stdClass Object

(

[agents_bottom_line] =>

Getting pre-approved for a mortgage helps you better understand what you can afford and signals to sellers you’re serious about purchasing their home. Let’s connect so you have the tools you need to succeed as a homebuyer in today’s market.

[assets] => Array

(

)

[can_share] => no

[categories] => Array

(

[0] => stdClass Object

(

[category_type] => standard

[children] =>

[created_at] => 2019-06-03T18:18:43Z

[id] => 5

[name] => For Buyers

[parent] =>

[parent_id] =>

[published_at] => 2019-06-03T18:18:43Z

[slug] => buyers

[status] => public

[translations] => stdClass Object

(

[es] => stdClass Object

(

[name] => Para los compradores

)

)

[updated_at] => 2019-06-03T18:18:43Z

)

[1] => stdClass Object

(

[category_type] => standard

[children] =>

[created_at] => 2019-06-03T18:18:43Z

[id] => 11

[name] => First-Time Buyers

[parent] =>

[parent_id] =>

[published_at] => 2024-04-10T15:59:33Z

[slug] => first-time-buyers

[status] => public

[translations] => stdClass Object

(

[es] => stdClass Object

(

[name] => Compradores de vivienda por primera vez

)

)

[updated_at] => 2024-04-10T15:59:33Z

)

[2] => stdClass Object

(

[category_type] => standard

[children] =>

[created_at] => 2019-06-03T18:18:43Z

[id] => 38

[name] => Move-Up

[parent] =>

[parent_id] =>

[published_at] => 2024-04-10T16:00:35Z

[slug] => move-up

[status] => public

[translations] => stdClass Object

(

[es] => stdClass Object

(

[name] => Compradores de casa mas grande

)

)

[updated_at] => 2024-04-10T16:00:35Z

)

)

[content_type] => blog

[contents] => Being intentional and competitive are musts when buying a home this season. That’s why pre-approval is so important today. Pre-approval from a lender is the only way to know your true price range and how much money you can borrow for your loan. Peter Warden, Editor of The Mortgage Reports, explains:

“The lender will check out your personal finances and issue you a letter confirming the amount you’re eligible to borrow. This not only gives you a firm budget for house hunting, but also lets sellers know you’re qualified to make an offer.”

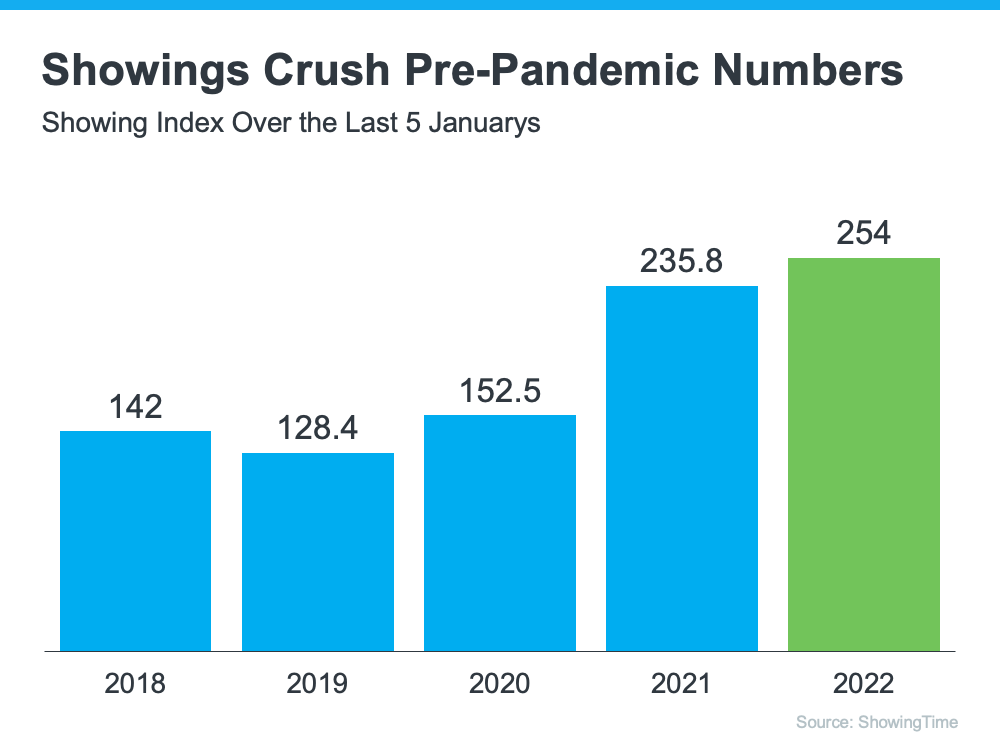

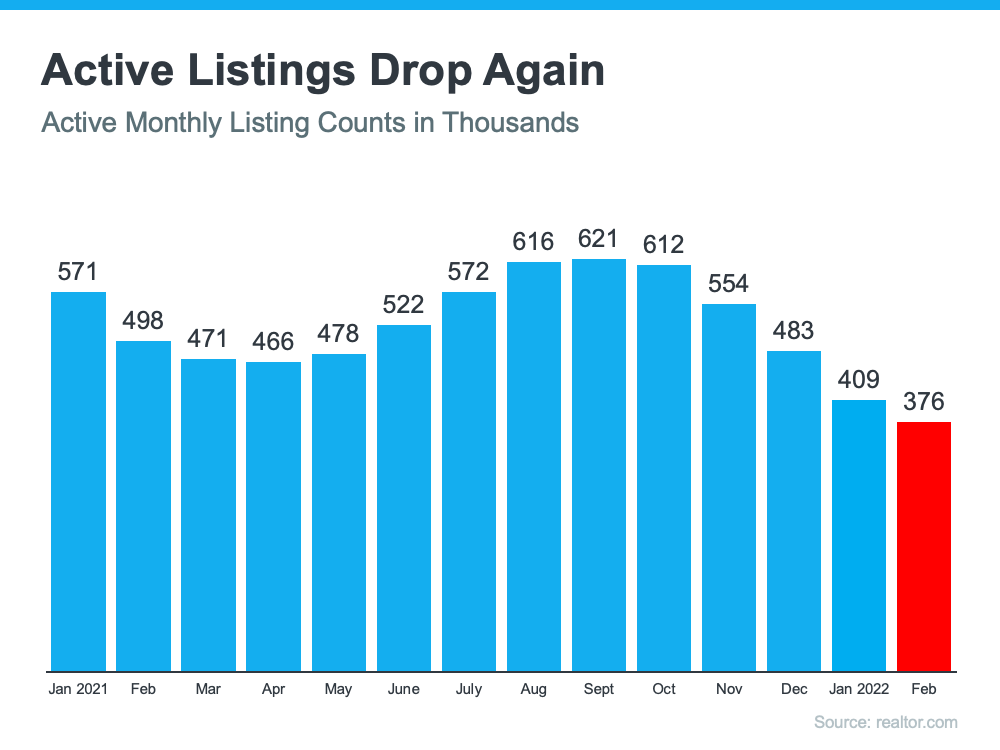

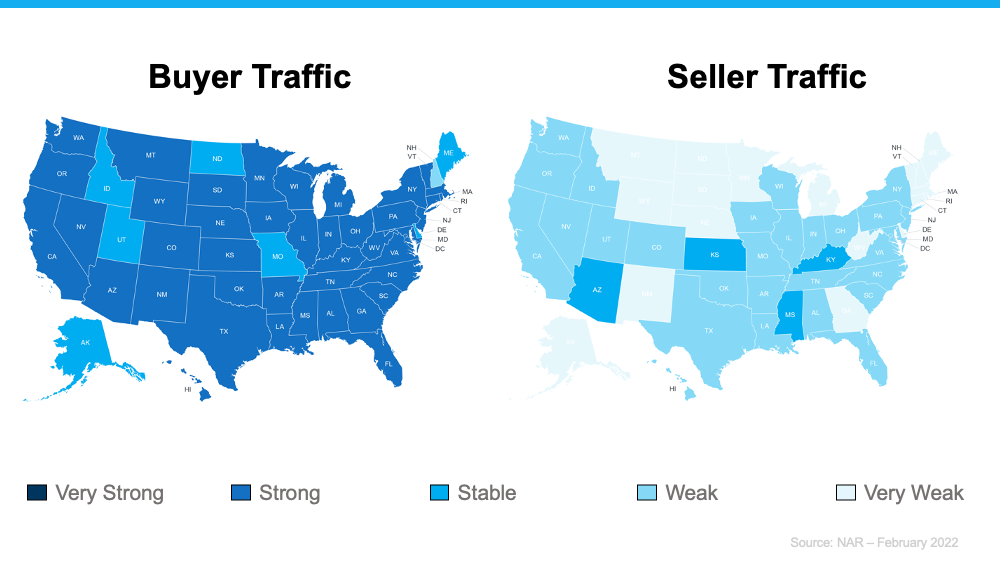

Why does that matter so much today? There are many more buyers looking for homes today than there are homes available for sale, and that’s creating some serious competition. According to the National Association of Realtors (NAR), the average home is getting 4.8 offers per sale. As a result, bidding wars are still common.

Your pre-approval gives you a leg up in these situations. That’s because you know exactly what you’re approved to borrow before you write your offer, and it lets the seller know you’re qualified to buy their home. This helps both you and the seller feel confident in what you’re bringing to the table. And that puts you in a better position to potentially win a bidding war.

As Warden puts it:

“There’s another important reason to get preapproved, too. And that’s because there are way more buyers than homes in today’s market — which means you need to be ultra-prepared if you want to win a bidding war. Most sellers are getting multiple offers right now. And most won’t even entertain an offer without a preapproval letter included.”

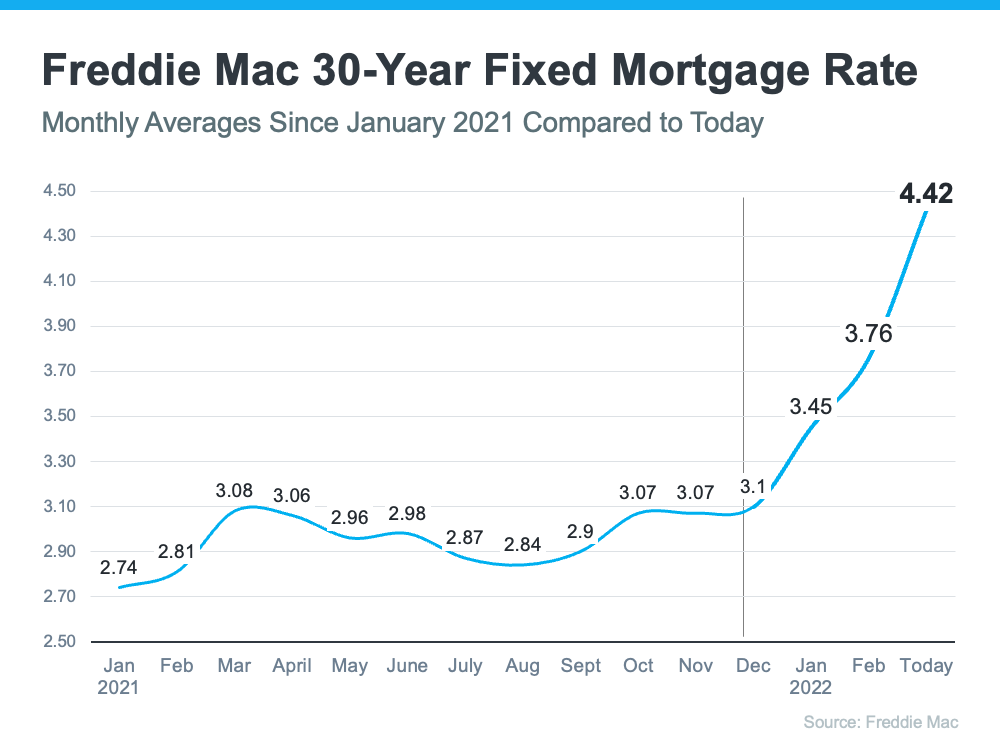

Every advantage you can gain as a buyer is crucial in a market that’s constantly changing. Mortgage rates are rising, home prices are going up, and lending institutions are regularly updating their standards. You’re going to need guidance to navigate these waters, so it’s important to have a team of professionals, such as a loan officer and a trusted real estate advisor, on your side. They’ll help make sure you’re ready to put your best foot forward.

Bottom Line

Getting pre-approved for a mortgage helps you better understand what you can afford and signals to sellers you’re serious about purchasing their home. Let’s connect so you have the tools you need to succeed as a homebuyer in today’s market.

[created_at] => 2022-04-15T17:55:53Z

[description] => Being intentional and competitive are musts when buying a home this season. That’s why pre-approval is so important today. Pre-approval from a lender is the only way to know your true price range and how much money you can borrow for your loan. Peter Warden, Editor of The Mortgage Reports, explains:

[exclusive_id] =>

[expired_at] =>

[featured_image] => https://files.simplifyingthemarket.com/wp-content/uploads/2022/04/15135536/20220419-KCM-Share.jpg

[id] => 3998

[kcm_ig_caption] => Being intentional and competitive are musts when buying a home this season. That’s why pre-approval is so important today. Pre-approval from a lender is the only way to know your true price range and how much money you can borrow for your loan. Why does that matter so much today? There are many more buyers looking for homes today than there are homes available for sale, and that’s creating some serious competition. According to NAR, the average home is getting 4.8 offers per sale. As a result, bidding wars are still common. Your pre-approval gives you a leg up in these situations. That’s because you know exactly what you’re approved to borrow before you write your offer, and it lets the seller know you’re qualified to buy their home. This helps both you and the seller feel confident in what you’re bringing to the table. And that puts you in a better position to potentially win a bidding war. As Peter Warden, Editor of The Mortgage Reports, puts it, “There’s another important reason to get preapproved, too. And that’s because there are way more buyers than homes in today’s market — which means you need to be ultra-prepared if you want to win a bidding war. Most sellers are getting multiple offers right now. And most won’t even entertain an offer without a preapproval letter included.” Every advantage you can gain as a buyer is crucial in a market that’s constantly changing. Mortgage rates are rising, home prices are going up, and lending institutions are regularly updating their standards. DM me so you have the tools you need to succeed as a homebuyer in today’s market.

[kcm_ig_hashtags] => expertanswers,stayinformed,staycurrent,powerfuldecisions,confidentdecisions,realestate,homevalues,homeownership,homebuying,realestategoals,realestatetips,realestatelife,realestatenews,realestateagent,realestateexpert,realestateagency,realestateadvice,realestateblog,realestatemarket,realestateexperts,instarealestate,instarealtor,realestatetipsoftheday,realestatetipsandadvice,keepingcurrentmatters

[kcm_ig_quote] => Pre-approval is an important step for today’s homebuyers.

[public_bottom_line] =>

[published_at] => 2022-04-19T10:00:05Z

[related] => Array

(

)

[slug] => why-pre-approval-is-an-important-step-for-todays-homebuyers

[status] => published

[tags] => Array

(

)

[title] => Why Pre-Approval Is an Important Step for Today’s Homebuyers

[updated_at] => 2022-11-16T17:28:48Z

[url] => /2022/04/19/why-pre-approval-is-an-important-step-for-todays-homebuyers/

)

Why Pre-Approval Is an Important Step for Today’s Homebuyers

Being intentional and competitive are musts when buying a home this season. That’s why pre-approval is so important today. Pre-approval from a lender is the only way to know your true price range and how much money you can borrow for your loan. Peter Warden, Editor of The Mortgage Reports, explains:

![What Is Multigenerational Housing? [INFOGRAPHIC] | Simplifying The Market](https://files.keepingcurrentmatters.com/wp-content/uploads/2022/04/20220415-MEM.png)

![Do You Know How Much Equity You Have in Your Home? [INFOGRAPHIC] | Simplifying The Market](https://files.keepingcurrentmatters.com/wp-content/uploads/2022/04/20220408-MEM.png)

![It’s Still a Sellers’ Market [INFOGRAPHIC] | Simplifying The Market](https://files.simplifyingthemarket.com/wp-content/uploads/2022/03/31142111/20220401-MEM.png)

![How an Energy Efficient Home Can Be a Bright Idea [INFOGRAPHIC] | Simplifying The Market](https://files.keepingcurrentmatters.com/wp-content/uploads/2022/03/20220325-MEM.png)

![Spring Cleaning Checklist for Sellers [INFOGRAPHIC] | Simplifying The Market](https://files.keepingcurrentmatters.com/wp-content/uploads/2022/03/20220318-MEM.png)