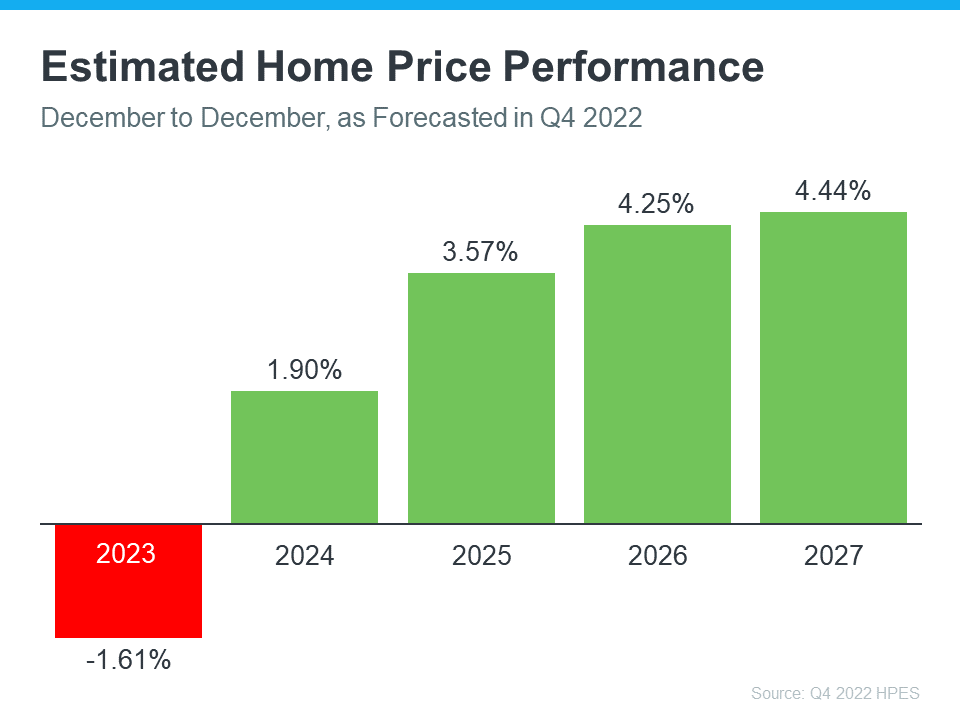

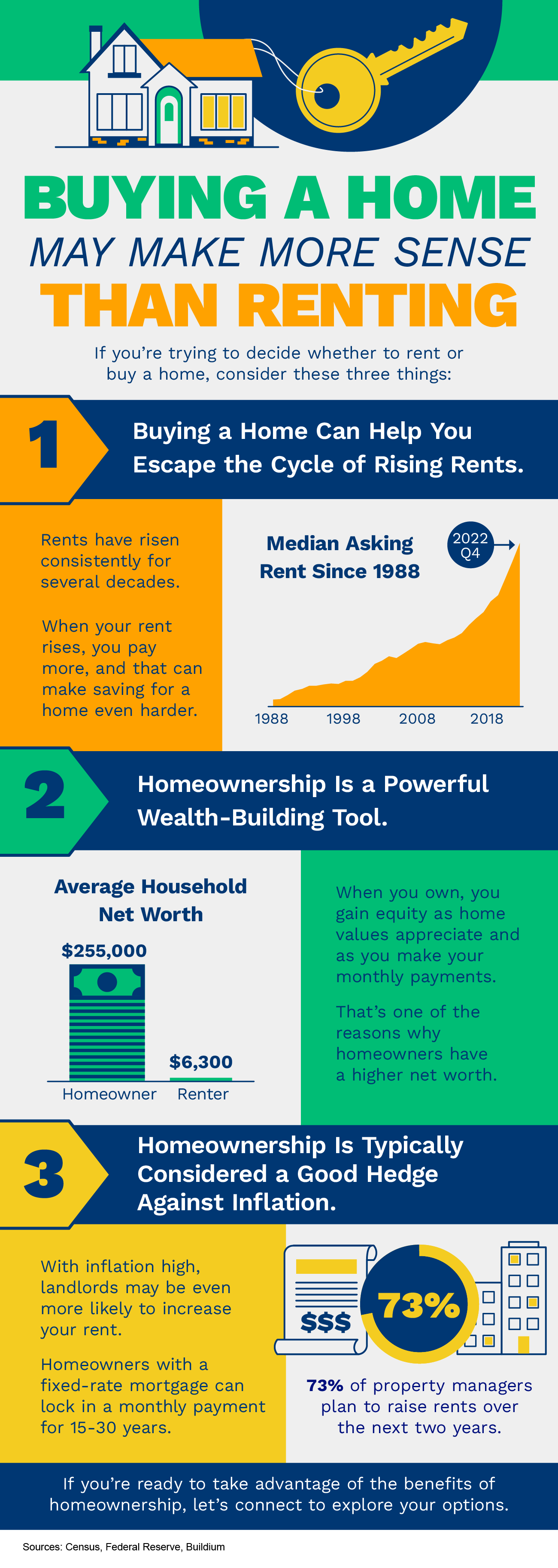

- Waiting to buy a home could mean it’ll become more expensive to do so.

- Buying now means the value of your home, and your net worth, will likely grow over time.

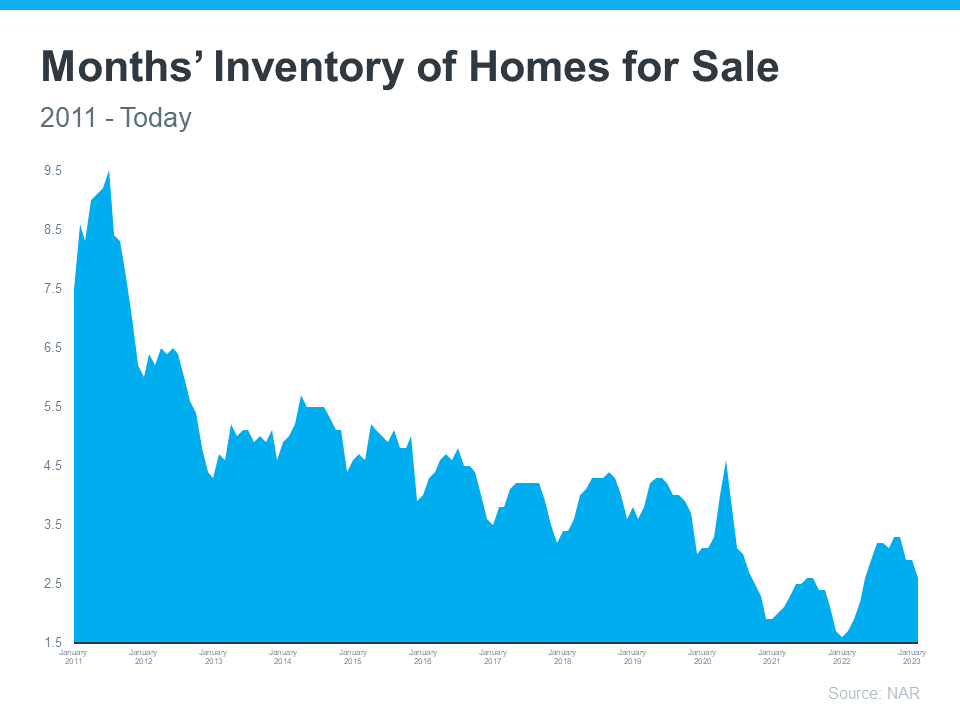

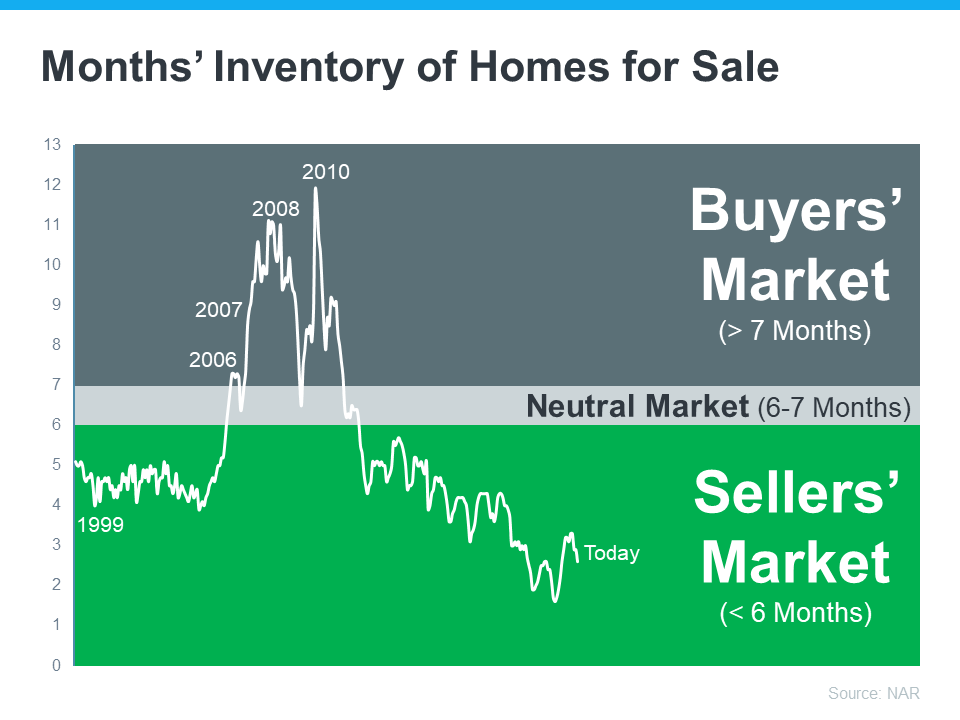

We’re still in a sellers’ market.

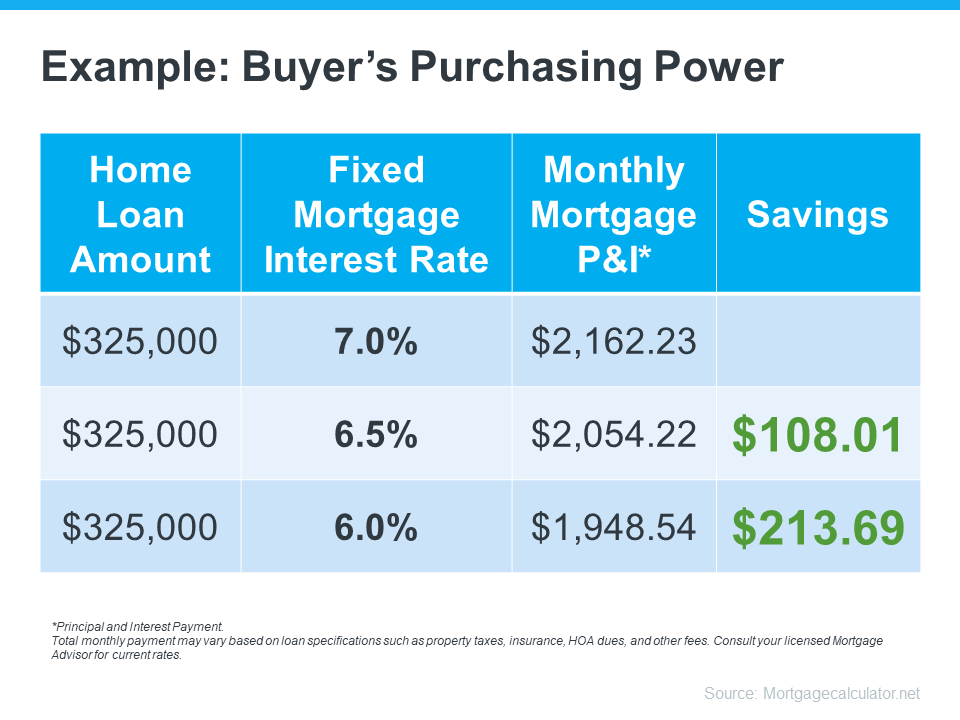

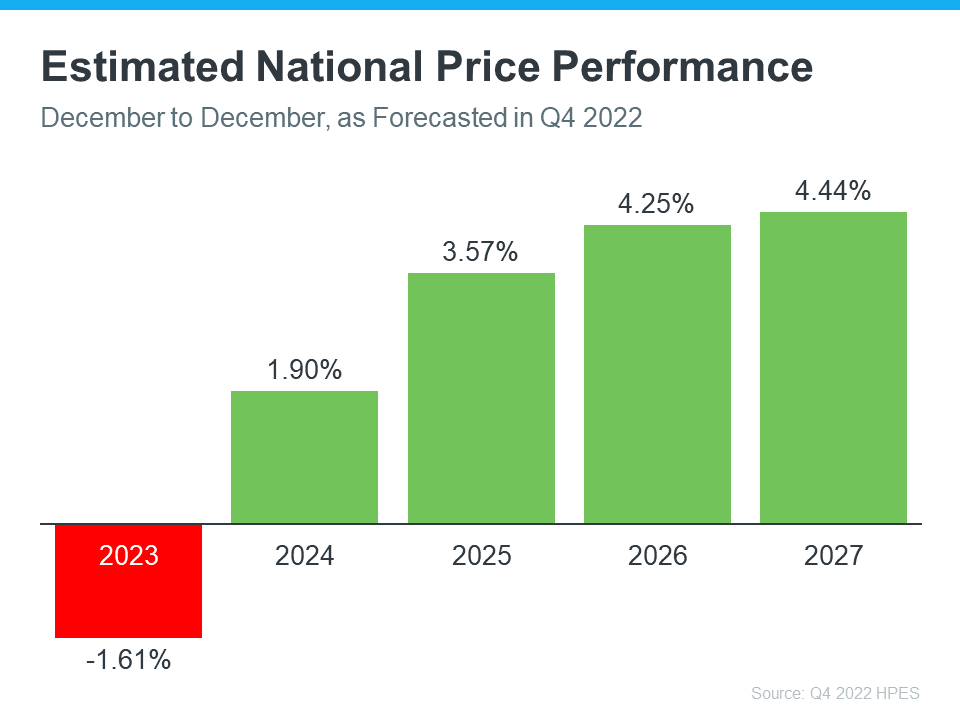

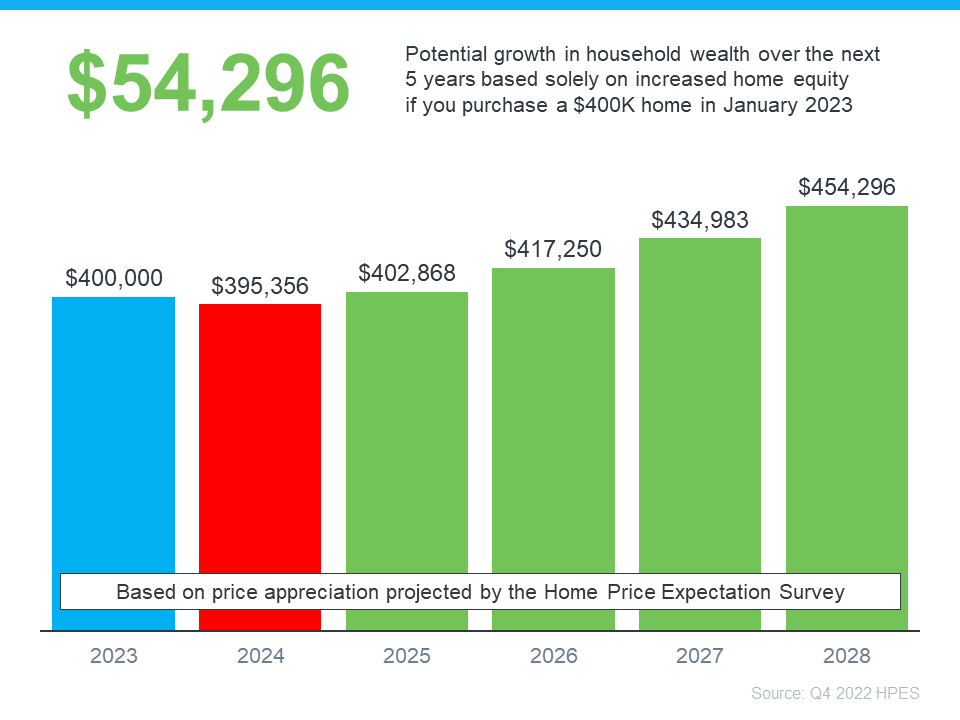

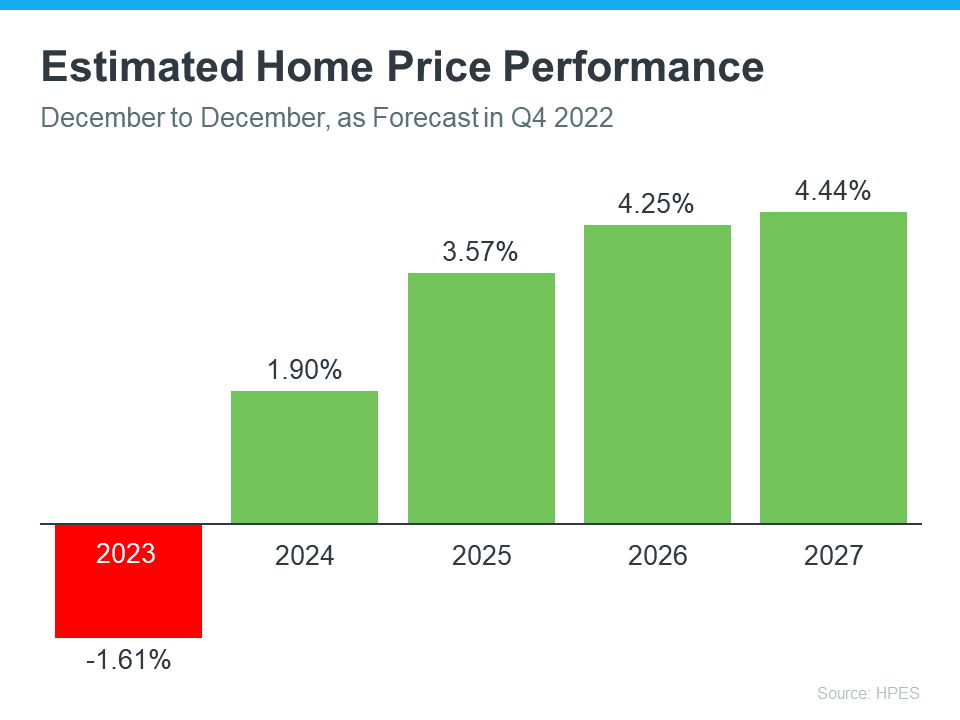

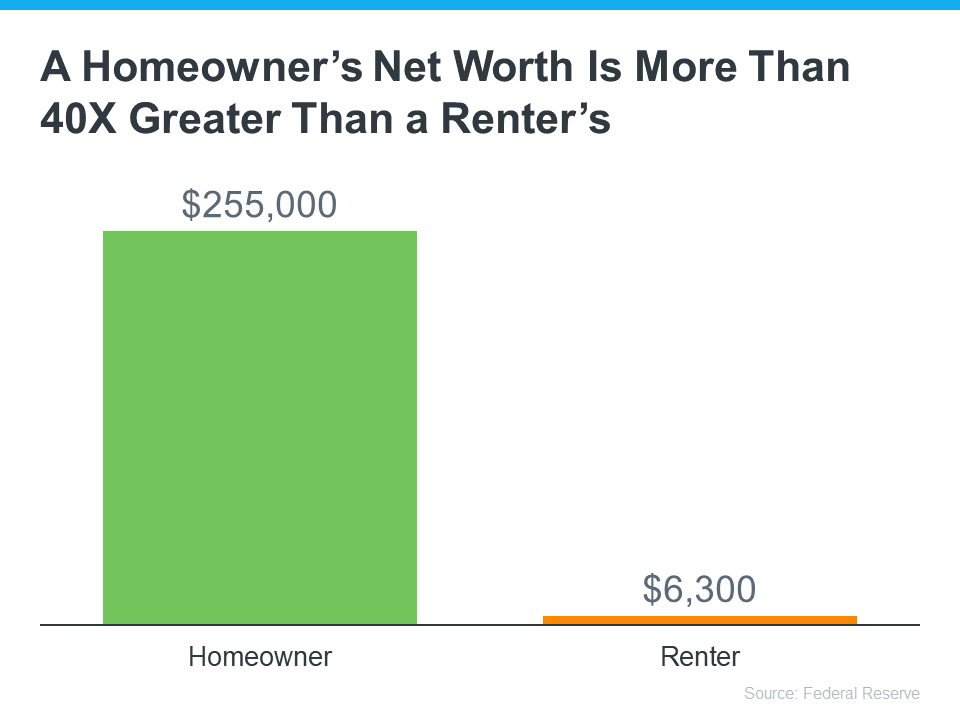

[exclusive_id] => [expired_at] => [featured_image] => https://files.keepingcurrentmatters.com/content/images/20230405/20230406-trying-to-buy-a-home-hang-in-there-KCM.jpg [id] => 15111 [kcm_ig_caption] => There are some benefits to being a buyer in today’s market that give you good reason to stick with your search. Here are a few of them. >>Long-Term Benefits Outweigh Short-Term Challenges Owning a home grows your net worth – and since building that wealth takes time, it makes sense to start as soon as you can. Freddie Mac puts it this way: “Homeownership not only builds a sense of pride and accomplishment, but it’s also an important step toward achieving long-term financial stability.” The key there is long-term because the financial benefits homeownership provides, like home value appreciation and equity, grow over time. >>Mortgage Rates Are Constantly Changing Mortgage rates have been hovering around 6.5% over the last several months. However, as Sam Khater, Chief Economist at Freddie Mac, notes, they’ve been coming down some recently: “Economic uncertainty continues to bring mortgage rates down. Over the last several weeks, declining rates have brought borrowers back to the market . . .” Lower mortgage rates improve your purchasing power when you buy, and that can help make homeownership more affordable. The recent drop in mortgage rates is good news if you couldn’t afford to buy a home when they peaked. >>Home Prices Will Increase According to the Home Price Expectation Survey, which polls over 100 real estate experts, home values will go up steadily over the next few years after a slight decline this year. Rising home prices in the coming years means two things for you as a buyer: • Waiting to buy a home could mean it’ll become more expensive to do so. • Buying now means the value of your home, and your net worth, will likely grow over time. [kcm_ig_hashtags] => realestate,homeownership,homebuying,realestategoals,realestatetips,realestatelife,realestatenews,realestateagent,realestateexpert,realestateagency,realestateadvice,realestateblog,realestatemarket,realestateexperts,realestateagents,instarealestate,instarealtor,realestatetipsoftheday,realestatetipsandadvice,keepingcurrentmatters [kcm_ig_quote] => Trying to buy a home? Hang in there. [public_bottom_line] =>If you’ve been trying to buy a home, hang in there. Mortgage rates have ticked down a bit recently, home prices are forecast to increase in the coming years, and the long-term benefits of homeownership outweigh many of the short-term challenges.

[published_at] => 2023-04-06T10:30:00Z [related] => Array ( ) [slug] => trying-to-buy-a-home-hang-in-there [status] => published [tags] => Array ( ) [title] => Trying To Buy a Home? Hang in There. [updated_at] => 2023-04-06T10:30:02Z [url] => /2023/04/06/trying-to-buy-a-home-hang-in-there/ )Trying To Buy a Home? Hang in There.

We’re still in a sellers’ market.

![Where Will You Go After You Sell Your House? [INFOGRAPHIC] | Simplifying The Market](https://files.simplifyingthemarket.com/wp-content/uploads/2023/03/02130847/Where-Will-You-Go-After-You-Sell-Your-House-MEM.png)