stdClass Object

(

[agents_bottom_line] =>

Let's get together and discuss whether you should buy now or wait until you save the 20%.

[assets] => Array

(

)

[can_share] => no

[categories] => Array

(

[0] => stdClass Object

(

[category_type] => standard

[children] =>

[created_at] => 2019-06-03T18:18:43Z

[id] => 5

[name] => For Buyers

[parent] =>

[parent_id] =>

[published_at] => 2019-06-03T18:18:43Z

[slug] => buyers

[status] => public

[translations] => stdClass Object

(

[es] => stdClass Object

(

[name] => Para los compradores

)

)

[updated_at] => 2019-06-03T18:18:43Z

)

[1] => stdClass Object

(

[category_type] => standard

[children] =>

[created_at] => 2019-06-03T18:18:43Z

[id] => 9

[name] => Home Prices

[parent] =>

[parent_id] =>

[published_at] => 2019-06-03T18:18:43Z

[slug] => home-prices

[status] => public

[translations] => stdClass Object

(

[es] => stdClass Object

(

[name] => Precios

)

)

[updated_at] => 2019-06-03T18:18:43Z

)

[2] => stdClass Object

(

[category_type] => standard

[children] =>

[created_at] => 2019-06-03T18:18:43Z

[id] => 35

[name] => Mortgage Rates

[parent] =>

[parent_id] =>

[published_at] => 2019-06-03T18:18:43Z

[slug] => mortgage-rates

[status] => public

[translations] => stdClass Object

(

[es] => stdClass Object

(

[name] => Tasas de interés

)

)

[updated_at] => 2019-06-03T18:18:43Z

)

)

[content_type] => blog

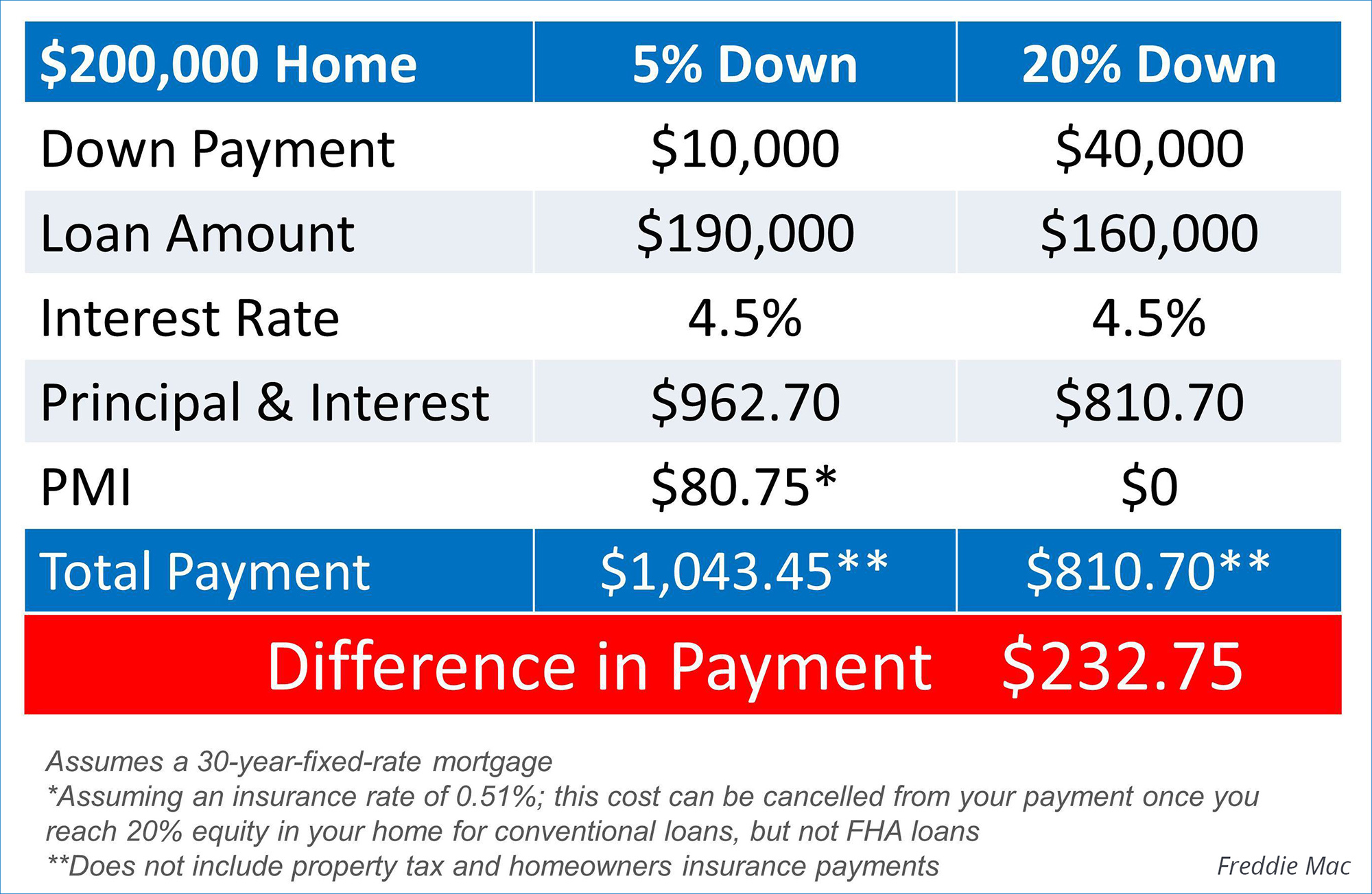

[contents] => Some experts are advising that first time and move-up buyers wait until they save up 20% before they move forward with their decision to purchase a home. One of the main reasons they suggest waiting is that a buyer must purchase private mortgage insurance if they have less than the 20%. That increases the monthly payment the buyer will be responsible for.

In a recent article, Freddie Mac explained what this would mean for a $200,000 house:

However, we must look at other aspects of the purchase to see if it truly makes sense to wait.

However, we must look at other aspects of the purchase to see if it truly makes sense to wait.

Are you actually saving money by waiting?

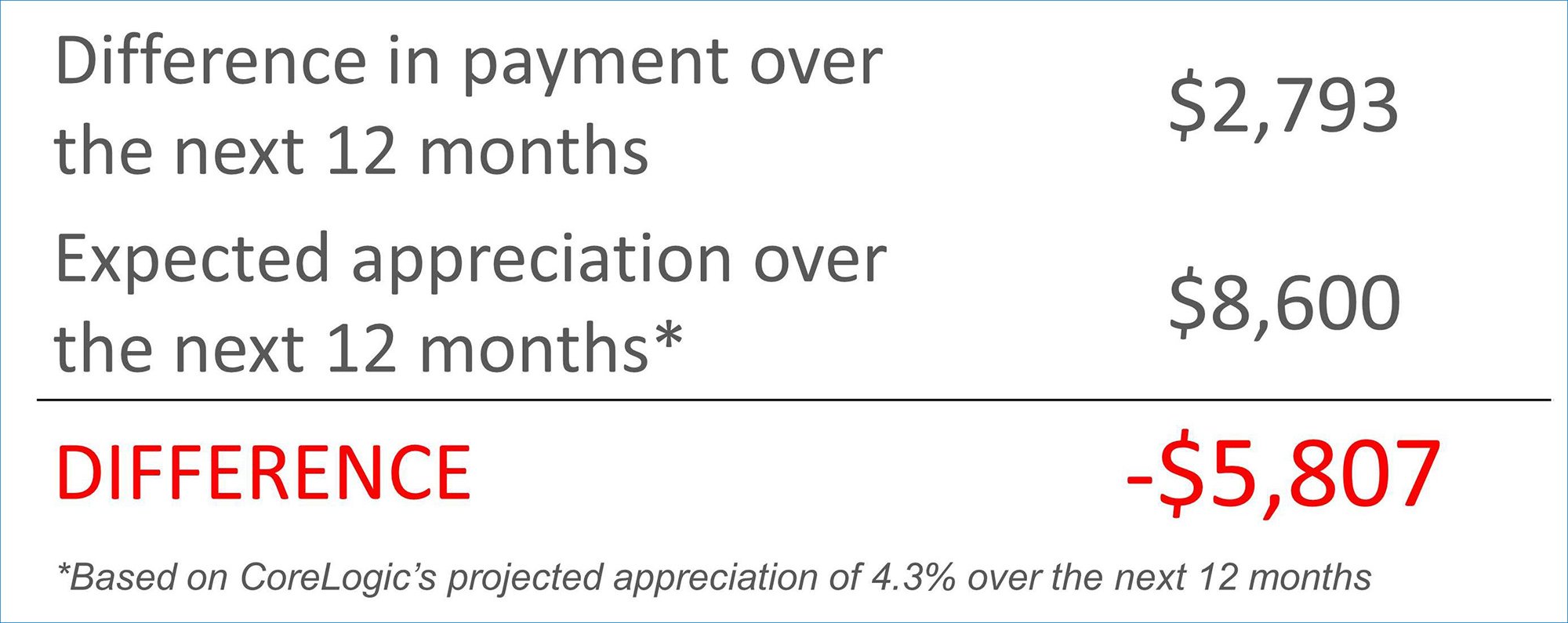

CoreLogic has recently projected that home values will increase by 4.3% over the next 12 months. Let’s compare the extra cost of PMI against the projected appreciation:

If you decide to wait until you have saved up a 20% down payment, the money you would have saved by avoiding the PMI payment could be surpassed by the additional price you eventually pay for the home. Prices are expected to increase by more than 3% each of the next five years.

Saving will also be more difficult if you are renting, as rents are also projected to increase over the next several years. Zillow Chief Economist Dr. Svenja Gudell explained in a recent report:

If you decide to wait until you have saved up a 20% down payment, the money you would have saved by avoiding the PMI payment could be surpassed by the additional price you eventually pay for the home. Prices are expected to increase by more than 3% each of the next five years.

Saving will also be more difficult if you are renting, as rents are also projected to increase over the next several years. Zillow Chief Economist Dr. Svenja Gudell explained in a recent report:

"Our research found that unaffordable rents are making it hard for people to save for a down payment ... There are good reasons to rent temporarily – when you move to a new city, for example – but from an affordability perspective, rents are crazy right now. If you can possibly come up with a down payment, then it's a good time to buy a home and start putting your money toward a mortgage."

Laura Kusisto of the Wall Street Journal recently agreed with Dr. Gudell:

“For some renters there may be a way out: Buy a house. Mortgages remain very affordable.”

Mortgage rates are expected to rise…

Freddie Mac is projecting that mortgage interest rates will increase by almost a full percentage point over the next 12 months. That will also impact your mortgage payment if you wait.

Bottom Line

Let's get together and discuss whether you should buy now or wait until you save the 20%.

[created_at] => 2015-08-26T06:00:14Z

[description] => Some experts are advising that first time and move-up buyers wait until they save up 20% before they move forward with their decision to purchase a home. One of the main reasons they suggest waiting is that a buyer must purchase private mortgage insurance if they have less than the 20%. That increases the monthly payment the buyer will be responsible for.

[exclusive_id] =>

[expired_at] =>

[featured_image] => https://simplifyingmedia/wp-content/uploads/2015/08/01162205/Should-I-Wait.jpg

[id] => 372

[published_at] => 2015-08-26T10:00:14Z

[related] => Array

(

)

[slug] => should-i-wait-to-put-down-a-bigger-down-payment

[status] => published

[tags] => Array

(

)

[title] => Should I Wait to Put Down a Bigger Down Payment?

[updated_at] => 2015-09-04T11:00:39Z

[url] => /2015/08/26/should-i-wait-to-put-down-a-bigger-down-payment/

)

Should I Wait to Put Down a Bigger Down Payment?

Some experts are advising that first time and move-up buyers wait until they save up 20% before they move forward with their decision to purchase a home. One of the main reasons they suggest waiting is that a buyer must purchase private mortgage insurance if they have less than the 20%. That increases the monthly payment the buyer will be responsible for.

The National Association of Realtors just released their

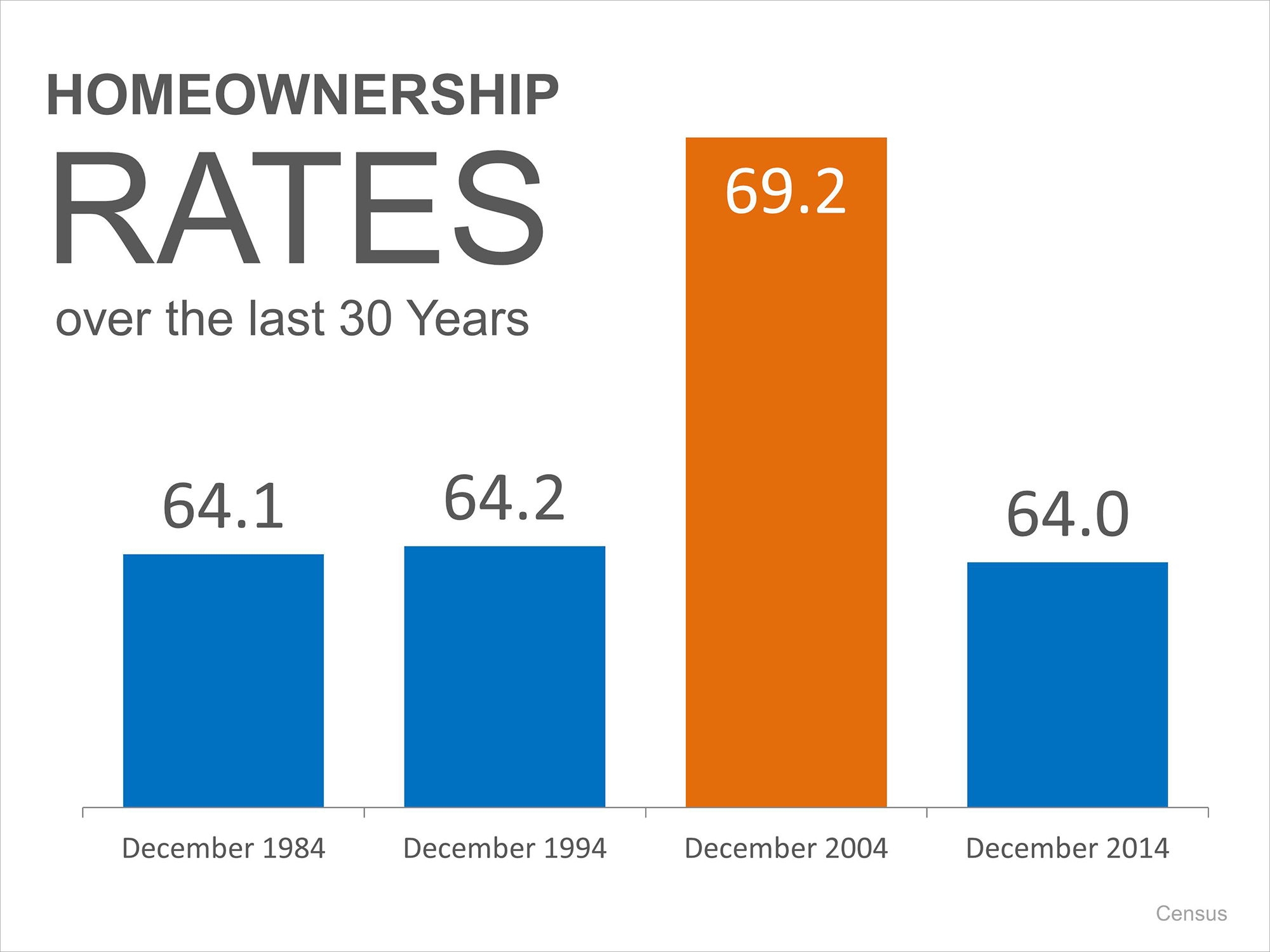

The National Association of Realtors just released their  The Census recently released their 2014 Homeownership Statistics, and many began to worry that Americans have taken a step back from the notion of homeownership.

The Census recently released their 2014 Homeownership Statistics, and many began to worry that Americans have taken a step back from the notion of homeownership.

The headlines agree mortgage interest rates have dropped substantially below initial projections. Many who are considering purchasing a home, or moving up to their dream home, might think that they should wait to buy, because rates may continue to fall.

A recent

The headlines agree mortgage interest rates have dropped substantially below initial projections. Many who are considering purchasing a home, or moving up to their dream home, might think that they should wait to buy, because rates may continue to fall.

A recent  A

A

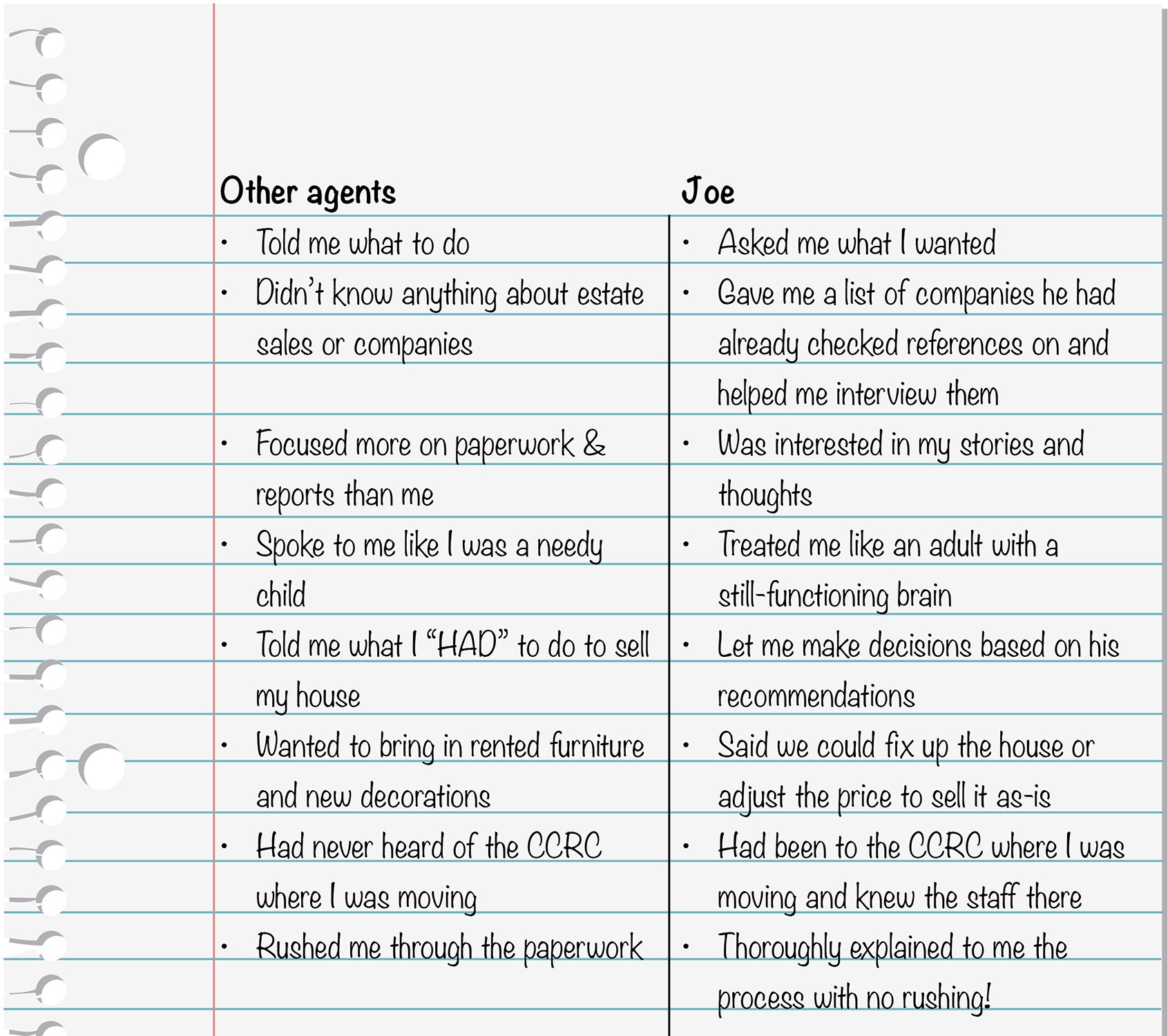

Whether you are buying or selling a home, the process can be challenging. That is why you should take on the services of a real estate professional when embarking on a potential home move. However, not all real estate agents are the same. A family must make sure they hire someone who truly understands the current housing market and, not only that, knows how to connect the dots to explain how market conditions may impact your decision.

How can you make sure you have an agent who meets these requirements?

Here are just a few questions every real estate professional should be able to answer for their clients and customers:

Whether you are buying or selling a home, the process can be challenging. That is why you should take on the services of a real estate professional when embarking on a potential home move. However, not all real estate agents are the same. A family must make sure they hire someone who truly understands the current housing market and, not only that, knows how to connect the dots to explain how market conditions may impact your decision.

How can you make sure you have an agent who meets these requirements?

Here are just a few questions every real estate professional should be able to answer for their clients and customers:

There are some pundits lamenting the softness of the 2014 housing market. We can’t understand why. Though it is true that the early part of the year disappointed because of a myriad of reasons (ex. weather, lack of inventory, less distressed sales), the recent housing news is extremely encouraging. Let’s give some examples:

There are some pundits lamenting the softness of the 2014 housing market. We can’t understand why. Though it is true that the early part of the year disappointed because of a myriad of reasons (ex. weather, lack of inventory, less distressed sales), the recent housing news is extremely encouraging. Let’s give some examples:

Every day we are pleasantly surprised with the research coming forward regarding the Millennial generation. Whether it was

Every day we are pleasantly surprised with the research coming forward regarding the Millennial generation. Whether it was

For almost a year now, we have been trying to debunk the myth that student debt is keeping the vast majority of Millennials from purchasing a home.

We explained that Millennials have purchased more homes over a recent twelve month period than any other generation as was

For almost a year now, we have been trying to debunk the myth that student debt is keeping the vast majority of Millennials from purchasing a home.

We explained that Millennials have purchased more homes over a recent twelve month period than any other generation as was  Many sellers are still hesitant about putting their house up for sale. Where are prices headed? Where are interest rates headed? Can buyers qualify for a mortgage? These are all valid questions. However, there are several reasons to sell your home sooner rather than later. Here are five of those reasons.

Many sellers are still hesitant about putting their house up for sale. Where are prices headed? Where are interest rates headed? Can buyers qualify for a mortgage? These are all valid questions. However, there are several reasons to sell your home sooner rather than later. Here are five of those reasons.

Do as I Say… not as I Do

Do as I Say… not as I Do Growing up it seemed ‘white lies’ were okay while lying was a sin. As children, we sometimes had difficulty understanding where the line was. As we matured, we realized there most definitely was a difference.

Growing up it seemed ‘white lies’ were okay while lying was a sin. As children, we sometimes had difficulty understanding where the line was. As we matured, we realized there most definitely was a difference. Someone said to me recently, “Sixty-five is the new forty-five.” We chuckled, but the more I thought about it, the more I found myself in full agreement.

With more and more people working beyond traditional retirement age and the advances in modern medicine, the lines between middle and late adulthood are becoming a bit blurred.

Someone said to me recently, “Sixty-five is the new forty-five.” We chuckled, but the more I thought about it, the more I found myself in full agreement.

With more and more people working beyond traditional retirement age and the advances in modern medicine, the lines between middle and late adulthood are becoming a bit blurred.

Millennials have become an important topic of discussion for media outlets and blogs throughout the Country. While some argue that my generation is blossoming later than our predecessors, optimists such as myself believe that with our rebounding economy will help Millennials finally arrive in the economic arena that allows them the growth potential generations before us were afforded.

While I truly believe Millennials are positioned to become an important force in the new economy, the widening economic policy that minimizes retirement accounts and creates underemployment of Millennials threatens what is now America’s largest demographic.

Millennials have become an important topic of discussion for media outlets and blogs throughout the Country. While some argue that my generation is blossoming later than our predecessors, optimists such as myself believe that with our rebounding economy will help Millennials finally arrive in the economic arena that allows them the growth potential generations before us were afforded.

While I truly believe Millennials are positioned to become an important force in the new economy, the widening economic policy that minimizes retirement accounts and creates underemployment of Millennials threatens what is now America’s largest demographic.

Nielsen recently released their report “

Nielsen recently released their report “