Where Are Mortgage Rates Headed?

The interest rate you pay on your home mortgage has a direct impact on your monthly payment. The higher the rate the greater the payment will be. That is why it is important to look at where rates are headed when deciding to buy now or wait until next year.

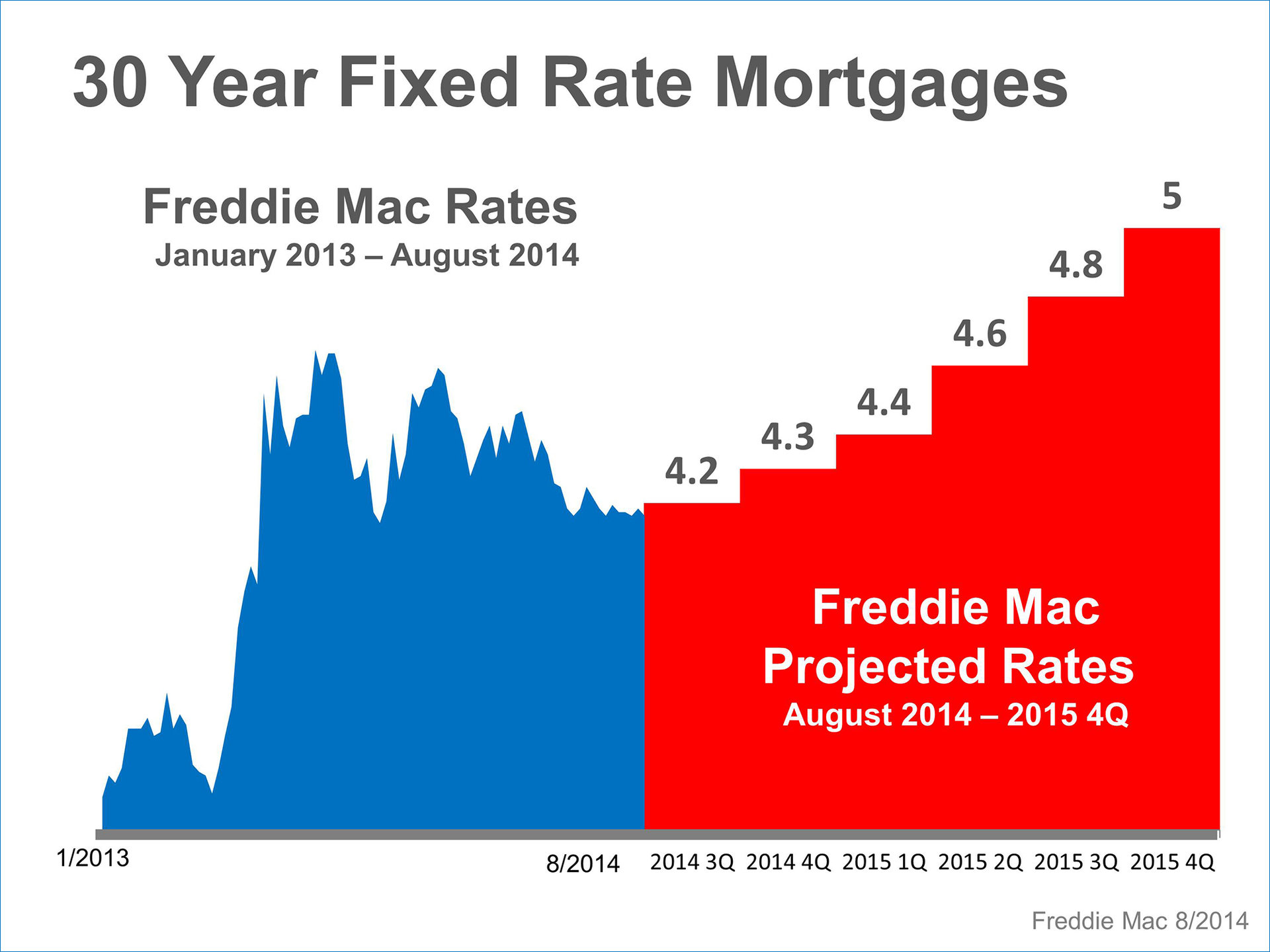

According to a recent article in Kiplinger, 30 year mortgage rates are about to increase:

“Now around 4.1%, rates will edge slowly toward 4.4% by the end of this year. Then they’ll follow the Treasury bond rate’s upward move in early 2015. Thirty-year home loans should end 2015 at around 5.1%, still low by historical standards.”

Here is a graph created by using interest rate projections in Freddie Mac’s August 2014 U.S. Economic & Housing Market Outlook:

How will this impact a mortgage payment?

Research released this month by Zillow reveals:

“We examined how a 1 percentage point rise in mortgage rates would impact monthly payments for the typical home in 35 metro areas, and found that the difference this year versus next year varies dramatically from market to market. In the San Jose/Silicon Valley area, for example, potential buyers should expect to see a monthly payment increase of more than $700 if they waited a year to buy the same home they were considering today. By contrast, in St. Louis, the difference is only $65 per month.” (emphasis added)

Bottom Line

Again, we turn to the Zillow research:

“As rates rise, new home buyers will confront higher financing costs and monthly mortgage payments. For many, this will mean tightening their budgets and sacrificing some luxuries they may take for granted today.”

|

Members: Sign in now to set up your Personalized Posts & start sharing today!

Not a Member Yet? Click Here to learn more about KCM’s newest feature, Personalized Posts. |