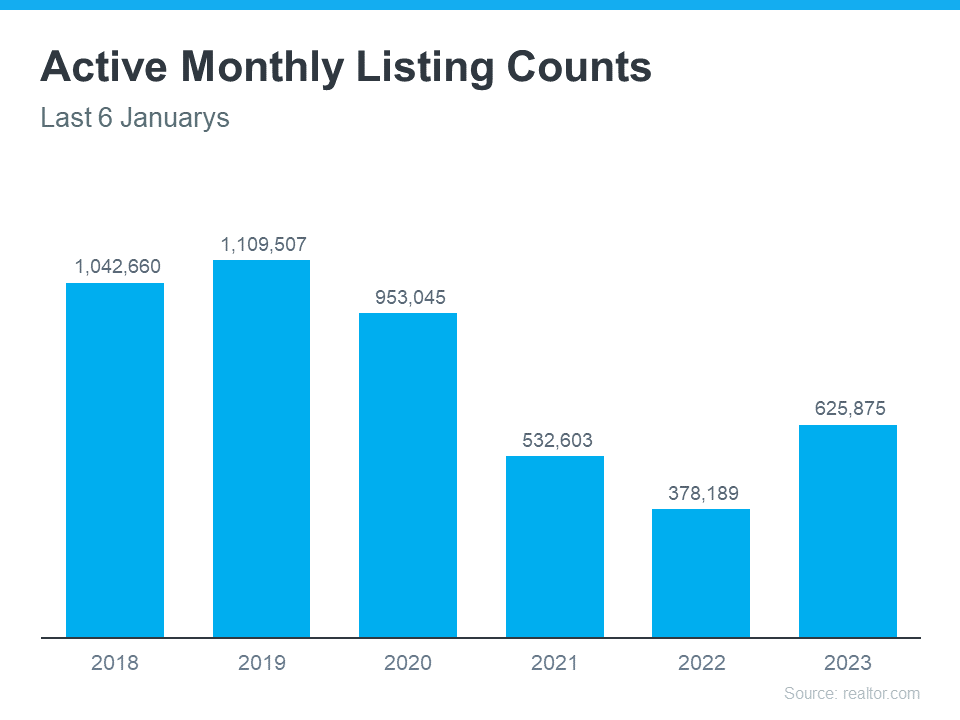

The Two Big Issues the Housing Market’s Facing Right Now

Spring into Action: Boost Your Home’s Curb Appeal with Expert Guidance

- The biggest challenge in the housing market is how few houses there are for sale compared to the number of people who want to buy.

- The number of homes for sale is up from last year but below pre-pandemic numbers, and that means we’re still in a sellers’ market.

- The housing market needs more homes for sale to meet the demand of today’s buyers. If you’ve thought about selling, let’s connect today.

Some Highlights

- The biggest challenge in the housing market is how few houses there are for sale compared to the number of people who want to buy.

- The number of homes for sale is up from last year but below pre-pandemic numbers, and that means we’re still in a sellers’ market.

- The housing market needs more homes for sale to meet the demand of today’s buyers. If you’ve thought about selling, let’s connect today.

Some Highlights

- The biggest challenge in the housing market is how few houses there are for sale compared to the number of people who want to buy.

- The number of homes for sale is up from last year but below pre-pandemic numbers, and that means we’re still in a sellers’ market.

- The biggest challenge in the housing market is how few houses there are for sale compared to the number of people who want to buy.

- The number of homes for sale is up from last year but below pre-pandemic numbers, and that means we’re still in a sellers’ market.

- The housing market needs more homes for sale to meet the demand of today’s buyers. If you’ve thought about selling, now’s the time to connect with a local expert.

The Spring Housing Market Could Be a Sweet Spot for Sellers [INFOGRAPHIC]

Some Highlights

- The biggest challenge in the housing market is how few houses there are for sale compared to the number of people who want to buy.

- The number of homes for sale is up from last year but below pre-pandemic numbers, and that means we’re still in a sellers’ market.

Wondering What’s Going on with Home Prices?

Should You Consider Buying a Newly Built Home?

- 91% of homeowners say they feel secure, stable, or successful owning a home

- 64% of American homeowners say living through a pandemic has made their home more important to them than ever

It’s no surprise this study also reveals that homeowners now love their homes even more as our attachments to them have grown:

The National Association of Realtors (NAR) also explains:

“In addition to tangible financial benefits, homeownership brings substantial social benefits for [households], communities, and the country as a whole.”

In other words, not only does owning a home build your net worth over time, but it also gives you and your loved ones a place to thrive. And by living near people with shared experiences, homeownership helps you connect with your community and contribute meaningfully.

Bottom Line

Whether you’re thinking of buying your first home, moving up to your dream home, or downsizing to something that better fits your changing lifestyle, let me be the key to unlocking a home you can truly fall in love with.

[created_at] => 2023-02-09T15:26:39Z [description] =>No matter how the housing market changes, there are some things about owning a home that never change—like the personal benefits it can provide. When you own your home, you likely feel a sense of attachment because of the comfort it gives and also because it’s a space that’s truly yours.

[email_copy] => [exclusive_id] => [expired_at] => [featured_image] => https://files.keepingcurrentmatters.com/wp-content/uploads/2023/02/13104549/why-its-easy-to-fall-in-love-with-homeownership-KCM.jpg [gif] => https://videos.mykcm.com/videos/gifs/WhyItsEasyToFallinLovewithHomeownership.gif [hashtags] => valentinesday,homeownership,dreamhome [id] => 4582 [kcm_ig_caption] => No matter how the housing market changes, there are some things about owning a home that never change—like the personal benefits it can provide. When you own your home, you likely feel a sense of attachment because of the comfort it gives and also because it’s a space that’s truly yours. Over the last few years, we’ve fully embraced the meaning of our homes as we spent more time than ever in them. As a result, the emotional benefits our homes provide have become even more important to us. As the most recent State of the American Homeowner from Unison puts it: “. . . one thing has stayed the same: the home continues to be of the utmost importance and a place of security and comfort.” The same study from Unison notes: • 91% of homeowners say they feel secure, stable, or successful owning a home • 64% of American homeowners say living through a pandemic has made their home more important to them than ever The National Association of Realtors (NAR) also explains: “In addition to tangible financial benefits, homeownership brings substantial social benefits for [households], communities, and the country as a whole.” In other words, not only does owning a home build your net worth over time, but it also gives you and your loved ones a place to thrive. And by living near people with shared experiences, homeownership helps you connect with your community and contribute meaningfully. Whether you’re thinking of buying your first home, moving up to your dream home, or downsizing to something that better fits your changing lifestyle, let me be the key to unlocking a home you can truly fall in love with. DM me today. [kcm_ig_hashtags] => firsttimehomebuyer,opportunity,housingmarket,househunting,makememove,homegoals,houseshopping,housegoals,investmentproperty,emptynest,downsizing,locationlocationlocation,newlisting,homeforsale,renovated,starterhome,dreamhome,curbappeal,keepingcurrentmatters [kcm_ig_quote] => Here’s why it’s easy to fall in love with homeownership. [public_bottom_line] => Whether you’re thinking of buying your first home, moving up to your dream home, or downsizing to something that better fits your changing lifestyle, a local market expert is the key to unlocking a home you can truly fall in love with. [published_at] => 2023-02-14T11:30:53Z [related] => Array ( ) [slug] => why-its-easy-to-fall-in-love-with-homeownership-1 [sources] => [status] => published [tags] => Array ( ) [thumbnail_timestamp] => [title] => Why It’s Easy To Fall in Love with Homeownership [type] => blog [updated_at] => 2023-02-14T17:54:29Z [url] => /2023/02/14/why-its-easy-to-fall-in-love-with-homeownership-1/ )Why It’s Easy To Fall in Love with Homeownership

No matter how the housing market changes, there are some things about owning a home that never change—like the personal benefits it can provide. When you own your home, you likely feel a sense of attachment because of the comfort it gives and also because it’s a space that’s truly yours.

- Government recording costs

- Appraisal fees

- Credit report fees

- Lender origination fees

- Title services

- Tax service fees

- Survey fees

- Attorney fees

- Underwriting Fees

How Much Will You Need To Budget for Closing Costs?

Understanding what closing costs include is important, but knowing what you’ll need to budget to cover them is critical, too. According to the Freddie Mac article mentioned above, the costs to close are typically between 2% and 5% of the total purchase price of your home. With that in mind, here’s how you can get an idea of what you’ll need to cover your closing costs.

Let’s say you find a home you want to purchase for the median price of $366,900. Based on the 2-5% Freddie Mac estimate, your closing fees could be between roughly $7,500 and $18,500.

Keep in mind, if you’re in the market for a home above or below this price range, your closing costs will be higher or lower.

What’s the Best Way To Make Sure You’re Prepared at Closing Time?

Freddie Mac provides great advice for homebuyers, saying:

“As you start your homebuying journey, take the time to get a sense of all costs involved – from your down payment to closing costs.”

Work with a team of trusted real estate professionals to understand exactly how much you’ll need to budget for closing costs. An agent can help connect you with a lender, and together your expert team can answer any questions you might have.

Bottom Line

It’s important to plan for the fees and payments you’ll be responsible for at closing. Let’s connect so I can help you feel confident throughout the process.

[created_at] => 2023-02-10T16:56:27Z [description] => Before you buy a home, it’s important to plan ahead. While most buyers consider how much they need to save for a down payment, many are surprised by the closing costs they have to pay. To ensure you aren’t caught off guard when it’s time to close on your home, you need to understand what closing costs are and how much you should budget for. [exclusive_id] => [expired_at] => [featured_image] => https://api.simplifyingthemarket.com/wp-content/uploads/2023/02/what-you-should-know-about-closing-costs-KCM.jpg [id] => 4589 [kcm_ig_caption] => Before you buy a home, it’s important to plan ahead. While most buyers consider how much they need to save for a down payment, many are surprised by the closing costs they have to pay. To ensure you aren’t caught off guard when it’s time to close on your home, you need to understand what closing costs are and how much you should budget for. >>What Are Closing Costs? People are sometimes surprised by closing costs because they don’t know what they are. According to Bankrate: “Closing costs are the fees and expenses you must pay before becoming the legal owner of a house, condo or townhome . . . Closing costs vary depending on the purchase price of the home and how it’s being financed . . .” In other words, your closing costs are a collection of fees and payments involved with your transaction. According to Freddie Mac, while they can vary by location and situation, closing costs typically include: • Government recording costs • Appraisal fees • Credit report fees • Lender origination fees • Title services • Tax service fees • Survey fees • Attorney fees • Underwriting Fees >>How Much Will You Need To Budget for Closing Costs? According to Freddie Mac, the costs to close are typically between 2% and 5% of the total purchase price of your home. With that in mind, here’s how you can get an idea of what you’ll need to cover your closing costs. Let’s say you find a home you want to purchase for the median price of $366,900. Based on the 2-5% Freddie Mac estimate, your closing fees could be between roughly $7,500 and $18,500. It’s important to plan for the fees and payments you’ll be responsible for at closing. DM me so you can feel confident throughout the process. [kcm_ig_hashtags] => firsttimehomebuyer,opportunity,housingmarket,househunting,makememove,homegoals,houseshopping,housegoals,investmentproperty,emptynest,downsizing,locationlocationlocation,newlisting,homeforsale,renovated,starterhome,dreamhome,curbappeal,keepingcurrentmatters [kcm_ig_quote] => Here’s what you should know about closing costs. [public_bottom_line] => It’s important to plan for the fees and payments you’ll be responsible for at closing. Work with a local real estate professional who can help you feel confident throughout the process. [published_at] => 2023-02-13T11:30:44Z [related] => Array ( ) [slug] => what-you-should-know-about-closing-costs [status] => published [tags] => Array ( ) [title] => What You Should Know About Closing Costs [updated_at] => 2023-02-13T11:35:02Z [url] => /2023/02/13/what-you-should-know-about-closing-costs/ )What You Should Know About Closing Costs

- In today’s housing market, you can still be the champion if you have the right team and strategy.

- To win as a buyer, you need to build your team, make strategic plays, consider what’s in and out of bounds, and stand out from the crowd.

- Let’s connect today to make your game-winning play.

Some Highlights

- In today’s housing market, you can still be the champion if you have the right team and strategy.

- To win as a buyer, you need to build your team, make strategic plays, consider what’s in and out of bounds, and stand out from the crowd.

- Let’s connect today to make your game-winning play.

Some Highlights

- In today’s housing market, you can still be the champion if you have the right team and strategy.

- To win as a buyer, you need to build your team, make strategic plays, consider what’s in and out of bounds, and stand out from the crowd.

- In today’s housing market, you can still be the champion if you have the right team and strategy.

- To win as a buyer, you need to build your team, make strategic plays, consider what’s in and out of bounds, and stand out from the crowd.

- Connect with a real estate professional today to make your game-winning play.

How To Win as a Buyer in Today’s Housing Market [INFOGRAPHIC]

Some Highlights

- In today’s housing market, you can still be the champion if you have the right team and strategy.

- To win as a buyer, you need to build your team, make strategic plays, consider what’s in and out of bounds, and stand out from the crowd.

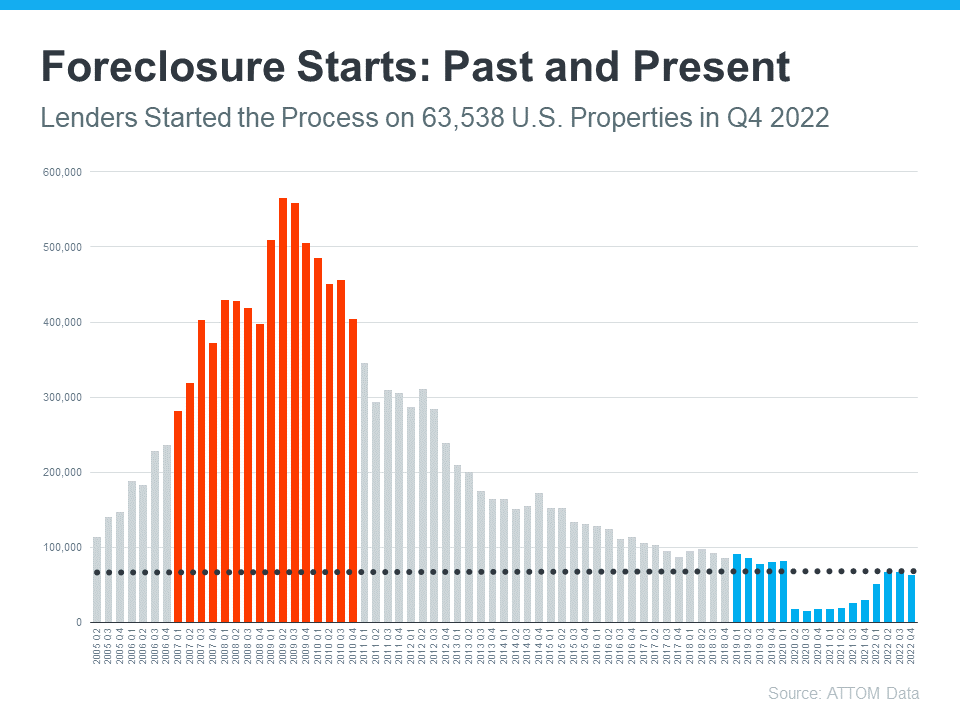

Why Today’s Housing Market Isn’t Headed for a Crash

Number of Homes for Sale Up from Last Year, but Below Pre-Pandemic Years

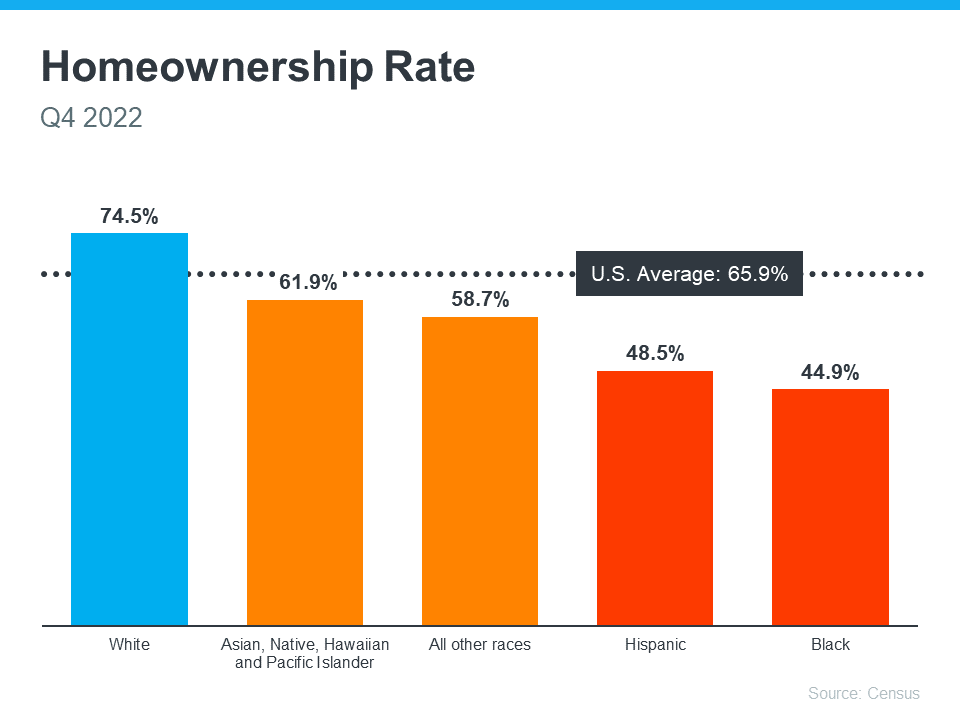

How Experts Can Help Close the Gap in Today’s Homeownership Rate

The Top Reasons for Selling Your House

- Many people believe you need to put down 20% of the purchase price when you buy a home. But recent homebuyers actually put down far less on their purchase.

- And with programs like FHA loans, VA loans, and USDA loans, some qualified buyers are able to put down as little as 0-3.5%.

- Let’s connect to make sure you have a trusted lender and can find out if you’re ready to buy a home sooner rather than later.

Some Highlights

- Many people believe you need to put down 20% of the purchase price when you buy a home. But recent homebuyers actually put down far less on their purchase.

- And with programs like FHA loans, VA loans, and USDA loans, some qualified buyers are able to put down as little as 0-3.5%.

- Let’s connect to make sure you have a trusted lender and can find out if you’re ready to buy a home sooner rather than later.

Some Highlights

- Many people believe you need to put down 20% of the purchase price when you buy a home. But recent homebuyers actually put down far less on their purchase.

- And with programs like FHA loans, VA loans, and USDA loans, some qualified buyers are able to put down as little as 0-3.5%.

- Many people believe you need to put down 20% of the purchase price when you buy a home. But recent homebuyers actually put down far less on their purchase.

- And with programs like FHA loans, VA loans, and USDA loans, some qualified buyers are able to put down as little as 0-3.5%.

- Connect with a real estate professional and find out if you’re ready to buy a home sooner rather than later.

You May Not Need as Much as You Think for Your Down Payment [INFOGRAPHIC]

Some Highlights

- Many people believe you need to put down 20% of the purchase price when you buy a home. But recent homebuyers actually put down far less on their purchase.

- And with programs like FHA loans, VA loans, and USDA loans, some qualified buyers are able to put down as little as 0-3.5%.

Experts Forecast a Turnaround in the Housing Market in 2023

Should You Rent Your House or Sell It?

Lower Mortgage Rates Are Bringing Buyers Back to the Market

Where Will You Go If You Sell? You Have Options.

- If you’re thinking of buying a home this year, be sure to factor in the long-term benefits of homeownership.

- On average, nationwide, home prices appreciated by 288.7% over the last 32 years. That means homeowners grow their net worth significantly in the long term.

- Homeownership wins over time. Let’s connect so you can start your homebuying journey today.

Some Highlights

- If you’re thinking of buying a home this year, be sure to factor in the long-term benefits of homeownership.

- On average, nationwide, home prices appreciated by 288.7% over the last 32 years. That means homeowners grow their net worth significantly in the long term.

- Homeownership wins over time. Let’s connect so you can start your homebuying journey today.

Some Highlights

- If you’re thinking of buying a home this year, be sure to factor in the long-term benefits of homeownership.

- On average, nationwide, home prices appreciated by 288.7% over the last 32 years. That means homeowners grow their net worth significantly in the long term.

- If you’re thinking of buying a home this year, be sure to factor in the long-term benefits of homeownership.

- On average, nationwide home prices appreciated by 288.7% over the last 32 years. That means homeowners grow their net worth significantly in the long term.

- Homeownership wins over time. Reach out to a real estate professional so you can start your homebuying journey today.

Homeownership Builds Your Wealth over Time [INFOGRAPHIC]

Some Highlights

- If you’re thinking of buying a home this year, be sure to factor in the long-term benefits of homeownership.

- On average, nationwide, home prices appreciated by 288.7% over the last 32 years. That means homeowners grow their net worth significantly in the long term.

Why It Makes Sense To Move Before Spring

Why You Shouldn’t Fear Today’s Foreclosure Headlines

The 3 Factors That Affect Home Affordability

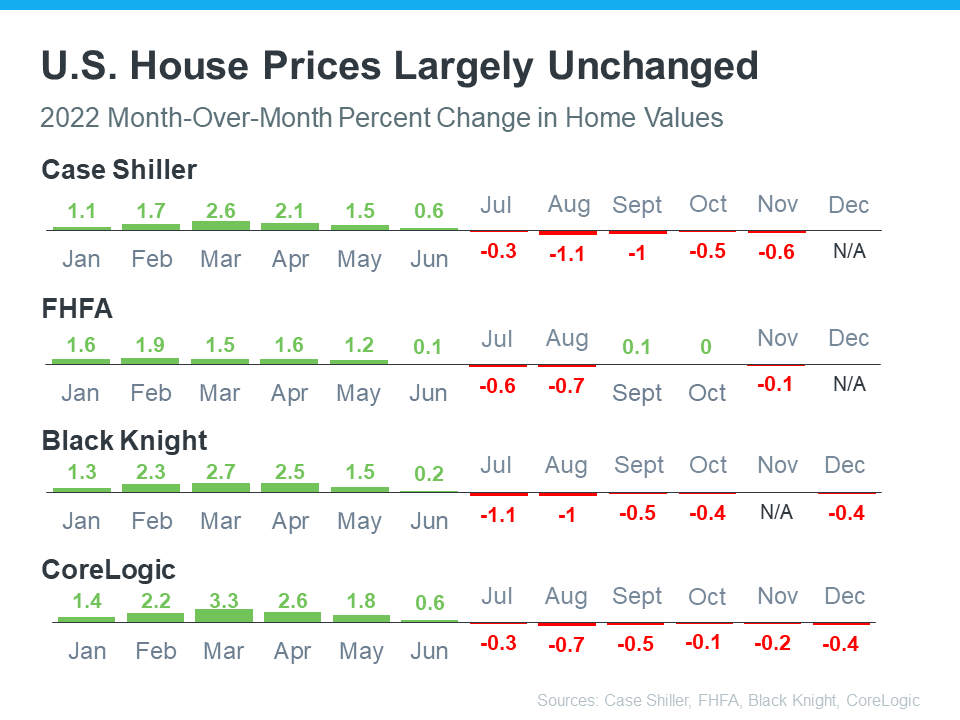

- If you’re thinking about selling your house, recent headlines about home prices falling month-over-month may have you second guessing your decision—but perspective matters.

- While home prices are down slightly month-over-month in some markets, home values are still up almost 10% nationally on a year-over-year basis. A nearly 10% gain is still dramatic compared to the more normal level of appreciation, which is 3-4%.

- Let’s connect to find out how much equity you have in your current home and how you can use it to fuel your next purchase.

Some Highlights

- If you’re thinking about selling your house, recent headlines about home prices falling month-over-month may have you second guessing your decision—but perspective matters.

- While home prices are down slightly month-over-month in some markets, home values are still up almost 10% nationally on a year-over-year basis. A nearly 10% gain is still dramatic compared to the more normal level of appreciation, which is 3-4%.

- Let’s connect to find out how much equity you have in your current home and how you can use it to fuel your next purchase.

Some Highlights

- If you’re thinking about selling your house, recent headlines about home prices falling month-over-month may have you second guessing your decision—but perspective matters.

- While home prices are down slightly month-over-month in some markets, home values are still up almost 10% nationally on a year-over-year basis. A nearly 10% gain is still dramatic compared to the more normal level of appreciation, which is 3-4%.

- If you’re thinking about selling your house, recent headlines about home prices falling month-over-month may have you second guessing your decision—but perspective matters.

- While home prices are down slightly month-over-month in some markets, home values are still up almost 10% nationally on a year-over-year basis. A nearly 10% gain is still dramatic compared to the more normal level of appreciation, which is 3-4%.

- Reach out to a real estate professional to find out how much equity you have in your current home and how you can use it to fuel your next purchase.

What’s Really Happening with Home Prices? [INFOGRAPHIC]

Some Highlights

- If you’re thinking about selling your house, recent headlines about home prices falling month-over-month may have you second guessing your decision—but perspective matters.

- While home prices are down slightly month-over-month in some markets, home values are still up almost 10% nationally on a year-over-year basis. A nearly 10% gain is still dramatic compared to the more normal level of appreciation, which is 3-4%.

![The Spring Housing Market Could Be a Sweet Spot for Sellers [INFOGRAPHIC] | Simplifying The Market](https://files.simplifyingthemarket.com/wp-content/uploads/2023/02/16105224/The-Spring-Housing-Market-Could-Be-A-Sweet-Spot-For-Sellers-MEM.png)

![How To Win as a Buyer in Today’s Housing Market [INFOGRAPHIC] | Simplifying The Market](https://files.simplifyingthemarket.com/wp-content/uploads/2023/02/10132046/Resize-UPDATED-MEM_Homeownership-Builds-Your-Wealth-In-The-Over-Time-MEM.png)

![You May Not Need as Much as You Think for Your Down Payment [INFOGRAPHIC] | Simplifying The Market](https://api.simplifyingthemarket.com/wp-content/uploads/2023/02/You-May-Not-Need-As-Much-As-You-Think-For-Your-Down-Payment-MEM.png)

![Homeownership Builds Your Wealth over Time [INFOGRAPHIC] | Simplifying The Market](https://files.simplifyingthemarket.com/wp-content/uploads/2023/01/26130049/Homeownership-Builds-Your-Wealth-In-The-Over-Time-MEM.png)

![What’s Really Happening with Home Prices? [INFOGRAPHIC] | Simplifying The Market](https://files.simplifyingthemarket.com/wp-content/uploads/2023/01/19133822/Whats-Really-Happening-With-Home-Prices-MEM.png)