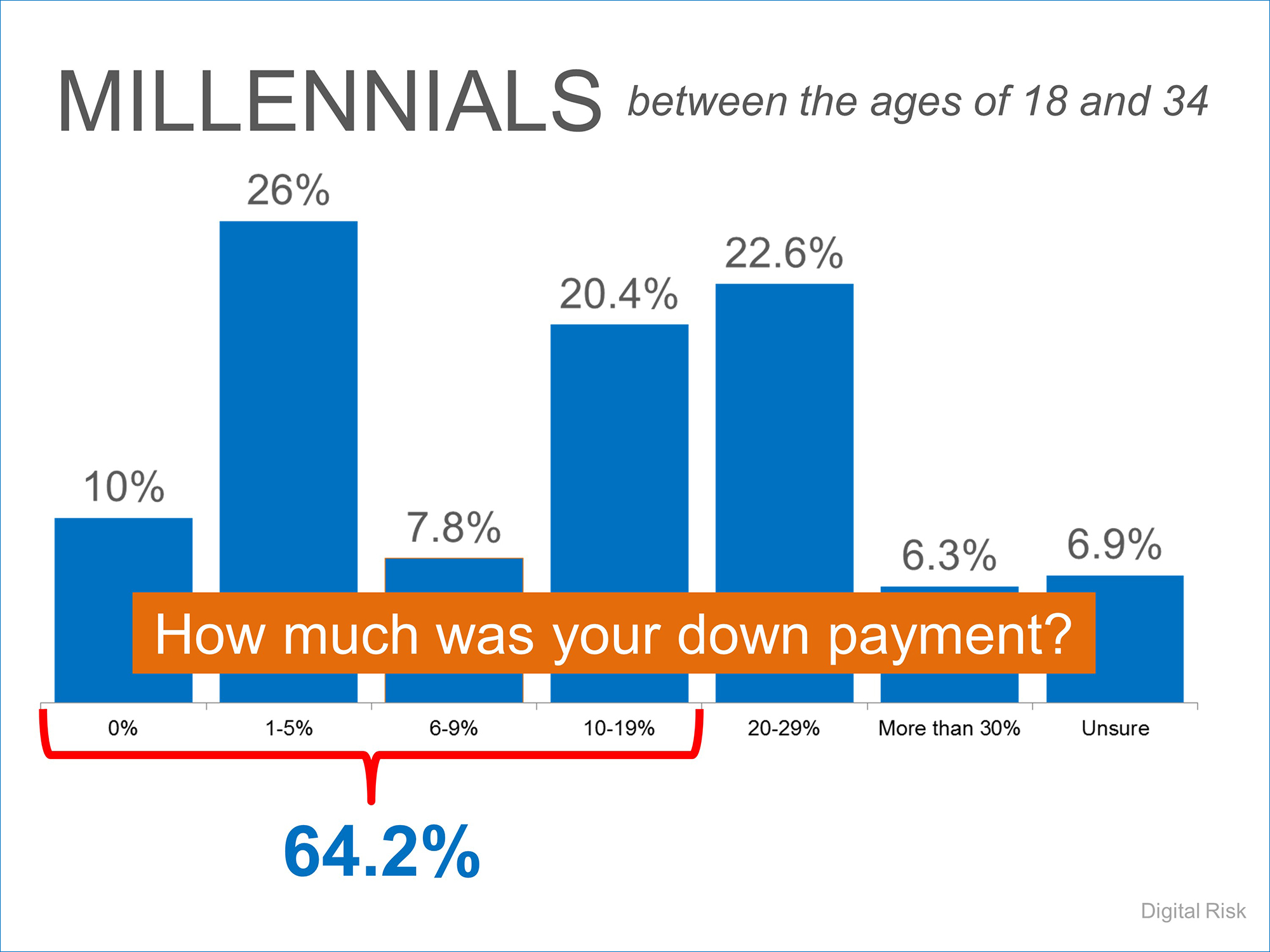

64.2 % de los ‘millennials’ ponen menos del 20 % de cuota inicial

Digital Risk recientemente encuestó a los ‘millennials’ sobre el mercado de la vivienda. Entre sus hallazgos está el hecho de que casi dos tercios de la generación que recientemente compró una casa, lo han hecho con menos del 20 % de cuota inicial; ¡Con 36 % poniendo una cuota inicial de menos del 5 %!

Here is a graph detailing the results:

This means that more and more American’s between the ages of 18 and 34 stopped paying their landlord’s mortgage and started building their own family’s wealth.

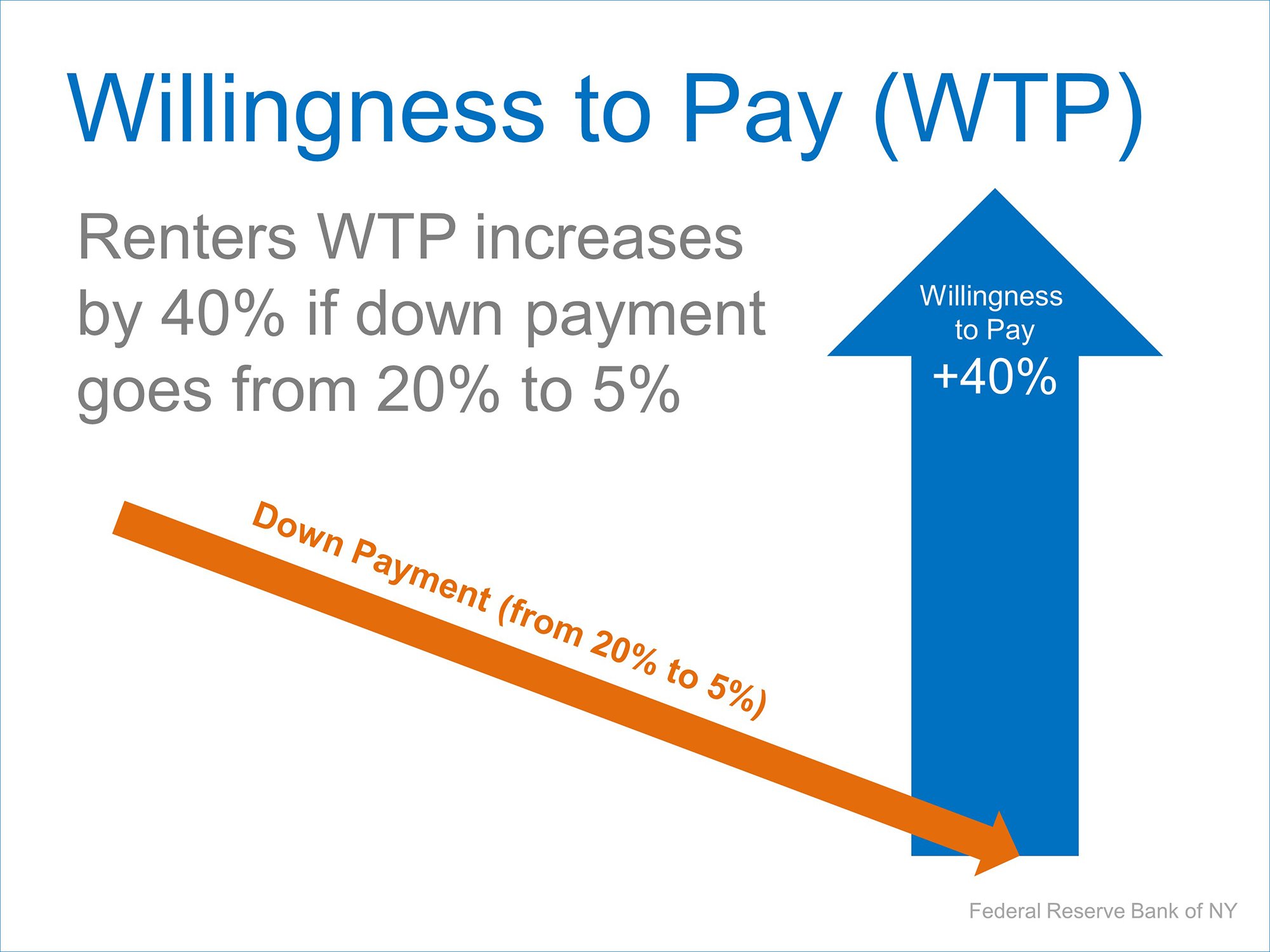

Millennials aren’t the only ones taking advantage of lower down payments.

The Federal Reserve Bank of New York found that if the down payment required to purchase a home went from 20% to 5%, a renter’s Willingness To Pay (WTP) increased by 40%.

The problem is that thirty-six percent of Americans still think a 20% down payment is always required when buying a home. Many renters may actually be able to enter the housing market sooner than they ever imagined with new programs that have emerged allowing less cash out of pocket.

Bottom Line

If you are one of the many renters now realizing that the home of your dreams is obtainable, let’s get together and discuss your options.

| Miembros: ¡regístrese ahora y configure su Post Personalizado & empiece a compartirlo hoy!

¿No es un miembro aun? Haga un clic aquí para aprender más acerca de la nueva función de KCM, Post Personalizados. |

|