- The buyer, who wants the best deal possible

- The buyer’s agent, who will use their expertise to advocate for the buyer

- The inspection company, which works for the buyer and will almost always find concerns with the house

- The appraiser, who assesses the property’s value to protect the lender

5. A Professional Knows How To Set the Right Price for Your House

If you sell your house on your own, you may over or undershoot your asking price. That could mean you’ll leave money on the table because you priced it too low or your house will sit on the market because you priced it too high. Pricing a house requires expertise. NAR explains it like this:“A great real estate agent will look at your home with an unbiased eye, providing you with the information you need to enhance marketability and maximize price.”Real estate professionals know the ins and outs of how to price your house accurately and competitively. To do so, they compare your house to recently sold homes in your area and factor in the current condition of your home. These steps are key to making sure it’s set to move quickly while still getting you the highest possible final sale price.

Bottom Line

Whether it’s following local and national trends and guiding you through a shifting market or pricing your house right, a real estate agent has essential insights you'll want to rely on throughout the transaction. Don’t go at it alone. If you plan to sell, let’s connect so you have an expert on your side. [created_at] => 2022-06-29T20:17:29Z [description] => It can be tempting, especially with how hot the housing market has been over the past two years, to consider selling your home on your own. But today’s market is at a turning point, making it more essential than ever to work with a real estate professional. [exclusive_id] => [expired_at] => [featured_image] => https://files.simplifyingthemarket.com/wp-content/uploads/2022/06/29161712/20220630-KCM-Share.jpg [id] => 4144 [kcm_ig_caption] => It can be tempting, especially with how hot the housing market has been over the past two years, to consider selling your home on your own. But today’s market is at a turning point, making it more essential than ever to work with a real estate professional. Not only will a trusted real estate advisor keep you updated and help you make the best decisions based on current market trends, but they’re also experts in managing the many aspects of selling your house. Here are five key reasons why working with a real estate professional makes sense today. >>A Professional Follows the Latest Market Trends When conditions change, following the trends and staying on top of new information is crucial when you sell. >>A Professional Helps Maximize Your Pool of Buyers Real estate professionals have a large variety of tools at their disposal, such as social media followers, agency resources, and the MLS to ensure your house is viewed by the most buyers. >>A Professional Understands the Fine Print Today, more disclosures and regulations are mandatory when selling a house. >>A Professional Is a Trained Negotiator If you sell without a professional, you’ll also be solely responsible for all the negotiations. >>A Professional Knows How To Set the Right Price for Your House If you sell your house on your own, you may over or undershoot your asking price. Whether it’s following local and national trends and guiding you through a shifting market or pricing your house right, a real estate agent has essential insights you'll want to rely on throughout the transaction. Don’t go at it alone. If you plan to sell, DM me so you have an expert on your side. [kcm_ig_hashtags] => Sellyourhouse,FSBO,realestate,homeownership,realestategoals,realestatetips,realestatelife,realestatenews,realestateagent,realestateexpert,realestateagency,realestateadvice,realestateblog,realestatemarket,realestateexperts,instarealestate,instarealtor,realestatetipsoftheday,realestatetipsandadvice,justsold,keepingcurrentmatters [kcm_ig_quote] => If you’re selling your house this summer, hiring a pro is critical. [public_bottom_line] => Whether it’s following local and national trends and guiding you through a shifting market or pricing your house right, a real estate agent has essential insights you'll want to rely on throughout the transaction. Don’t go at it alone. If you plan to sell, reach out to a local real estate professional so you have an expert on your side. [published_at] => 2022-06-30T10:00:31Z [related] => Array ( ) [slug] => if-youre-selling-your-house-this-summer-hiring-a-pro-is-critical [status] => published [tags] => Array ( ) [title] => If You’re Selling Your House This Summer, Hiring a Pro Is Critical [updated_at] => 2023-02-03T15:34:08Z [url] => /2022/06/30/if-youre-selling-your-house-this-summer-hiring-a-pro-is-critical/ )If You’re Selling Your House This Summer, Hiring a Pro Is Critical

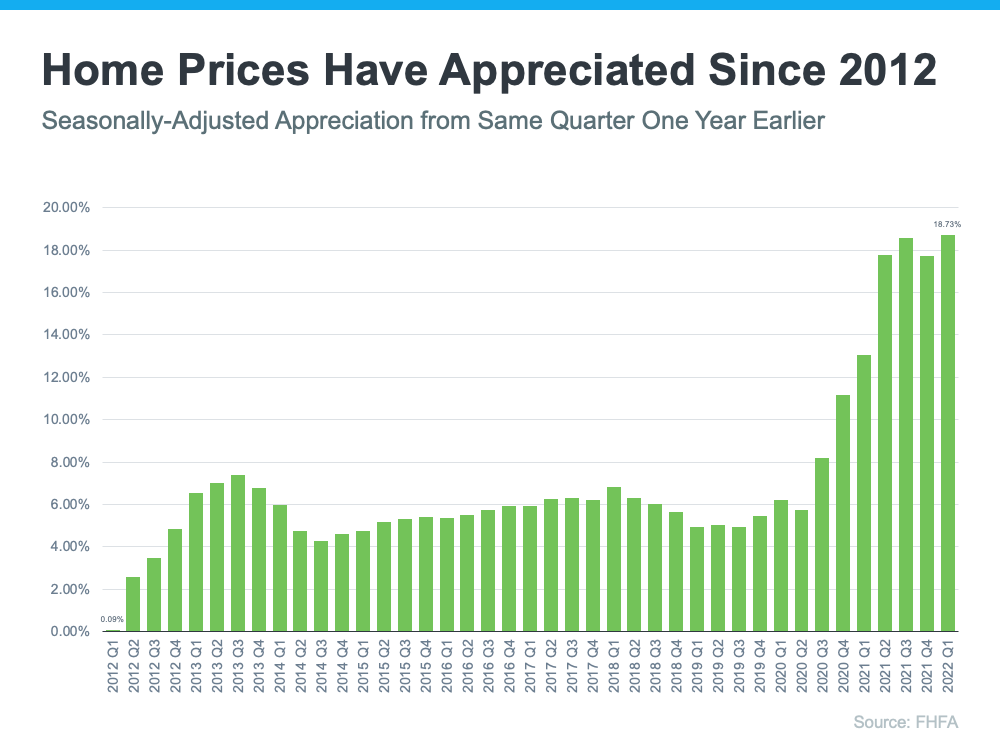

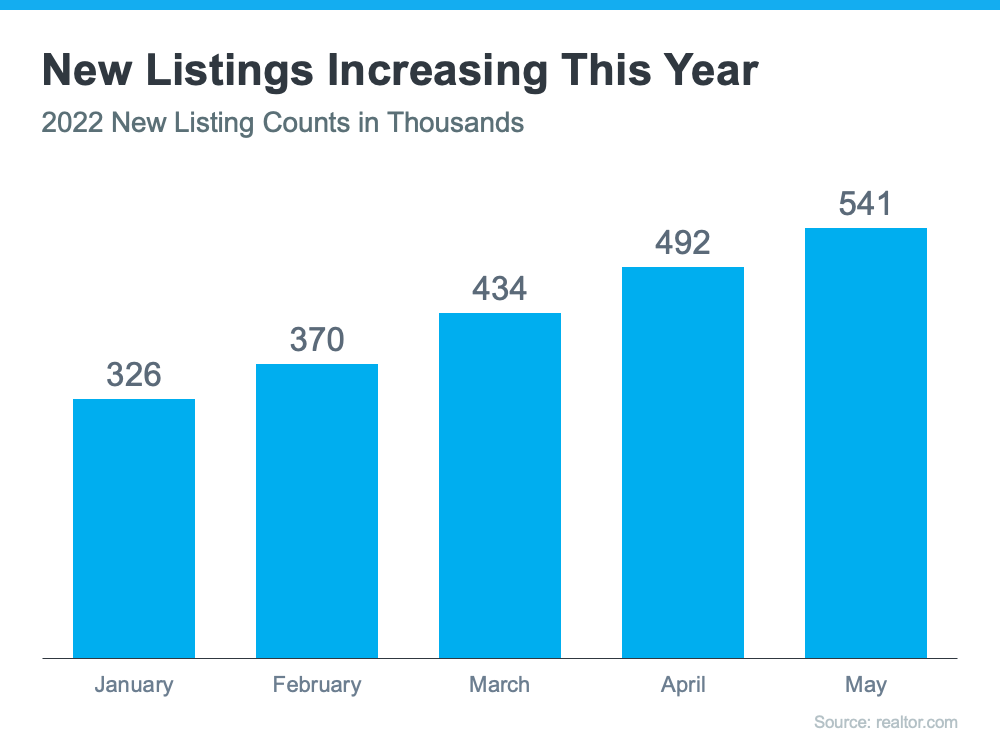

It can be tempting, especially with how hot the housing market has been over the past two years, to consider selling your home on your own. But today’s market is at a turning point, making it more essential than ever to work with a real estate professional.

![Why an Agent Is Essential When Pricing Your House [INFOGRAPHIC] | Simplifying The Market](https://files.keepingcurrentmatters.com/wp-content/uploads/2022/06/20220624-MEM.png)

![More Listings Are Coming onto the Market [INFOGRAPHIC] | Simplifying The Market](https://files.keepingcurrentmatters.com/wp-content/uploads/2022/06/20220617-MEM.png)

![The Top Reasons To Own Your Home [INFOGRAPHIC] | Simplifying The Market](https://files.keepingcurrentmatters.com/wp-content/uploads/2022/06/20220603-MEM-A.png)

![History Proves Recession Doesn’t Equal a Housing Crisis [INFOGRAPHIC] | Simplifying The Market](https://files.keepingcurrentmatters.com/wp-content/uploads/2022/06/20220603-MEM-2.png)

![Bright Days Are Ahead When You Move Up This Summer [INFOGRAPHIC] | Simplifying The Market](https://files.keepingcurrentmatters.com/wp-content/uploads/2022/05/20220527-MEM.png)