stdClass Object

(

[agents_bottom_line] =>

If you’ve been thinking about making a move, now’s the time to get your house ready to sell. Let’s connect so you can learn about buyer demand in our area the best time to put your house on the market.

[assets] => Array

(

)

[can_share] => no

[categories] => Array

(

[0] => stdClass Object

(

[category_type] => standard

[children] =>

[created_at] => 2019-06-03T18:18:43Z

[id] => 6

[name] => For Sellers

[parent] =>

[parent_id] =>

[published_at] => 2019-06-03T18:18:43Z

[slug] => sellers

[status] => public

[translations] => stdClass Object

(

[es] => stdClass Object

(

[name] => Para los vendedores

)

)

[updated_at] => 2019-06-03T18:18:43Z

)

[1] => stdClass Object

(

[category_type] => standard

[children] =>

[created_at] => 2019-06-03T18:18:43Z

[id] => 38

[name] => Move-Up

[parent] =>

[parent_id] =>

[published_at] => 2024-04-10T16:00:35Z

[slug] => move-up

[status] => public

[translations] => stdClass Object

(

[es] => stdClass Object

(

[name] => Compradores de casa mas grande

)

)

[updated_at] => 2024-04-10T16:00:35Z

)

)

[content_type] => blog

[contents] => As mortgage rates rose last year, activity in the housing market slowed down. And as a result, homes started seeing fewer offers and stayed on the market longer. That meant some homeowners decided to press pause on selling.

Now, however, rates are beginning to come down—and buyers are starting to reenter the market. In fact, the latest data from the Mortgage Bankers Association (MBA) shows mortgage applications increased last week by 7% compared to the week before.

So, if you’ve been planning to sell your house but you’re unsure if there will be anyone to buy it, this shift in the market could be your chance. Here’s what experts are saying about buyers returning to the market as we approach spring.

Mike Fratantoni, SVP and Chief Economist, MBA:

“Mortgage rates are now at their lowest level since September 2022, and about a percentage point below the peak mortgage rate last fall. As we enter the beginning of the spring buying season, lower mortgage rates and more homes on the market will help affordability for first-time homebuyers.”

Lawrence Yun, Chief Economist, National Association of Realtors (NAR):

“The upcoming months should see a return of buyers, as mortgage rates appear to have already peaked and have been coming down since mid-November.”

Thomas LaSalvia, Senior Economist, Moody’s Analytics:

"We expect the labor market to remain robust, wages to continue to rise—maybe not at the pace that they did during the pandemic, but that will open up some opportunity for folks to enter homeownership as interest rates stabilize a bit."

Sam Khater, Chief Economist, Freddie Mac:

“Homebuyers are waiting for rates to decrease more significantly, and when they do, a strong job market and a large demographic tailwind of Millennial renters will provide support to the purchase market.”

Bottom Line

If you’ve been thinking about making a move, now’s the time to get your house ready to sell. Let’s connect so you can learn about buyer demand in our area the best time to put your house on the market.

[created_at] => 2023-01-30T17:24:54Z

[description] => As mortgage rates rose last year, activity in the housing market slowed down. And as a result, homes started seeing fewer offers and stayed on the market longer. That meant some homeowners decided to press pause on selling.

[exclusive_id] =>

[expired_at] =>

[featured_image] => https://files.keepingcurrentmatters.com/wp-content/uploads/2023/01/30122511/lower-mortgage-rates-are-bringing-buyers-back-to-the-market-KCM.jpg

[id] => 4552

[kcm_ig_caption] => As mortgage rates rose last year, activity in the housing market slowed down. Now, however, rates are beginning to come down—and buyers are starting to reenter the market.

So, if you’ve been planning to sell your house but you’re unsure if there will be anyone to buy it, this shift in the market could be your chance. Here’s what experts are saying.

>>Mike Fratantoni, SVP and Chief Economist, MBA:

“Mortgage rates are now at their lowest level since September 2022, and about a percentage point below the peak mortgage rate last fall. As we enter the beginning of the spring buying season, lower mortgage rates and more homes on the market will help affordability for first-time homebuyers.”

>>Lawrence Yun, Chief Economist, National Association of Realtors (NAR):

“The upcoming months should see a return of buyers, as mortgage rates appear to have already peaked and have been coming down since mid-November.”

>>Thomas LaSalvia, Senior Economist, Moody’s Analytics:

"We expect the labor market to remain robust, wages to continue to rise—maybe not at the pace that they did during the pandemic, but that will open up some opportunity for folks to enter homeownership as interest rates stabilize a bit."

>>Sam Khater, Chief Economist, Freddie Mac:

“Homebuyers are waiting for rates to decrease more significantly, and when they do, a strong job market and a large demographic tailwind of Millennial renters will provide support to the purchase market.”

If you’ve been thinking about making a move, now’s the time to get your house ready to sell. DM me to learn about buyer demand in our area and the best time to put your house on the market.

[kcm_ig_hashtags] => firsttimehomebuyer,opportunity,housingmarket,househunting,makememove,homegoals,houseshopping,housegoals,investmentproperty,emptynest,downsizing,locationlocationlocation,newlisting,homeforsale,renovated,starterhome,dreamhome,curbappeal,keepingcurrentmatters

[kcm_ig_quote] => Lower mortgage rates are bringing buyers back to the market.

[public_bottom_line] => If you’ve been thinking about making a move, now’s the time to get your house ready to sell. Contact a local real estate professional to learn about buyer demand in your area and the best time to put your house on the market.

[published_at] => 2023-01-31T11:30:30Z

[related] => Array

(

)

[slug] => lower-mortgage-rates-are-bringing-buyers-back-to-the-market

[status] => published

[tags] => Array

(

)

[title] => Lower Mortgage Rates Are Bringing Buyers Back to the Market

[updated_at] => 2023-02-03T15:33:27Z

[url] => /2023/01/31/lower-mortgage-rates-are-bringing-buyers-back-to-the-market/

)

New Search

If you are not happy with the results below please do another search

2660 search results for: what if i wait a year to buy a home

As mortgage rates rose last year, activity in the housing market slowed down. And as a result, homes started seeing fewer offers and stayed on the market longer. That meant some homeowners decided to press pause on selling.

Where Will You Go If You Sell? You Have Options.

There are plenty of good reasons you might be ready to move. No matter your motivations, before you list your current house, you need to consider where you’ll go next.

- If you’re thinking of buying a home this year, be sure to factor in the long-term benefits of homeownership.

- On average, nationwide, home prices appreciated by 288.7% over the last 32 years. That means homeowners grow their net worth significantly in the long term.

- Homeownership wins over time. Let’s connect so you can start your homebuying journey today.

Some Highlights

- If you’re thinking of buying a home this year, be sure to factor in the long-term benefits of homeownership.

- On average, nationwide, home prices appreciated by 288.7% over the last 32 years. That means homeowners grow their net worth significantly in the long term.

- Homeownership wins over time. Let’s connect so you can start your homebuying journey today.

Some Highlights

- If you’re thinking of buying a home this year, be sure to factor in the long-term benefits of homeownership.

- On average, nationwide, home prices appreciated by 288.7% over the last 32 years. That means homeowners grow their net worth significantly in the long term.

- If you’re thinking of buying a home this year, be sure to factor in the long-term benefits of homeownership.

- On average, nationwide home prices appreciated by 288.7% over the last 32 years. That means homeowners grow their net worth significantly in the long term.

- Homeownership wins over time. Reach out to a real estate professional so you can start your homebuying journey today.

Homeownership Builds Your Wealth over Time [INFOGRAPHIC]

Some Highlights

- If you’re thinking of buying a home this year, be sure to factor in the long-term benefits of homeownership.

- On average, nationwide, home prices appreciated by 288.7% over the last 32 years. That means homeowners grow their net worth significantly in the long term.

Why It Makes Sense To Move Before Spring

Spring is usually the busiest season in the housing market. Many buyers wait until then to make their move, believing it’s the best time to find a home. However, that isn’t always the case when you factor in the competition you could face with other buyers at that time of year. If you’re ready to buy a home, here’s why it makes sense to move before the spring market picks up.

Why You Shouldn’t Fear Today’s Foreclosure Headlines

If you’ve seen recent headlines about foreclosures surging in the housing market, you’re certainly not alone. There’s no doubt, the stories in the media can be pretty confusing right now. They may even make you think twice about buying a home for fear that prices could crash. The reality is, the data shows a foreclosure crisis is not where the market is headed, and understanding what that really means is mission critical if you want to know the truth about what’s happening today. Here’s a deeper look.

The 3 Factors That Affect Home Affordability

If you’ve been following the housing market over the last couple of years, you’ve likely heard about growing affordability challenges. But according to experts, the key factors that determine housing affordability are projected to improve this year. Selma Hepp, Executive, Deputy Chief Economist at CoreLogic, shares:

- If you’re thinking about selling your house, recent headlines about home prices falling month-over-month may have you second guessing your decision—but perspective matters.

- While home prices are down slightly month-over-month in some markets, home values are still up almost 10% nationally on a year-over-year basis. A nearly 10% gain is still dramatic compared to the more normal level of appreciation, which is 3-4%.

- Let’s connect to find out how much equity you have in your current home and how you can use it to fuel your next purchase.

Some Highlights

- If you’re thinking about selling your house, recent headlines about home prices falling month-over-month may have you second guessing your decision—but perspective matters.

- While home prices are down slightly month-over-month in some markets, home values are still up almost 10% nationally on a year-over-year basis. A nearly 10% gain is still dramatic compared to the more normal level of appreciation, which is 3-4%.

- Let’s connect to find out how much equity you have in your current home and how you can use it to fuel your next purchase.

Some Highlights

- If you’re thinking about selling your house, recent headlines about home prices falling month-over-month may have you second guessing your decision—but perspective matters.

- While home prices are down slightly month-over-month in some markets, home values are still up almost 10% nationally on a year-over-year basis. A nearly 10% gain is still dramatic compared to the more normal level of appreciation, which is 3-4%.

- If you’re thinking about selling your house, recent headlines about home prices falling month-over-month may have you second guessing your decision—but perspective matters.

- While home prices are down slightly month-over-month in some markets, home values are still up almost 10% nationally on a year-over-year basis. A nearly 10% gain is still dramatic compared to the more normal level of appreciation, which is 3-4%.

- Reach out to a real estate professional to find out how much equity you have in your current home and how you can use it to fuel your next purchase.

What’s Really Happening with Home Prices? [INFOGRAPHIC]

Some Highlights

- If you’re thinking about selling your house, recent headlines about home prices falling month-over-month may have you second guessing your decision—but perspective matters.

- While home prices are down slightly month-over-month in some markets, home values are still up almost 10% nationally on a year-over-year basis. A nearly 10% gain is still dramatic compared to the more normal level of appreciation, which is 3-4%.

Pre-Approval in 2023: What You Need To Know

One of the first steps in your homebuying journey is getting pre-approved. To understand why it’s such an important step, you need to understand what pre-approval is and what it does for you. Business Insider explains:

Have Home Values Hit Bottom?

Whether you’re already a homeowner or you’re looking to become one, the recent headlines about home prices may leave you with more questions than answers. News stories are talking about home prices falling, and that’s raising concerns about a repeat of what happened to prices in the crash in 2008.

Think Twice Before Waiting for 3% Mortgage Rates

Last year, the Federal Reserve took action to try to bring down inflation. In response to those efforts, mortgage rates jumped up rapidly from the record lows we saw in 2021, peaking at just over 7% last October. Hopeful buyers experienced a hit to their purchasing power as a result, and some decided to press pause on their plans.

What Past Recessions Tell Us About the Housing Market

It doesn’t matter if you’re someone who closely follows the economy or not, chances are you’ve heard whispers of an upcoming recession. Economic conditions are determined by a broad range of factors, so rather than explaining them each in depth, let’s lean on the experts and what history tells us to see what could lie ahead. As Greg McBride, Chief Financial Analyst at Bankrate, says:

- Buying a home is a major transaction that can seem even more complex when you don’t understand the terms used throughout the process.

- If you’re looking to become a homeowner this year, it’s important to know these housing terms and how they relate to the current market so you feel confident throughout the homebuying process.

- Let’s connect so you have expert answers for any questions as they come up.

Some Highlights

- Buying a home is a major transaction that can seem even more complex when you don’t understand the terms used throughout the process.

- If you’re looking to become a homeowner this year, it’s important to know these housing terms and how they relate to the current market so you feel confident throughout the homebuying process.

- Let’s connect so you have expert answers for any questions as they come up.

Some Highlights

- Buying a home is a major transaction that can seem even more complex when you don’t understand the terms used throughout the process.

- If you’re looking to become a homeowner this year, it’s important to know these housing terms and how they relate to the current market so you feel confident throughout the homebuying process.

Key Terms To Know When Buying a Home [INFOGRAPHIC]

Some Highlights

- Buying a home is a major transaction that can seem even more complex when you don’t understand the terms used throughout the process.

- If you’re looking to become a homeowner this year, it’s important to know these housing terms and how they relate to the current market so you feel confident throughout the homebuying process.

Is It Time To Sell Your Second Home?

During the pandemic, second homes became popular because of the rise in work-from-home flexibility. That’s because owning a second home, especially in the luxury market, allowed those homeowners to spend more time in their favorite places or with different home features. Keep in mind, a luxury home isn’t only defined by price. In a recent article, Investopedia shares additional factors that push a home into this category: location, such as a home on the water or in a desirable city, and features, the things that make the home itself feel luxurious.

Today’s Housing Market Is Nothing Like 15 Years Ago

There’s no doubt today’s housing market is very different than the frenzied one from the past couple of years. In the second half of 2022, there was a dramatic shift in real estate, and it caused many people to make comparisons to the 2008 housing crisis. While there may be a few similarities, when looking at key variables now compared to the last housing cycle, there are significant differences.

The Truth About Negative Home Equity Headlines

Home equity has been a hot topic in real estate news lately. And if you’ve been following along, you may have heard there’s a growing number of homeowners with negative equity. But don’t let those headlines scare you.

What Experts Are Saying About the 2023 Housing Market

If you’re thinking about buying or selling a home soon, you probably want to know what you can expect from the housing market this year. In 2022, the market underwent a major shift as economic uncertainty and higher mortgage rates reduced buyer demand, slowed the pace of home sales, and moderated home prices. But what about 2023?

- If you’re planning to buy a home in 2023, here are a few things to focus on.

- Work on your credit and save for a down payment. If saving feels like a challenge, there’s help available. Then, get pre-approved, create a list of desired features, and prioritize them.

- Let’s connect so you have expert advice on how to reach your homebuying goals this year.

Some Highlights

- If you’re planning to buy a home in 2023, here are a few things to focus on.

- Work on your credit and save for a down payment. If saving feels like a challenge, there’s help available. Then, get pre-approved, create a list of desired features, and prioritize them.

- Let’s connect so you have expert advice on how to reach your homebuying goals this year.

Some Highlights

- If you’re planning to buy a home in 2023, here are a few things to focus on.

- Work on your credit and save for a down payment. If saving feels like a challenge, there’s help available. Then, get pre-approved, create a list of desired features, and prioritize them.

Tips To Reach Your Homebuying Goals in 2023 [INFOGRAPHIC]

Some Highlights

- If you’re planning to buy a home in 2023, here are a few things to focus on.

- Work on your credit and save for a down payment. If saving feels like a challenge, there’s help available. Then, get pre-approved, create a list of desired features, and prioritize them.

3 Best Practices for Selling Your House This Year

A new year brings with it the opportunity for new experiences.

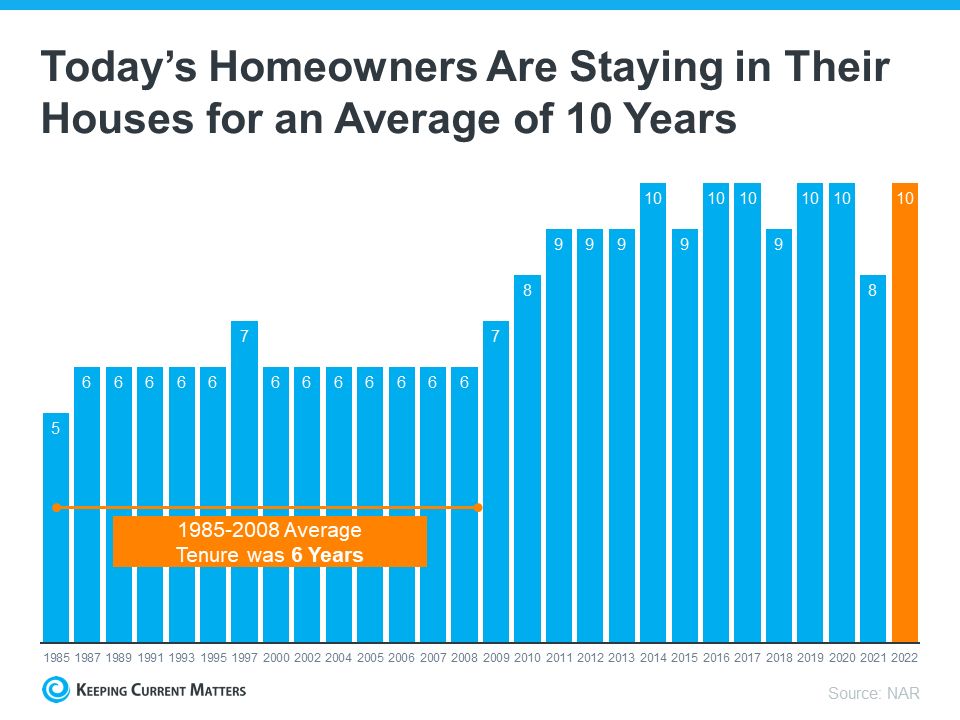

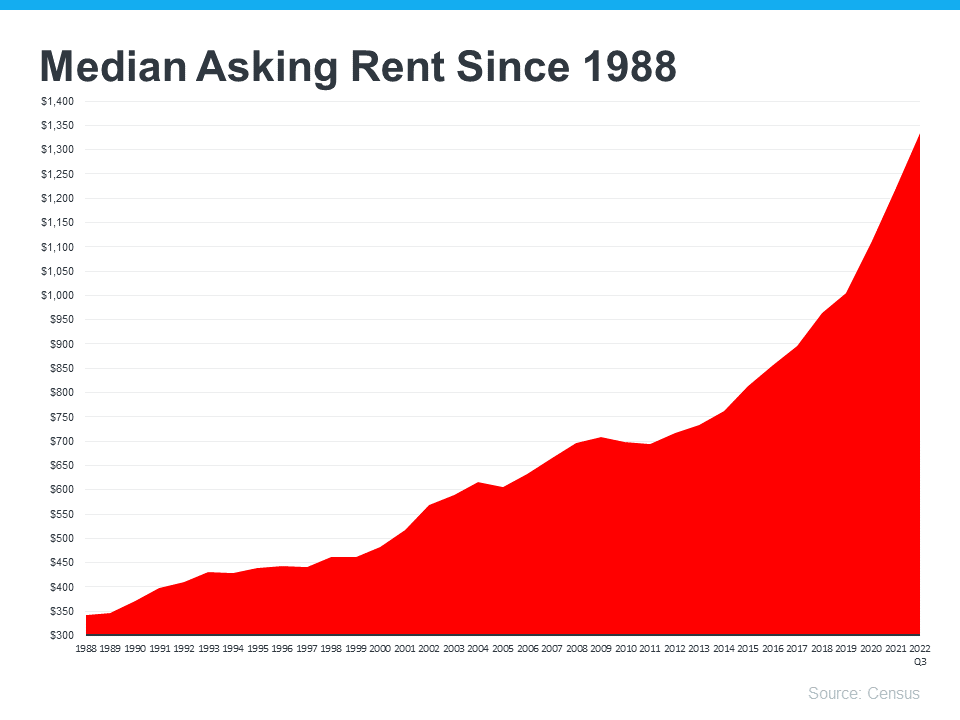

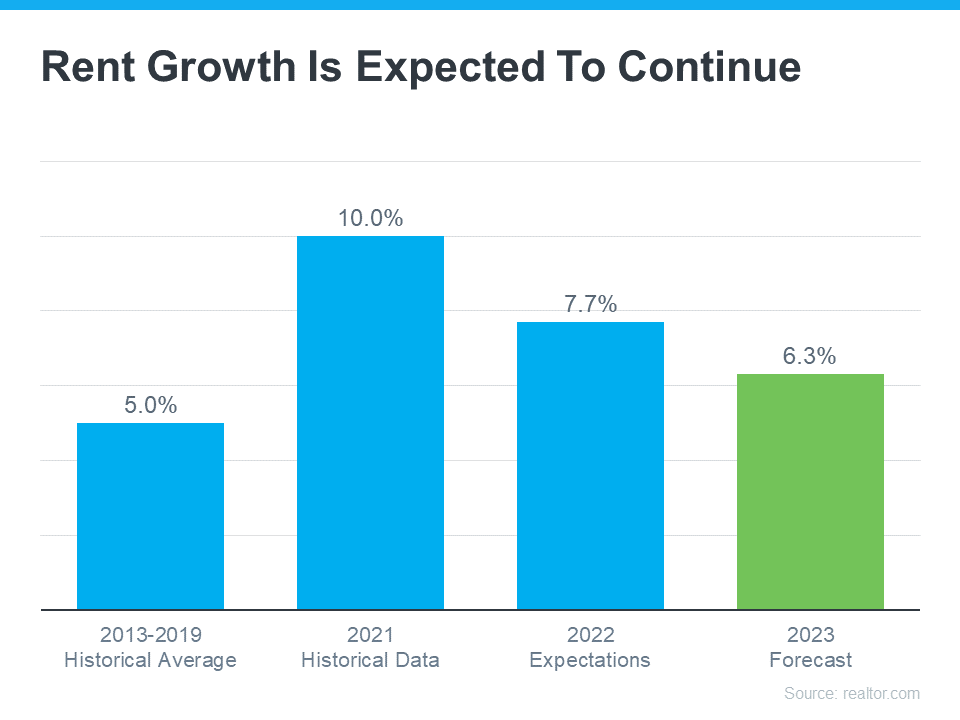

Avoid the Rental Trap in 2023

If you’re a renter, you likely face an important decision every year: renew your current lease, start a new one, or buy a home. This year is no different. But before you dive too deeply into your options, it helps to understand the true costs of renting moving forward.

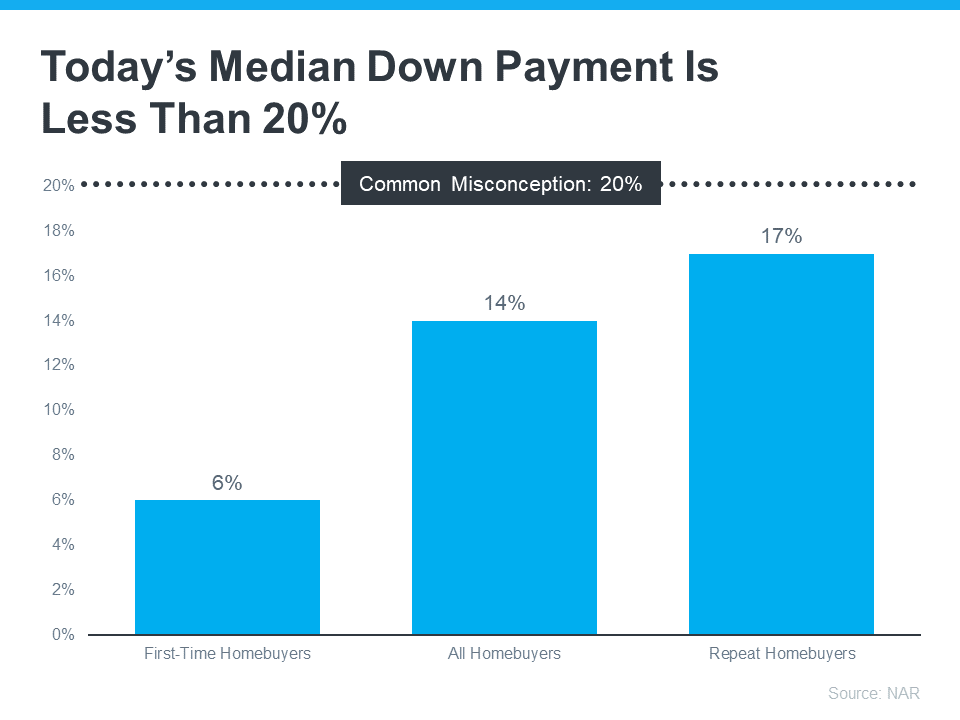

Wondering How Much You Need To Save for a Down Payment?

If you’re getting ready to buy your first home, you’re likely focused on saving up for everything that purchase involves. One cost that’s likely top of mind is your down payment. But don't let a common misconception about how much you need to save make the process harder than it could be.

What Are Your Goals in the Housing Market This Year?

If buying or selling a home is part of your dreams for 2023, it’s essential for you to understand today’s housing market, define your goals, and work with industry experts to bring your homeownership vision for the new year into focus.

- The buyer, who wants the best deal possible

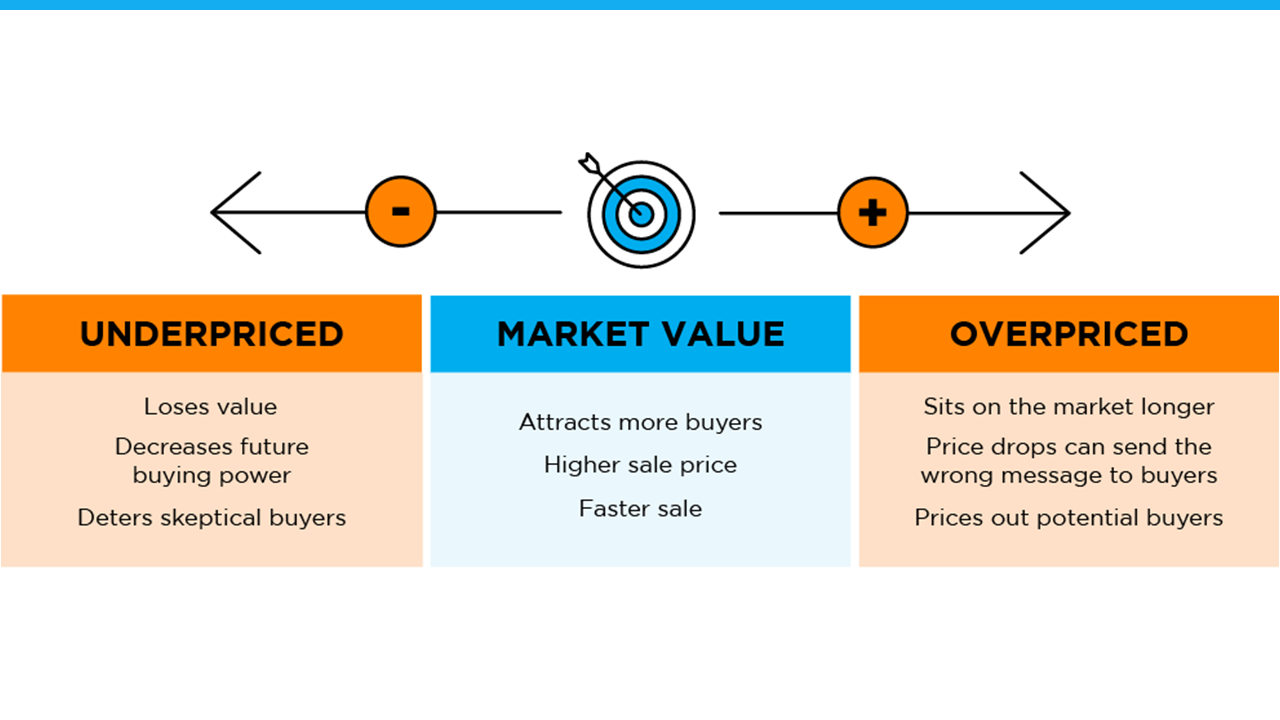

- The buyer’s agent, who will use their expertise to advocate for the buyer

- The inspection company, which works for the buyer and will almost always find concerns with the house

- The appraiser, who assesses the property’s value to protect the lender

Bottom Line

Don’t go at it alone. If you’re planning to sell your house this winter, let’s connect so you have an expert by your side to guide you in today’s market. [created_at] => 2022-12-21T12:15:37Z [description] => With higher mortgage rates and moderating buyer demand, conditions in the housing market are different today. And if you’re thinking of selling your house, it’s important to understand how the market has changed and what that means for you. The best way to make sure you’re in the know is to work with a trusted housing market expert. [exclusive_id] => [expired_at] => [featured_image] => https://files.simplifyingthemarket.com/wp-content/uploads/2022/12/21071128/planning-to-sell-your-house-its-critical-to-hire-a-pro-KCM.jpg [id] => 4463 [kcm_ig_caption] => If you’re thinking of selling your house, the best way to make sure you’re in the know is to work with a trusted housing market expert. Here's why. >>1. A Real Estate Advisor Is an Expert on Market Trends An expert real estate advisor has the latest information about national trends and your local area too. More importantly, they’ll know what all of this means for you so they’ll be able to help you make a decision based on trustworthy, data-bound information. >>2. A Local Professional Knows How To Set the Right Price If you sell your house on your own, you may be more likely to overshoot your asking price because you’re not as aware of where prices are today. Real estate professionals provide an unbiased eye when they help you price your house. >>3. A Real Estate Advisor Helps Maximize Your Pool of Buyers Real estate professionals have a large variety of tools at their disposal, such as social media followers, agency resources, and the Multiple Listing Service (MLS) to ensure your house gets in front of people looking to make a purchase. >>4. A Real Estate Expert Will Read – and Understand – the Fine Print Today, more disclosures and regulations are mandatory when selling a house. That means the number of legal documents you’ll need to juggle is growing. A real estate professional knows exactly what all the fine print means, and how to work through it efficiently. >>5. A Trusted Advisor Is a Skilled Negotiator If you sell without a professional, you’ll also be responsible for any back-and-forth. Instead of going toe-to-toe with all the parties involved with a transaction alone, lean on an expert. DM me so you have an expert by your side to guide you in today’s market. [kcm_ig_hashtags] => realestate,homeownership,homebuying,realestategoals,realestatetips,realestatelife,realestatenews,realestateagent,realestateexpert,realestateagency,realestateadvice,realestateblog,realestatemarket,realestateexperts,realestateagents,instarealestate,instarealtor,realestatetipsoftheday,realestatetipsandadvice,keepingcurrentmatters [kcm_ig_quote] => Selling your house? It’s critical to hire a pro. [public_bottom_line] => Don’t go at it alone. If you’re planning to sell your house this winter, connect with a local real estate advisor so you have an expert by your side to guide you in today’s market. [published_at] => 2022-12-29T11:00:38Z [related] => Array ( ) [slug] => planning-to-sell-your-house-its-critical-to-hire-a-pro [status] => published [tags] => Array ( ) [title] => Planning To Sell Your House? It’s Critical To Hire a Pro. [updated_at] => 2023-02-03T15:33:32Z [url] => /2022/12/29/planning-to-sell-your-house-its-critical-to-hire-a-pro/ )Planning To Sell Your House? It’s Critical To Hire a Pro.

With higher mortgage rates and moderating buyer demand, conditions in the housing market are different today. And if you’re thinking of selling your house, it’s important to understand how the market has changed and what that means for you. The best way to make sure you’re in the know is to work with a trusted housing market expert.

Applying For a Mortgage? Here’s What You Should Avoid Once You Do.

While it’s exciting to start thinking about moving in and decorating after you’ve applied for your mortgage, there are some key things to keep in mind before you close. Here’s a list of things you may not realize you need to avoid after applying for your home loan.

![Homeownership Builds Your Wealth over Time [INFOGRAPHIC] | Simplifying The Market](https://files.simplifyingthemarket.com/wp-content/uploads/2023/01/26130049/Homeownership-Builds-Your-Wealth-In-The-Over-Time-MEM.png)

![What’s Really Happening with Home Prices? [INFOGRAPHIC] | Simplifying The Market](https://files.simplifyingthemarket.com/wp-content/uploads/2023/01/19133822/Whats-Really-Happening-With-Home-Prices-MEM.png)

![Key Terms To Know When Buying a Home [INFOGRAPHIC] | Simplifying The Market](https://files.simplifyingthemarket.com/wp-content/uploads/2023/01/11164449/Key-Terms-To-Know-When-Buying-A-Home-MEM.png)

![Tips To Reach Your Homebuying Goals in 2023 [INFOGRAPHIC] | Simplifying The Market](https://files.simplifyingthemarket.com/wp-content/uploads/2023/01/05124208/Tips-To-Reach-Your-Homebuying-Goals-in-2023-MEM.png)