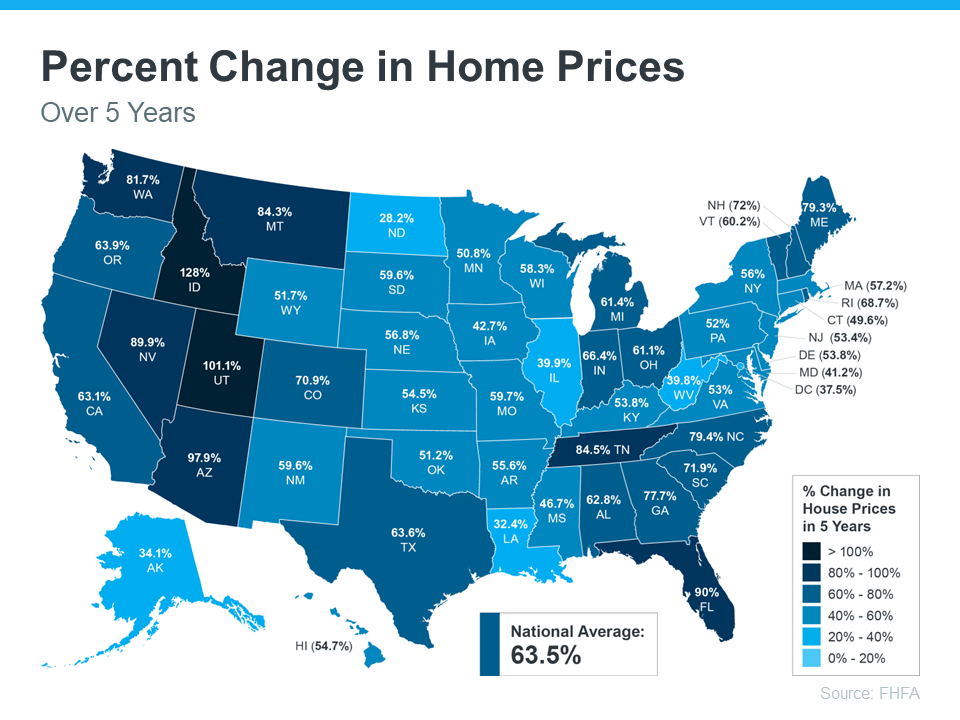

- If you’re questioning whether or not to buy a home this year due to today’s cooling market, consider the long-term financial benefits of homeownership.

- As a homeowner, equity increases your wealth. On average, nationwide, home prices appreciated by 290.2% since 1991.

- Homeownership wins in the long run. If you’re ready to buy a home, let’s connect today.

Some Highlights

- If you’re questioning whether or not to buy a home this year due to today’s cooling market, consider the long-term financial benefits of homeownership.

- As a homeowner, equity increases your wealth. On average, nationwide, home prices appreciated by 290.2% since 1991.

- Homeownership wins in the long run. If you’re ready to buy a home, let’s connect today.

Some Highlights

- If you’re questioning whether or not to buy a home this year due to today’s cooling market, consider the long-term financial benefits of homeownership.

- As a homeowner, equity increases your wealth. On average, nationwide, home prices appreciated by 2% since 1991.

Homeownership Wins Over Time [INFOGRAPHIC]

Some Highlights

- If you’re questioning whether or not to buy a home this year due to today’s cooling market, consider the long-term financial benefits of homeownership.

- As a homeowner, equity increases your wealth. On average, nationwide, home prices appreciated by 2% since 1991.

![Homeownership Wins Over Time [INFOGRAPHIC] | Simplifying The Market](https://files.keepingcurrentmatters.com/wp-content/uploads/2022/11/20221104_homeownership-wins-over-time-MEM.png)

![Applying for a Mortgage Doesn’t Have To Be Scary [INFOGRAPHIC] | Simplifying The Market](https://files.keepingcurrentmatters.com/wp-content/uploads/2022/10/applying-for-a-mortgage-doesnt-have-to-be-scary-MEM.png)

![3 Questions You May Be Asking About Selling Your House Today [INFOGRAPHIC] | Simplifying The Market](https://files.keepingcurrentmatters.com/wp-content/uploads/2022/10/3-questions-you-may-be-asking-about-selling-your-house-today-MEM.png)

![Tips For First-Time Homebuyers [INFOGRAPHIC] | Simplifying The Market](https://files.keepingcurrentmatters.com/wp-content/uploads/2022/10/20221014-MEM.png)

![The Journey To Buy a Home [INFOGRAPHIC] | Simplifying The Market](https://files.keepingcurrentmatters.com/wp-content/uploads/2022/10/20221007-MEM.png)