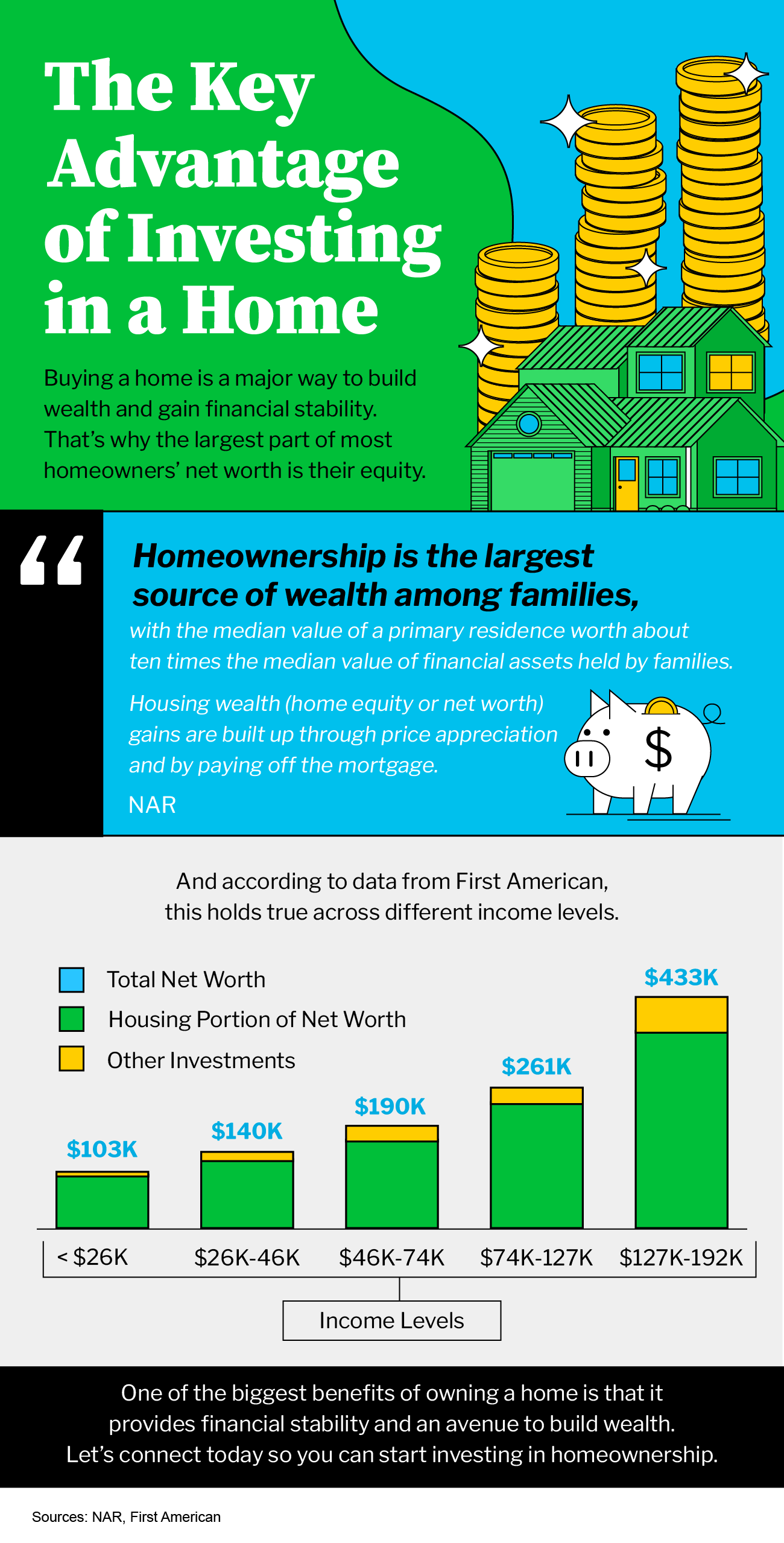

- Saving for a down payment – One of the largest barriers to homeownership is saving for a down payment. You could reach your savings goal more quickly than expected by using your tax refund to help with your down payment.

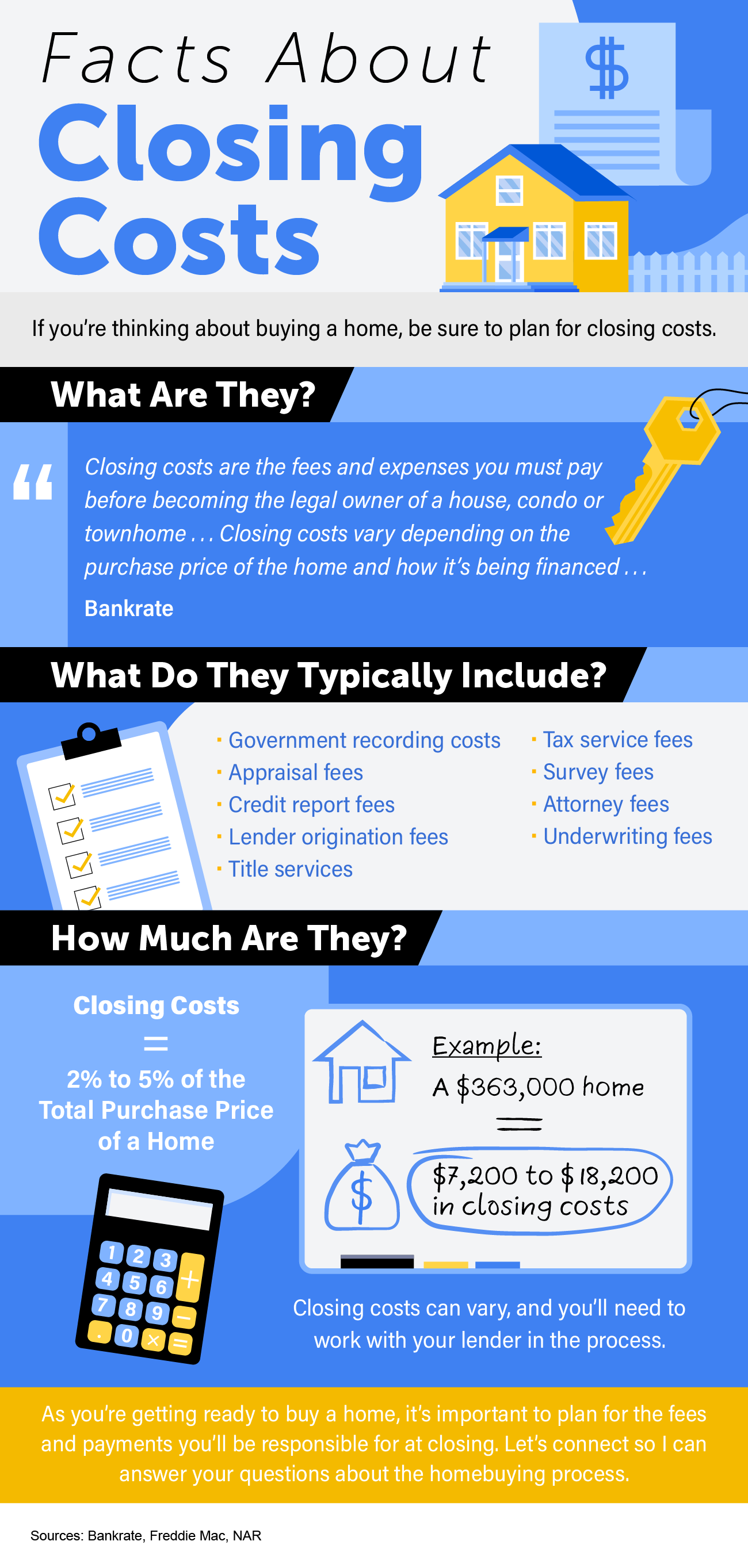

- Paying for closing costs – You have to pay fees to your lender, real estate agent, and other parties involved in the homebuying transaction before you can officially take ownership of your home. You could direct your tax refund toward these closing costs.

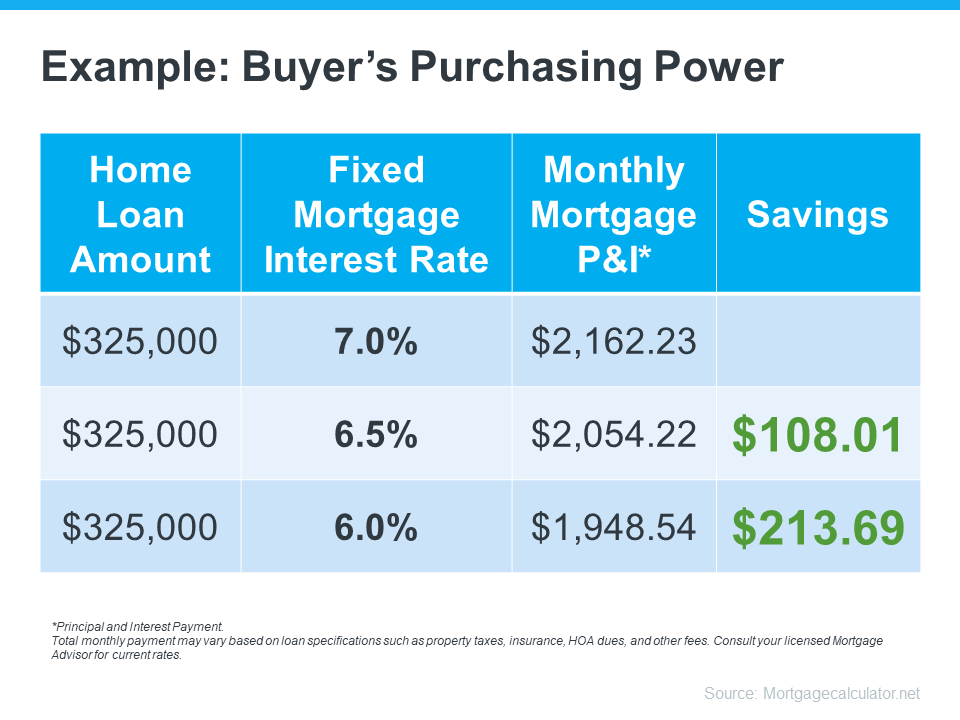

- Lowering your interest rate – Your lender might give you the option to buy down your mortgage interest rate during the homebuying process. That means, you could pay upfront to have a lower interest rate on your fixed-rate mortgage.

The best way to prepare to buy a home is to work with a trusted real estate professional who understands the process. They’ll help you navigate the costs you may encounter as you begin your homebuying journey.

[created_at] => 2023-04-11T17:45:10Z [description] =>Have you been saving up to buy a home this year?

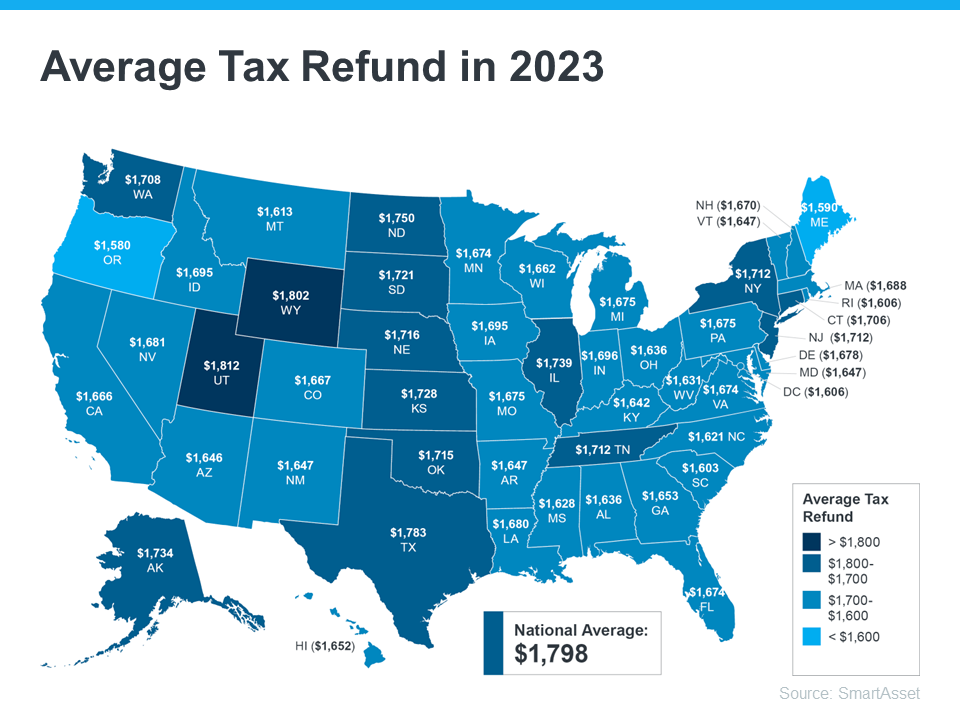

[exclusive_id] => [expired_at] => [featured_image] => https://files.keepingcurrentmatters.com/content/images/20230411/20230411-your-tax-refund-can-help-you-reach-your-homebuying-goals-KCM.jpg [id] => 15126 [kcm_ig_caption] => Have you been saving up to buy a home this year? If so, you know there are a variety of expenses involved – from your down payment to closing costs. But there’s good news – your tax refund can help you achieve your goals by paying for some of these expenses. SmartAsset estimates the average American will receive a $1,798 tax refund this year. According to Freddie Mac, there are multiple ways your refund check can help you as a homebuyer. If you’re getting a refund this year and thinking about buying a home, here are a few tips to keep: Saving for a down payment – One of the largest barriers to homeownership is saving for a down payment. You could reach your savings goal more quickly than expected by using your tax refund to help with your down payment. Paying for closing costs – You have to pay fees to your lender, real estate agent, and other parties involved in the homebuying transaction before you can officially take ownership of your home. You could direct your tax refund toward these closing costs. Lowering your interest rate – Your lender might give you the option to buy down your mortgage interest rate during the homebuying process. That means, you could pay upfront to have a lower interest rate on your fixed-rate mortgage. The best way to prepare to buy a home is to work with a trusted real estate professional who understands the process. They’ll help you navigate the costs you may encounter as you begin your homebuying journey. DM me and let’s connect to discuss how you can start your journey today. [kcm_ig_hashtags] => expertanswers,purchasingpower,buyingpower,homepriceappreciation,affordability,realestate,homevalues,homeownership,homebuying,realestategoals,realestatetips,realestatelife,realestatenews,realestateagent,realestateexpert,realestateagency,realestateadvice,realestateblog,realestatemarket,realestateexperts,instarealestate,instarealtor,realestatetipsoftheday,realestatetipsandadvice,keepingcurrentmatters [kcm_ig_quote] => Your tax refund can help you achieve your homebuying goals. [public_bottom_line] =>Your tax refund can help you reach your goals of homeownership. Connect with a local real estate agent to discuss how you can start your journey today.

[published_at] => 2023-04-12T10:30:00Z [related] => Array ( ) [slug] => your-tax-refund-can-help-you-achieve-your-homebuying-goals [status] => published [tags] => Array ( ) [title] => Your Tax Refund Can Help You Achieve Your Homebuying Goals [updated_at] => 2023-04-12T10:30:58Z [url] => /2023/04/12/your-tax-refund-can-help-you-achieve-your-homebuying-goals/ )Your Tax Refund Can Help You Achieve Your Homebuying Goals

Have you been saving up to buy a home this year?